Security business models are changing as technology is advancing, with a number of developments having a major impact on the security industry. These technological advancements that are affecting the security market have led to a number of changes in business models. From companies eager to produce product offerings that better serve or appeal to consumers, which has seen the popularity of the self-installed DIY security solutions increase.

Security business models are changing as technology is advancing, with a number of developments having a major impact on the security industry. These technological advancements that are affecting the security market have led to a number of changes in business models. From companies eager to produce product offerings that better serve or appeal to consumers, which has seen the popularity of the self-installed DIY security solutions increase.

Self-installed DIY security solutions will significantly lower the cost of security, create new monitoring use cases, and, in doing so, expand the market beyond the traditional 20-25% of US households that have professionally monitored security, according to research by

Parks Associates. The strong increase in professionally monitored systems that are self-installed is fairly recent, and professional installation still dominates, but the DIY market is starting to impact upon

professional security providers' market share.

1. Significant shift toward DIY installation method

DIY security systems are on the rise; as both DIY and smart home products are adding volatility to the market for professionally monitored security and driving changes in the home security business. These solutions do have advantages with lower-cost, contract-free monitoring options that will attract new consumers, but adopting these new offerings without eroding the base of traditional customers requires careful navigation of the current business ecosystem.

New entrants for security and added options for smart home devices have entered the market from other industries which has resulted in an increase in competition and price pressures. This has been seen due to potential DIY security adopters deeming self-monitoring via smartphones to be sufficient to meet their security needs.

The flexibility of DIY systems is another factor that has allowed non-traditional security providers to increase their penetration rate. However, professional installers can stave off the threat posed from DIY by offering variety in; equipment, monitoring contracts and solutions. Another approach for professional installers to consider is to adopt an open ecosystem.

2. Smart home device adoption

The

smart home market is an important area of convergence with security, where security providers can find new revenues to combat margins tightened by DIY. Similarly, the market can promote complementary use cases in safety and security to attract smart home device owners into home security ownership.

Monitoring, storage, and voice capabilities are popular, and while many devices might be bought via a retail channel and self-installed, providers can promote and monetize services and support related to these products. Video cameras and video doorbells are the most highly adopted adjacencies for security system owners. About one-third of owners adopted the camera or video doorbell in an aftermarket purchase. Furthermore, the appeal of DIY for these devices is apparent – among networked camera owners, 68% self-installed their device, according to Parks Associates.

3. Impact on the value chain revenue split

Traditionally, Recurring Monthly Revenue (RMR) is split among various players in the value chain. For professionally installed security systems with interactive services, the dealer amortizes the subscriber acquisition cost, which lessens any upfront fees paid by the consumer. The dealer also has to pay the cellular communication vendor, the interactive service provider, and the wholesale monitoring station.

However, new DIY solutions have business models that monetize acquisition costs through upfront fees; therefore, as with hardware costs, these solutions do not need to charge higher monthly fees to recoup acquisition costs. These DIY systems also use broadband services rather than cellular services, or use broadband as the primary communications method, which lowers communication costs and reduces or eliminates cellular-related fees. They also eliminate communication and interactive service providers from the value chain, further solidifying their cost advantages.

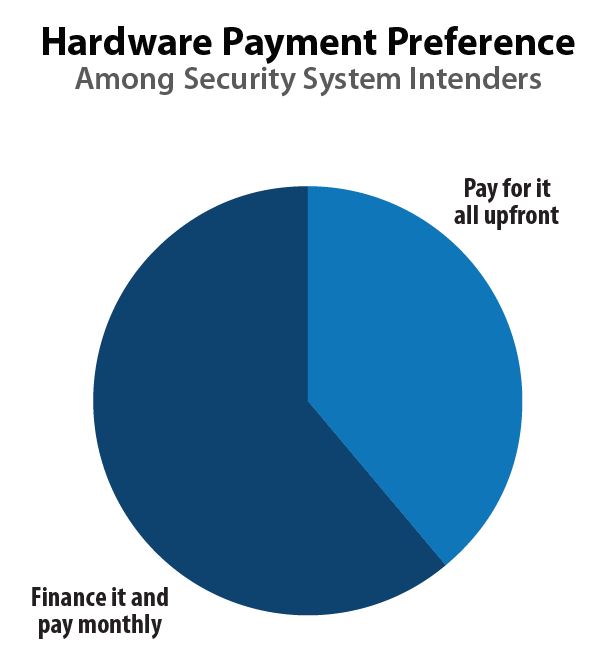

Security services are sold in tiers, with basic security monitoring as the baseline service at less than US$40 per month. Basic monitoring connects the central monitoring center directly to the security control panel through either telephone, cellular, or broadband communication. DIY security systems do not command higher monthly fees—since the customer pays upfront for the hardware, dealers do not need to amortize the hardware cost. Generally, dealers pass along the savings from lower acquisition costs in the form of lower monitoring fees. Monthly fees are $20 below those of the professional monitoring market, on average, while the upfront hardware fees are higher. Consumers are generally more price sensitive about upfront cost than recurring fees, but different models appeal to different segments of consumers.

DIY devices and systems will expand the security market among non-owners and are likely to cannibalize a portion of value-driven traditional subscribers. Staving off erosion will require aggressive differentiation strategies to prove the value of professional monitoring over self-monitoring, including aggressive marketing of more fully integrated interactive services, home controls, and video monitoring services enhanced by these new smart home solutions.

Video analytics and context-based monitoring are the types of new services emerging in the monitoring business that can help maintain and even expand professional monitoring in the face of challenges from DIY and self-monitored offerings. The vast majority of future security buyers want advanced access and safety monitoring services with the system they are planning to buy, but high upfront costs are an obstacle to these purchase intentions. New business models that are able to distribute upfront costs and tie in popular smart home features are likely to be successful.