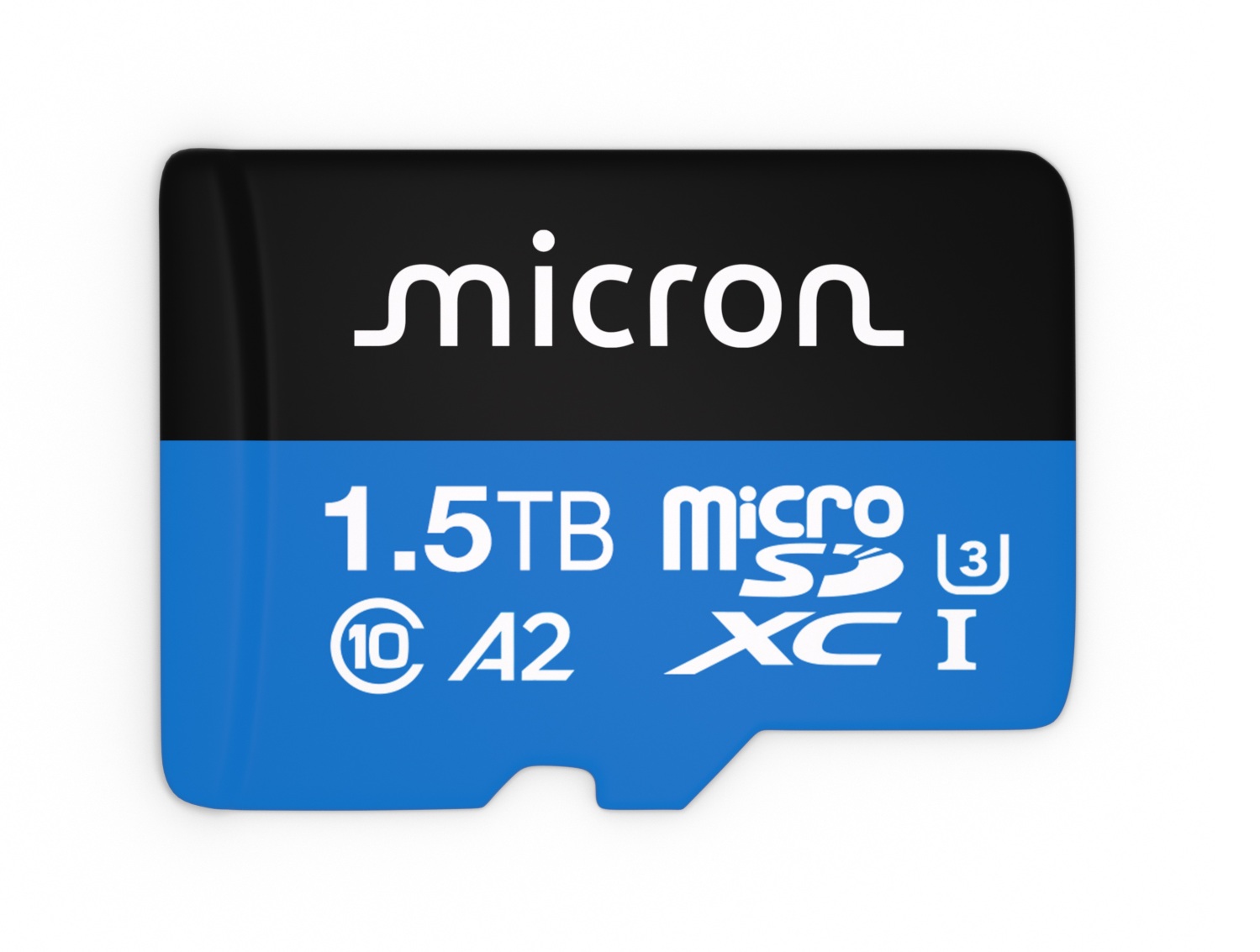

Micron's i400, with up to 1.5TB storage capacity, is specifically built to withstand the challenges of the most demanding conditions of in-vehicle security systems.

Security cameras installed under the ceilings of buses and trains have been a common sight for decades now, but few riders have noticed the revolution taking place inside in-vehicle video security systems.

It is easy to overlook the changes, with ever-more potent cameras becoming smaller and less obvious to the eye of the rider on public transportation. What the latest generation of video security tools can do, however, goes far beyond their initial function of documenting incidents and providing footage for security teams to analyze after the fact.

At the heart of any video security infrastructure remains the core function of documenting incidents, though. This is

Tier 1 of in-vehicle video security. Innovation has been continuous and gradual, but the latest generation of devices have come a long way, with cameras sporting up to 4K resolution, sensors that can capture razor-sharp footage from angles that used to be impossible, and more edge devices overall. Video streams are in operation 24 hours, for example on subway trains that run overnight in many cities.

Needless to say, this adds significant workload to the systems, including video processing, analysis and storage. It requires that all parts of the system are highly reliable, as every potential failover comes at an increasing cost.

From passive to active

The biggest innovation is in the systems’ ability to interpret events in real time. Modern in-vehicle systems can detect incidents like fights, falls or abnormal behavior as they happen, and trigger alarms or other real-time responses. This expanded functionality is based on more data and faster processing. It involves higher-resolution footage, faster frame rates, and added AI metadata.

Some functions that go beyond security have been available for a long time, such as people counting and occupancy tracking. With AI, however, they are taken to the next level of sophistication.

This layer of functions—

Tier 2 of in-vehicle video security—is becoming more central to the systems. More cameras and sensors enhance safety by, for example, monitoring the train or bus driver and interpreting their behavior. Systems can assist the driver by detecting signs of distraction, drowsiness or inattention, and triggering alerts before incidents occur. This, too, involves the generation (and storage) of additional data. Every movement needs to be categorized, labeled and time-stamped so the system can distinguish between normal and risky behaviors, and eventually enable AI to learn from it.

From basic security to smart city infrastructure

Cameras and other sensors also face the outside of vehicles, monitoring road conditions, traffic, lane changes and nearby objects. This enables functions such as collision avoidance and blind spot monitoring. Exterior cameras can also serve as mobile components in broader smart city networks—gathering data for traffic flow optimization or infrastructure planning.

This is

Tier 3 of in-vehicle systems: The gathering of intelligence to improve service. With the right data generated in the right place, public transportation providers can boost ridership—for example by tailoring bus schedules to ever-changing real-word needs of the communities they serve. By analyzing passenger flow, dwell times and usage patterns at different times and stops, operators can make better decisions, not just about routes, but also fleet deployment, resource allocation and additional passenger-facing services such as dynamic advertising or infotainment content.

The seamless integration of all functions of public transportation systems increasingly relies on ever-more data gathered through cameras and other sensors that do much more than providing security.

The numbers reflect the expansion of opportunities: The mobile video security market was valued at US$2.71 billion in 2023 and expanded to US$2.96 billion last year. It is expected to continue growing at a CAGR of 9.58 percent to reach US$5.15 billion by 2030.

1

Failure not allowed

Robust storage solutions, such as ruggedized microSD cards, are the first line of defense against system failure. Even though it is possible to transmit data in real time to a centralized management system or the cloud, security video archives are typically stored in a local storage device and then synchronized to a central management system upon return to the terminal—for cost efficiency and connection reliability reasons.

Retention periods and form factor

A seven-day storage retention period covers most mobile video security application usage models in the transportation sector, but some models gradually move towards 14 days or even one month.

The analysis is based on above configurations:

- Camera bit rate: 1 Mb/s (1080P) / 2 Mb/s (2K) / 4 Mb/s (4K)

- Recording hours per day: 12 hours

- Connected camera channel per system: 1 - 8 channels

- Storage retention: 7 days

Over the past few years, microSD cards have become the dominant storage solution.

The compact size of the cards brings several advantages to in-vehicle systems. Their form factor allows enables flexible system design, simple installation and easy upgrades to add storage. Unlike HDDs, they don’t require shock-absorbing mounts or cooling enclosures. Their low power consumption is another key advantage—particularly in systems that rely on a large number of decentralized sensors.

Professional solutions for demanding requirements

Not all microSD cards are created equal, though. Even the most advanced consumer-grade cards aren’t built for the constant read/write demands of in-vehicle security. Industrial-grade cards, such as Micron’s i400 series, with up to 1.5TB storage, are engineered for high endurance and sustained performance.

The Micron i400 is specifically built to withstand the challenges of the most demanding conditions. Engineered with advanced 176-layer NAND, it was tested to withstand five full years of uninterrupted 24/7 high-quality video recording—even in challenging mobile environments. This level of endurance makes it ideal for in-vehicle systems, where constant write workloads and harsh physical conditions are the norm.

The Micron i400 features onboard self-diagnostics that monitor usage and predict remaining lifespan—giving fleet operators a timely warning every time a card in one of their many devices may need to be replaced. This helps prevent data loss and simplifies fleet-wide maintenance. Combined with firmware optimized to reduce frame drops during continuous recording, the i400 offers a scalable, low-maintenance solution for demanding in-vehicle video applications.

Facts about Micron’s i400 microSD card

Micron’s i400

microSD cards are specifically designed for edge video security workloads and features:

- Storage densities of 64GB, 128GB 256GB, 512GB 1TB and 1.5TB enable more video to be stored at the edge and increase design flexibility

- Five years of high-quality, continuous, 24x7 video recording in a wide range of temperatures and environments

- A two million hours mean-time-to-failure (MTTF) or 0.44 percent annualized failure rate (AFR), which is equal or better than most video security HDDs2

- 5-proof protection encompassing water, shock, x-ray, magnetic field and impact

- Special firmware designed for continuous video recording that minimizes frame drops, allowing for remote updates

- Self-health monitoring technology: Cards to provide information on usage and expected useful life remaining

- Reduced maintenance and repair costs for integrators managing large fleets

As in-vehicle video security systems evolve, so do their requirements for endurance, performance and reliability at the edge. Micron’s i400 microSD card meets these demands with robust, rigorously tested technology designed specifically for 24/7 deployment in the age of AI-powered systems that go far beyond security.

References

[1] 360iResearch —

Mobile Video Surveillance Market by Component, Application, End-User - Global Forecast 2025-2030

About Micron Technology, Inc. We are an industry leader in innovative memory and storage solutions. Through our global brands – Micron® and Crucial® – our broad portfolio of high-performance memory and storage technologies, including DRAM, NAND, 3D XPoint™ memory and NOR, is transforming how the world uses information to enrich life. Backed by more than 40 years of technology leadership, our memory and storage solutions enable disruptive trends, including artificial intelligence, 5G, machine learning and autonomous vehicles, in key market segments like mobile, data center, client, consumer, industrial, graphics, automotive, and networking. Our common stock is traded on the Nasdaq under the MU symbol. To learn more visit

Video security | Micron Technology Inc.