In this article, Malou Toft, VP of APAC at Milestone Systems, shares her insights into what we can expect of the Thai security market in the years to come.

Over the years, Thailand has become a major economic hub in the region. Having more than 15 years of experience in Thailand, Milestone Systems has witnessed first-hand Thailand’s transformation, and remains optimistic about the country’s future. In this article, Malou Toft, VP of APAC at Milestone Systems, gives a market update on Thailand and shares her insights into what we can expect in the years to come.

asmag: Tell us a little about Milestone’s history and track record in Thailand: When did you start working in the market, what kind of projects to you usually do?

Toft: Milestone has been working together with distribution partners and selling products in Thailand for more than 15 years, and was the first country in the APAC region that we had introduced our corporate portfolio in at that time. We remain committed to supporting local commercial partners and the government enhance their video security capabilities across varied industries.

Our focus industries are: Healthcare, higher education, smart cities (critical infrastructure, transportation), and hospitality.

In terms of healthcare, we recently introduced a new healthcare solution earlier this month that will address the manpower crunch of the industry and enable healthcare personnel to focus on what truly matters. XProtect Hospital Assist is designed exclusively for hospital units caring for patients in need of 24/7 or situational observation. A dedicated remote patient monitoring solution, it allows the hospital to increase staff efficiency, react to incidents rapidly and allow resource optimization for high-quality patient care where it is needed the most.

asmag: How is the Thai security market different, compared to other ASEAN markets you work in?

Toft: Thailand is a key market for Milestone as there has been great success in the adoption of our video surveillance software in country. There is potential for growth within the hospitality and manufacturing industries, as it is one of the biggest manufacturing hubs in Asia. Security is a priority for Thailand, as officials in Bangkok had installed over 62,000 security cameras and 13 monitoring centers where CCTV footage can be checked, across the capital to enhance the safety of residents. Members of the public can request to view footage from any of the cameras by contacting the monitoring centers. Footage can be used in criminal prosecutions as well as providing evidence in the event of road traffic accidents.

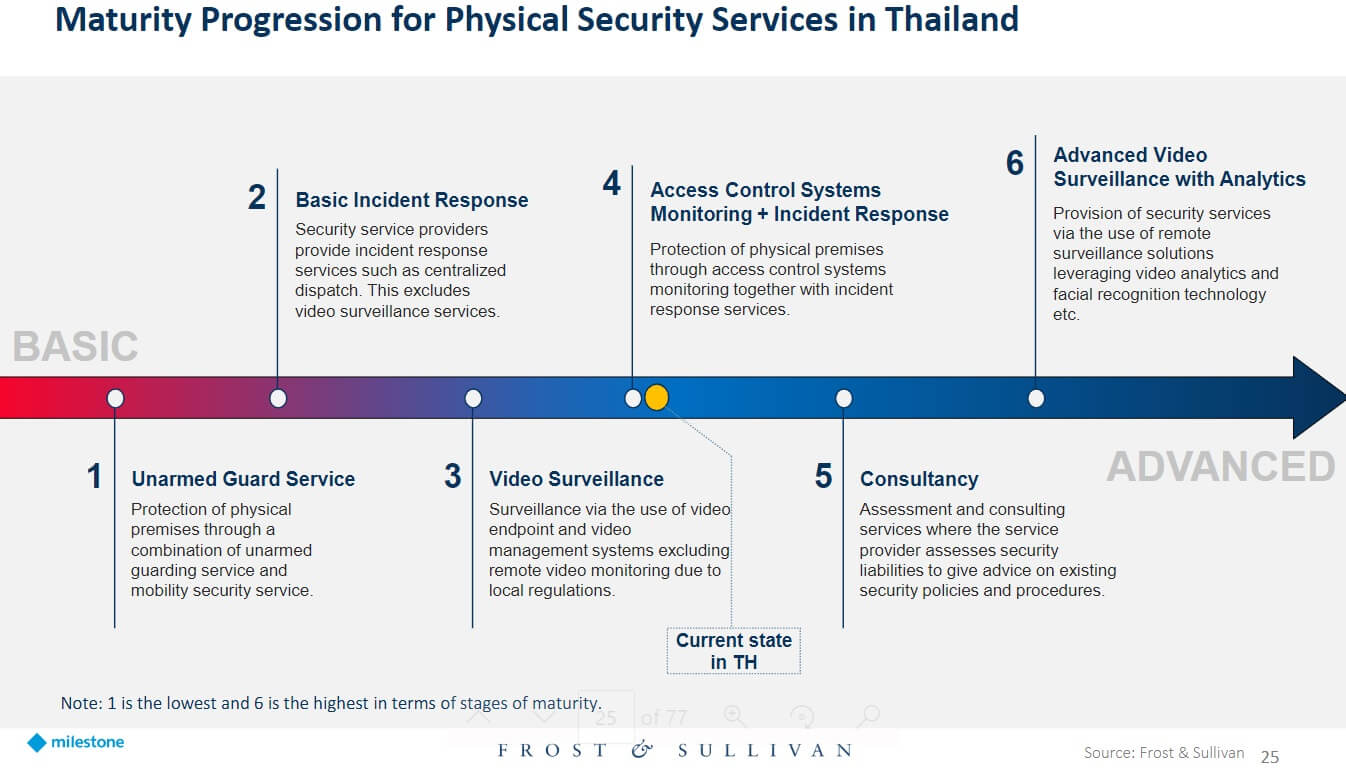

Based on a commissioned study with Frost & Sullivan, it was found that Thailand’s technology ecosystem currently is ahead of some ASEAN countries. This is due to the government’s strong support for digital transformation, and its plans to ramp up the integration of security technology and application. There is much more potential in Thailand advancing to derive smarter use of video surveillance and analytics with its Thailand 4.0 visions.

Compared to other ASEAN markets, we foresee Thailand evolving over the coming years due to the following factors:

Thailand 4.0 scheme: With the Thai government’s newest economic model ‘Thailand 4.0’ designed to use innovation to drive the country’s next phase of development, the emergence of analytics and business-intelligence capabilities will come to fore. Beyond managing data, businesses must find efficient ways to analyze their data and gather insights in a timely manner, to make informed business decisions. Beyond keeping citizens safe, this would impact various industries such as retail, hospitality, healthcare and transportation and enable businesses to relook the efficiency of their operations for better customer engagement.

Infrastructure development: The projected growth in the construction industry, upcoming new hotels and shopping malls, coupled with increasing urbanization rates, that are part of the Eastern Economic Corridor (ECC) development plan under the Thailand 4.0 ambitions, are some of the factors that will likely contribute towards the overall growth of video surveillance systems in Thailand. Projects such as the development of Krabi Airport and mass transit in Chiang Mai will push the demand for video surveillance systems in the market.

asmag.com: Overall, how did the Thai security market perform in 2022? What were some of the major growth drivers? How do you think the Thai market will perform in 2023? Will it experience higher growth compared to 2022? Will growth be generated more by public sector or private sector?

Toft: According to Omdia’s Video Surveillance and Analytics Intelligence Service Database in June 2022, the overall video surveillance market in Thailand (which includes cameras, VMS, standalone video analytics, servers, recorders, etc.) grew by 8.3 percent in 2022.

With ongoing efforts by the local Thai government to reinforce surveillance across Thailand, it is likely that that VMS will grow in the coming years. The applications for VMS span far and wide – adding security for hotel guests, enhancing the control of traffic to optimize travel within the country.

In line with the Thailand 4.0 initiative, it is likely that the growth will come from both public and private sectors, as businesses evolve to keep pace with the nations’ digitalization ambitions.

asmag: Can you estimate the total size of the market for VMS systems in Thailand?

Toft: According to Omdia’s Video Surveillance and Analytics Intelligence Service Database in June 2022, the VMS market in South East Asia (Indonesia, Malaysia, Singapore, Thailand, Vietnam, Philippines, Cambodia, Laos, Brunei and Burma) is expected to grow at CAGR of 10.5 percent from 2021 to 2026. The same report also gave a rough estimate suggesting that the Thailand VMS market was between US$5 to 6 million in 2021.

asmag: Which vertical markets (e.g. retail, hospitality, manufacturing, etc.) do you feel are especially strong in Thailand this year?

Toft: With Thailand’s focus on building smart cities, the transportation and hospitality sectors will be especially strong this year. They remain our key priority in this market.

One of the ambitious goals of the “Thailand 4.0” economy is to achieve 100 smart cities in the country by 2024. In Bangkok, there is a focus on smart mobility and improving infrastructure to ease transportation barriers. There are aspirations to run the city with IoT, sustainable and energy efficient buildings. Video technology can be used to monitor a variety of elements critical to a successful smart city, using tools such as facial recognition systems, people counting systems, and audio and video threat detection. This can range from air quality measures and safety solutions, to traffic management.

Thailand’s tourism and hospitality sector continues to be a key driver of its economy, contributing 18 percent of the country’s GDP. Features in video technology such as heat mapping and occupancy statistics can deliver insights to optimize operations, staffing decisions, and elevate guest experiences on the whole.

Healthcare is also a vertical with a lot of potential. For example, we have already started collaborating with hospitals to create a video management system for patient monitoring. This helps nurses to improve their services and provide immediate assistance to those in need.

asmag: Do you feel there is any special demand in the market for a specific solution (e.g. access control, video surveillance, parking, time and attendance, biometrics, etc.)?

Toft: Biometric Authentication – Biometric authentication technologies, such as fingerprint and facial recognition, are becoming more popular in Thailand for access control and identity verification purposes. For example, facial recognition technology is already the most common digital authentication method used by Thai banks.

Video Surveillance – Public safety is a priority in Thailand. CCTV cameras are commonly installed in public areas such as streets, airports, and train stations. CCTV footage can also be accessed online.

Beyond these siloed solutions, integrated solutions will start to be in demand as Thailand progress in video technology adoption as seen in more advanced markets. This will require tighter integration between CCTV and access control for wider adoption, especially with open platforms to tie different applications with visibility enabled via video. For example, Milestone’s new healthcare solution XProtect Hospital Assist will enable users to unlock doors remotely with facial verification via CCTV, or deploy nurses to wards with abnormal movements.

asmag: What security technologies (AI, cloud, etc.) are trendy in Thailand? What user challenges/needs are they supposed to solve?

Toft: New technologies such as AI and machine learning has been gaining traction in recent years. In 2022, the Thai government approved the Thailand National AI Strategy and Action Plan, that will promote the development of AI and its applications to enhance the quality of life for Thais by 2027.

The Thailand 4.0 economic stimulus plan also hopes to drive 5G networking capabilities, and the use of cloud and IoT.

Within security alone, these technologies are able to give users a more robust and secure system. It gives them the advantage of speed, to predict and detect threats even before it happens. IoT cameras can alert other devices within an IoT system accordingly in real-time, providing higher levels of security without the need for extra manpower. For example, a camera with can visually identify smoke before it reaches a smoke detector and tip a fire alarm.

We see the adoption of new technologies happening faster now than ever before. Tech such as face mask detection and touchless access control were heavily adopted during the pandemic, and will support societies and businesses well into the future too.

asmag: What would you describe as the biggest challenge for market growth? Manpower? Infrastructure? Supply chain?

Toft: Despite strong demand for new and emerging technologies, there has been a critical shortage of people skilled in this field. The local market is also in need of people with digital skills. As Thailand goes full speed ahead towards its Thailand 4.0 goals, these technologies will become increasingly common and reshape the digital economy. However, without the right talent to make the most of these technologies and integrated solutions to meet growing demand, market growth can be challenging.

That said, we remain optimistic that the market in Thailand will only continue to expand. We remain committed to supporting local commercial partners and the government to enhance their video security capabilities across varied industries, and are excited to witness the future of Thailand.

Find out more about the Thailand market just by clicking here!