Taking a look at this year’s Security 50, we can see clearly that growth has returned to the security industry. In this article we spoke with some of the growth companies to see what their secrets of success were.

Taking a look at this year’s Security 50, we can see clearly that growth has returned to the security industry. In this article we spoke with some of the growth companies to see what their secrets of success were.

In last year's Security 50, something unprecedented happened, with more companies – 28 – reporting revenue declines than growth in the height of the pandemic. Things are different this year: a large majority of companies reported year-over-year growth in 2021 revenue, reflecting what the industry was like pre-pandemic.

“We have experienced phenomenal growth in EMEA both last year and in 2022. Still, it has been a relief for all of us in the security industry to come out of two years of COVID lockdown. Being able to meet partners and customers face to face has been vital for Milestone and our sales in the first half of the year,” said Jos Beernink, VP for EMEA at Milestone Systems.

“Our growth and profitability are accelerating right into 2022, reflecting our continued leadership in specialty RFID applications for the IoT sector. We’re growing substantially faster than any of our segments which means we’re taking share from other companies,” said Steve Humphreys, CEO of Identiv. “Last quarter our RFID revenue grew 41 percent year-over-year. Our premises business grew 20 percent year-over-year. And our total revenue increase grew 16 percent year-over-year.”

Strategizing for growth

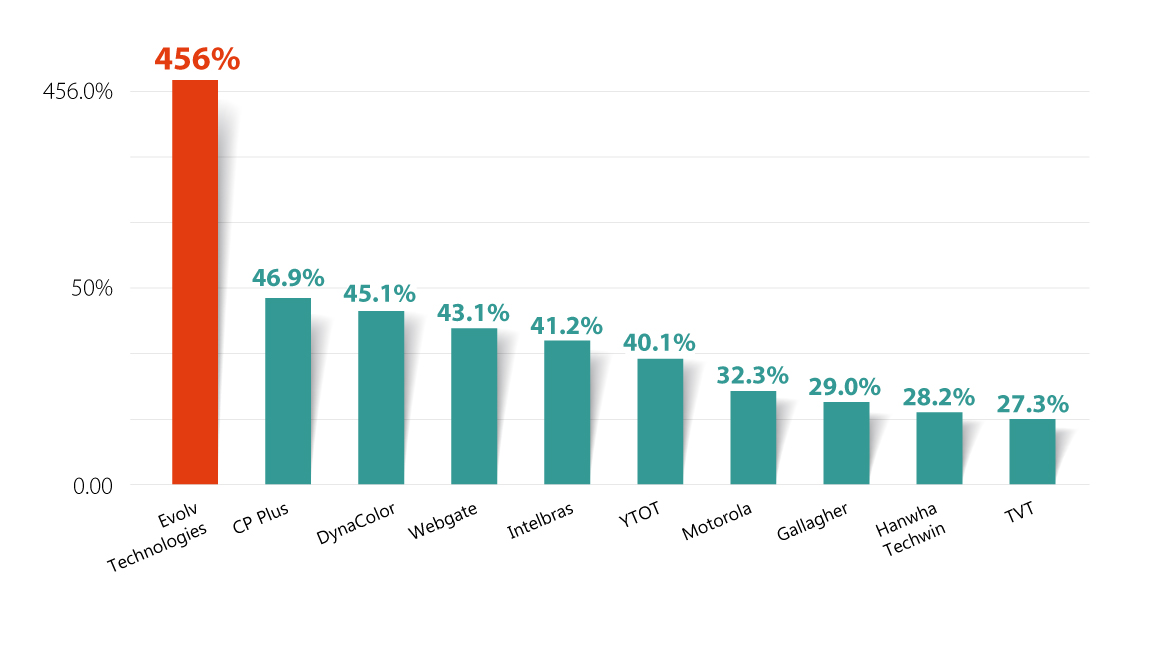

In total, 40 companies in this year’s Security 50 reported growth last year, with 28 growing by double to triple digit. The Top 10 growth companies were: Evolv Technologies, CP Plus, DynaColor, Webgate, Intelbras, Dongguan Yutong Optical Technology, Motorola Solutions, Gallagher, Hanwha Techwin and TVT Digital Technology. Of note, Evolv, a provider of weapons detection security screening solutions, reported 2021 revenue of US$21.77 million, compared to $3.92 million for 2020 and translating into a y-o-y growth of 455.98 percent, due to the company's effort to add customers and expand into key verticals and geographic markets.

Security 50 2022: Top growth companies in video surveillance and access control

Security 50 2022: Top growth companies in video surveillance and access control

(Revenue 2021-2020)

Indeed, these growth figures demonstrate security companies’ strength and resilience amid various challenges presented by COVID. So how did they do it? We spoke with some of the growth companies to find out.

Staying nimble and responsive

Staying nimble and responsive amid adversity is critical. “All told, it’s been a very interesting past couple of years, first dealing through Phase 1 of the pandemic in 2020, and then phase 2 in 2021. It was our supply chain that got us through these years. We were able to get ahead of the shutdown and pre-order 4x our general monthly orders for our main suppliers once we heard the World Health Organization was in Wuhan, China, knowing how quickly China closes when needed. Two days after our orders were placed, the shutdown happened. So having inventory was certainly a major factor, as much as having production teams willing to be in our headquarters building products for customer orders,” said Jeff Burgess, Founder and CEO of BCD.

Value creation for customers

Another key to growth is value creation for customers who can continue to stick to the supplier.

“With the growth of Dahua's AI implementation ability and its continuous effort in exploring data value, the company has gradually expanded its business from traditional security to enterprise operation and management. By helping enterprises reduce costs and increase efficiency, the value of each client has been greatly improved. The company's arduous effort in business has promoted the continuous improvement of each client's value, which is a significant factor that drives performance growth,” said Fu Liquan, Chairman of Dahua Technology.

According to Humphreys, a commitment to value creation is exactly the reason why the company achieved growth even amid the biggest global supply chain crisis seen in a generation.

“The reality is that supply chain shortages haven’t been this bad since 1972. The RFID industry has predominantly been dominated by companies that just want to get a simple design and then crank them out in the hundreds of millions. From a business perspective that’s never been our position, partly because that's not where the margins are,” he said. “When we go to market, the entire arc of the whole business platform is going in the direction of higher value add solutions. We are comfortable with long sales cycles. We understand customers aren't even necessarily going to know what they can accomplish when they start out. We introduce a highly collaborative and educational selling process with customers.”

Commitment to technology innovation

Closely related to value creation is technology innovation, which allows companies to deliver products/solutions required by users. “Identiv is designing and delivering next-generation solutions that are enabling the future of the IoT. We’re a technically deep company, which is helping us to get more market share,” Humphreys said. “Technology touches people every day and it’s at our core and that drives across the premises business and the identity business, especially in RFID. Although finding great talent across all departments is a major challenge in security, we have some of the most innovative and brilliant engineering minds in the industry working in research and development. Those engineers are making the technology more deeply embedded, leveraging it more effectively, and then making it totally pervasive so that security is all-encompassing.”

Respecting local laws and policies

For multinationals, respecting local laws and policies is key to ensuring growth in overseas business. “In the face of the current complex and changeable global political and economic environment, Dahua respects the laws, policies and customs of various countries and always complies with all applicable laws, regulations and business ethics of each market in which we operate to meet the requirements of globalization compliance,” Fu said. “The company continues to strengthen the strategy for the localization of overseas employees by building an international marketing and management team as well as localized marketing and service centers to further explore the global market. Globalization and the continuous growth in overseas market will also contribute to future business growth of the company.”

Growth expected to continue

Looking into 2023, most companies expressed optimism growth will continue. “We are very bullish about the security market because AI and Machine Learning open a whole new scale of possibilities, solutions, and integrations in and beyond security,” Beernink said. “At, for example transportation clients like airports, we see that our clients are enormously challenged to keep their operations running whilst challenged on employees and being confronted with much higher passenger quantity. This as an example drives a demand for clever VMS security solutions. Security managers in our markets are challenged to do more with less resources. We at Milestone Systems have great solutions to fulfil that market trend.”

“Over the past twenty years, we have been through tsunamis, memory factory fires in Japan, recessions, and presidential elections. We have basically seen it all, so we always feel like we are ready for anything. As we continue to challenge ourselves to deliver more platforms to the market, such as the Q4 2022 release of our All-in-One NVR and Deepstor high-availability external storage, it will allow us to widen our brand globally. This is also why we are forecasting twenty-percent year-over-year growth in 2023,” Burgess said.