Does sustainability influence buyers when choosing security manufacturers and design? And their perspectives on the future evolution of sustainability in the industry.

This is the second article in a 2-part discussion of the results of the asmag.com-Hikvision survey on “Sustainability and the Security Industry” aimed at understanding the market sentiment when it comes to green and sustainability practices.

The first article assesses overall market awareness and current green trends trending in the market. The current article aims to assess how these practices influences purchasing behavior and identify the key factors that hold greater importance as well as the trajectory of green and low carbon initiatives within the security industry in the near future.

Note: To simplify data analysis between regions, in some questions respondents were categorized into two general groups: Western (US, Europe and Middle East) and Asian (Asia and Oceania).

Click here to have a quick view of the result summary and read on for a full analysis of the survey results.

Key findings from the reader survey

1. In purchasing decisions, how do green sustainability practices measure against other considerations?

When making purchasing decisions, security channel players prioritize device design and features, followed by brand name and price. Green sustainability practices ranked last.

Although the majority of survey respondents indicated that green and low carbon initiatives were very important to them (

see part 1), it is evident that when it comes to actual purchasing decisions, practicalities take precedence.

Device design and features, brand reputation and pricing have immediate and tangible implications that impact day-to-day business operations. Green and low-carbon initiatives may be seen as long-term goals that are less immediately relevant to a security channel player’s business – with upfront costs and hassles associated with transitioning/integrating green technology or practices. It is also possible that security professionals don’t readily see how current green solutions align with the specific needs of their projects.

This underscores the need for accessible, cost-effective and practical green solutions (and market education) to encourage an industry shift towards a more balanced consideration of practicalities and sustainability in future purchasing decisions.

2. When choosing device design, what matters most when making purchasing decisions?

In terms of green device design, security channel players placed the highest importance on product durability, followed closely by designs with low-energy consumption. Sustainable storage and energy-saving modes came in third place, with alternative energy sources and sustainable materials in device production following closely behind.

Product durability is crucial for security solutions (e.g., video surveillance and access control) where downtime and frequent maintenance can have significant consequences. Moreover, durability and energy efficiency features can translate to tangible cost savings over both the short and long term. The relatively lower emphasis on sustainable storage, alternative energy sources and sustainable materials indicates that, at present, practical functionality takes precedence over eco-friendly considerations in purchasing decisions.

Of note though is that while solar-powered security devices were the most recognized green technology among respondents, this surprisingly only ranked fourth in this list. Nonetheless, there is growing demand for solar-powered devices in various projects as evidenced in

article 1.

3. When choosing manufacturers or brand names, what matters most when making purchasing decisions?

Of highest importance to security channel players is brand recognition, particularly brands that are eco-conscious and possess industry green certifications. Following closely behind are the emphasis on sustainable manufacturing and manufacturers that exclusively partner with sustainable suppliers adhering to strict environmental standards.

When brands make their eco-friendly stance and industry green certifications easily identifiable, it makes it easier for security channel players to make informed choices, which creates more business opportunities. This labelling also fosters credibility while providing brands a competitive advantage by offering sustainable solutions andnoptions that will bring about long-term cost savings.

4. In terms of packaging and delivery, what matters the most when making purchasing decisions?

Survey respondents placed nearly equal importance on using eco-friendly materials for packaging and reducing carbon footprint through the supply chain.

Overall, 80% of the survey respondents cited sustainable supply chains as an important consideration. This approach would involve optimizing transportation logistics and packaging practices to minimize greenhouse gas emissions (

click here to learn more about sustainable business solutions).

79% supported the eco-conscious efforts of manufacturers to reduce their carbon footprint through sustainable packaging to reduce waste (e.g., by eliminating excessive plastic packaging and using biodegradable materials). This was reaffirmed when both Western and Asian respondents affirmed their preference for green packaging options in a follow-up question. Thus signifying an overall promising shift toward more eco-conscious consumer behavior.

A balance between environmental consciousness and practical necessities

To ensure a comprehensive survey, respondents were asked if any factors have been overlooked. Remarkably, the majority of the comments in this section circled back to practicalities as their focal point.

Procurement priorities (47% of total comments)

59% of the comments focused on quality and performance.

- “Quality - Performance - Price”

- “First, understand the demand, understand the brand and reputation. Second, considering the comparison of price and performance comprehensively, choose the equipment with higher cost performance.”

- “Procurement matters need to consider equipment selection, brand selection, technical specifications, price comparison, service support, compliance requirements and other factors to ensure that the purchase of appropriate equipment and services.”

- Consider the overall cost effectiveness of the equipment, including equipment price, operation and maintenance costs, and energy consumption.

ROI and cost is another key consideration (41%)

- “Pricing to its benefits, purchaser consider its ROI”

- “Availability, comparative pricing”

- “Green, sustainable, eco-friendly mean that the finished goods will be much expensive, we've tried but the market didn't buy.”

- “’Green’ features (sustainability, eco-friendly, smaller carbon footprint, whatsoever) are very important but they can't be reason to choose a significant more expensive technology compared with existing ones.”

Technical support, service and compatibility (31% of total comments)

When it comes to compatibility (17%) , two aspects were considered: 1. how the device/solution will work with existing systems and 2. how the device abides with current environmental standards.

- "Consider device compatibility to ensure seamless integration with existing security systems or other devices. At the same time, consider the expansion of the equipment to meet the needs of future business development.”

- "When purchasing security equipment, ensure the legality and compliance of the equipment.”

- "Ensure that purchased equipment complies with relevant safety standards and certifications, and has reliable safety features.”

- "Look for Environment related certification of the product.”

14% are more focused on after-sales support and service for these devices.

- "Choose a supplier with perfect technical support and after-sales service system to ensure that equipment failures and problems can be solved in time to ensure the normal operation of equipment.”

- "Should have commercial Partner for each country to <provide, facilitate> and support end user and these companies should involved to train supply and support people and received international support and help.

- "Choose well-known brands and reputable suppliers to ensure the quality and after-sales service of the equipment.”

Of note, two respondents specifically mentioned “Lead time :)” as an important factor to consider.

Challenges to adopting green practices in the security industry

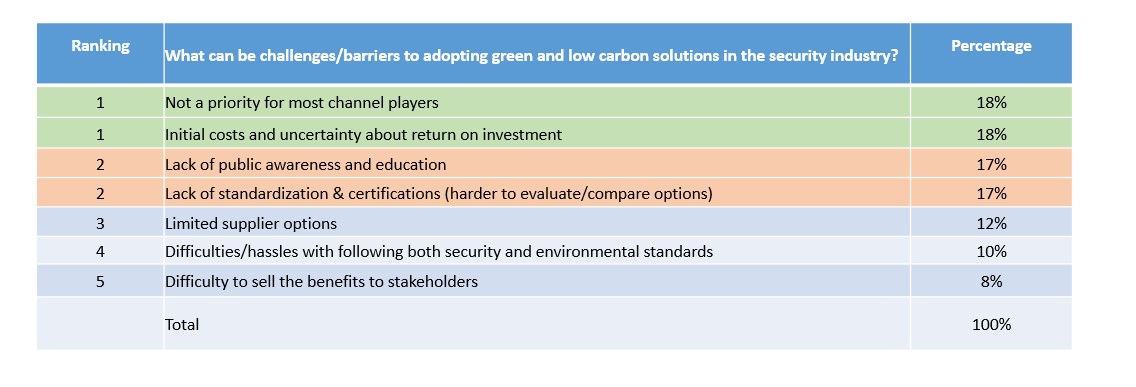

The primary challenges identified by respondents in this section align with the survey responses previously discussed. While the adoption of green and low carbon practices is on the rise, they are not yet recognized as essential in the security industry. This indicates an opportunity for market education, with a focus on making it easy for channel players to pick and choose between solutions, while demonstrating the tangible ROI, highlighting practical features/functionalities and addressing any issues relating to the integration of these green devices and technologies into existing solutions.

When asked about additional support or resources needed in the security industry for the adoption of green and low carbon practices, respondents again underscored the need to streamline the process for channel players to assess products and make informed comparisons. This includes providing clear and accessible information about a product’s energy efficiency and compliance with recognized green standards as well as case studies to illustrate the benefits of adopting green and low carbon practices to their bottom line and the environment. In the words of one respondent:

“Environmental solutions must not impact the Quality of Service (QoS): it must be a net-positive.”

Future of green and low carbon practices in the security industry

When inquired about the adoption of green and low carbon practices in the coming years, the overall responses convey a positive outlook, with only 4.7% expressing that sustainability would still not be a priority for the security industry.

The majority of survey participants (22.9%) anticipate that manufacturers will be able to attract a broader customer base and stand out in the market by clearly demonstrating their eco-conscious features, branding and certifications. Channel players and end users are also expected to anticipate and prepare for stricter government regulations in the near future (22.6%). Adopting greener products would ensure that their security solutions and practices align with upcoming environmental standards, avoiding potential fines or penalties.

Another 22.6% indicated that technology advancements will make greener products less expensive, making them more accessible to a wider audience. This would potentially create a self-reinforcing cycle: Accessible pricing encourages more users to use eco-friendly products, resulting in increased energy and cost savings, thus perpetuating the cycle of sustainability and business benefits.