In this article, we asked top security companies in the field about the technology trends they foresee would make the most impact in 2022, and correlated this with the findings from our tech trend maturity and suitablity index reader survey.

The year 2021 saw the security industry recover from the problems that COVID-19 brought about. As we enter 2022, market players and customers would hope that this recovery continues without setbacks.

Industry experts across the board remain optimistic about market prospects in the coming year. Technology has become an important enabler of growth in the physical security industry especially during Covid-19 – changing the way markets and regions do business and speeding up the development of new solutions and applications. But not all might be appropriate or ready for immediate adoption.

In this article, we asked top security companies in the field about the technology trends they foresee would make the most impact in 2022, and correlated this with the findings from our tech trend maturity and suitability index reader survey. The combination of which will help identify which technologies to take note of and take advantage of to gain a competitive advantage in the business.

1. Integration of more devices

Next year we're probably going to see even more hardware and data sources integrated into physical security systems for operations that go beyond safety and security.

"Building sensors is a big one – there are so many devices that could be integrated for monitoring and efficiency purposes, or for example, to help manage energy consumption or production facilities," says Laurent Villeneuve, Product Marketing Manager at Genetec. "We foresee that it will expand beyond traditional sensors, and customers will start to integrate water, temperature, lighting, HVAC, elevators, and other IoT devices that can help them better understand and control their environment and facilities."

2. 5G looks promising even though it's not fully ready

One technology that would accelerate the growth of the Internet of Things would be 5G wireless communication. Despite varied rollout of 5G across the globe (with various countries playing catching up to others), 5G has been regarded as the solution to address perpetual core issues in the industry relating to bandwidth and latency.

For video surveillance, 5G has been a conversation for some time now. Adding Wi-Fi and 5G to cameras can help enable real-time video surveillance from remote sites using mobile applications, which can be economically challenging for most end users with legacy technology. Despite the channel players' opinion that the technology is not yet ready for deployment, manufacturers remain upbeat on the prospects.

"Integrating that level of connectivity into a camera can provide increased situational awareness and early warning from unattended locations, translating into more effective incident prevention and an increased response time," Kinnera Angadi, Security CTO and CPO, Honeywell Building Technologies explained. "The connectivity of these cameras can also enable more analytics at the edge and reduce upload latency to the cloud. 5G also has the potential to decrease the cost of installation, which can have a large impact in areas like smart cities or communities, where a high number of cameras are needed."

Marti said that his company looks forward to the ongoing deployment of 5G as that will allow a considerable shift in how video can be transmitted and used, particularly from remote locations at significantly lower costs than today.

"Overall, it will allow for richer data streams for more sophisticated metadata analysis in the cloud, which is relevant for cases where pre-processing happens on a camera and full processing happens in the cloud," Marti added. "This new capability will also make it possible to leverage additional video streams for richer analytic analysis or simply more cameras and reduce latency of the stream at the same time."

As billions of information-collecting sensors and devices are interconnected and integrated, this provides the metadata volume and framework required to develop advanced artificial intelligence (AI) algorithms and train new analytics models for actionable insights.

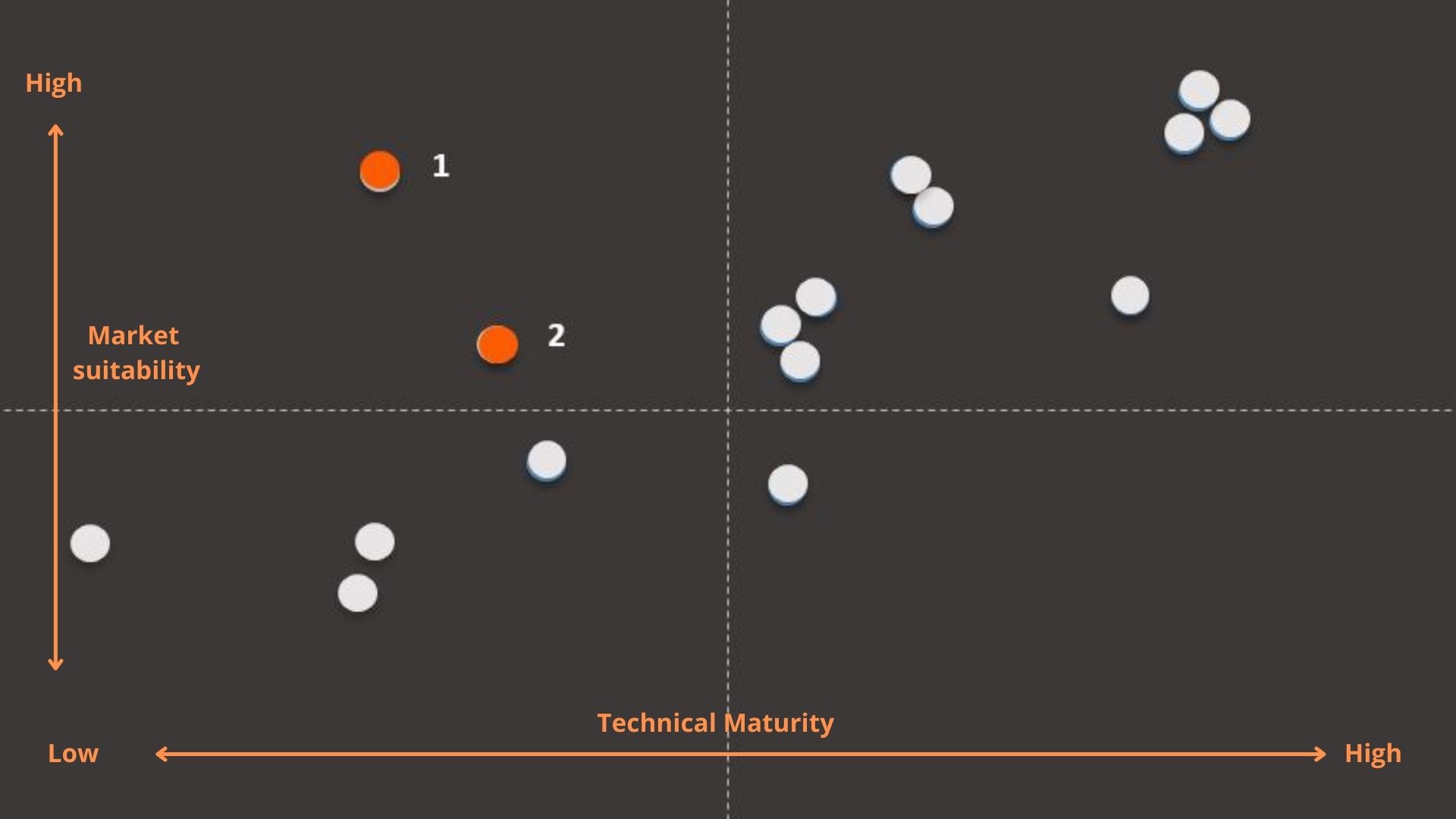

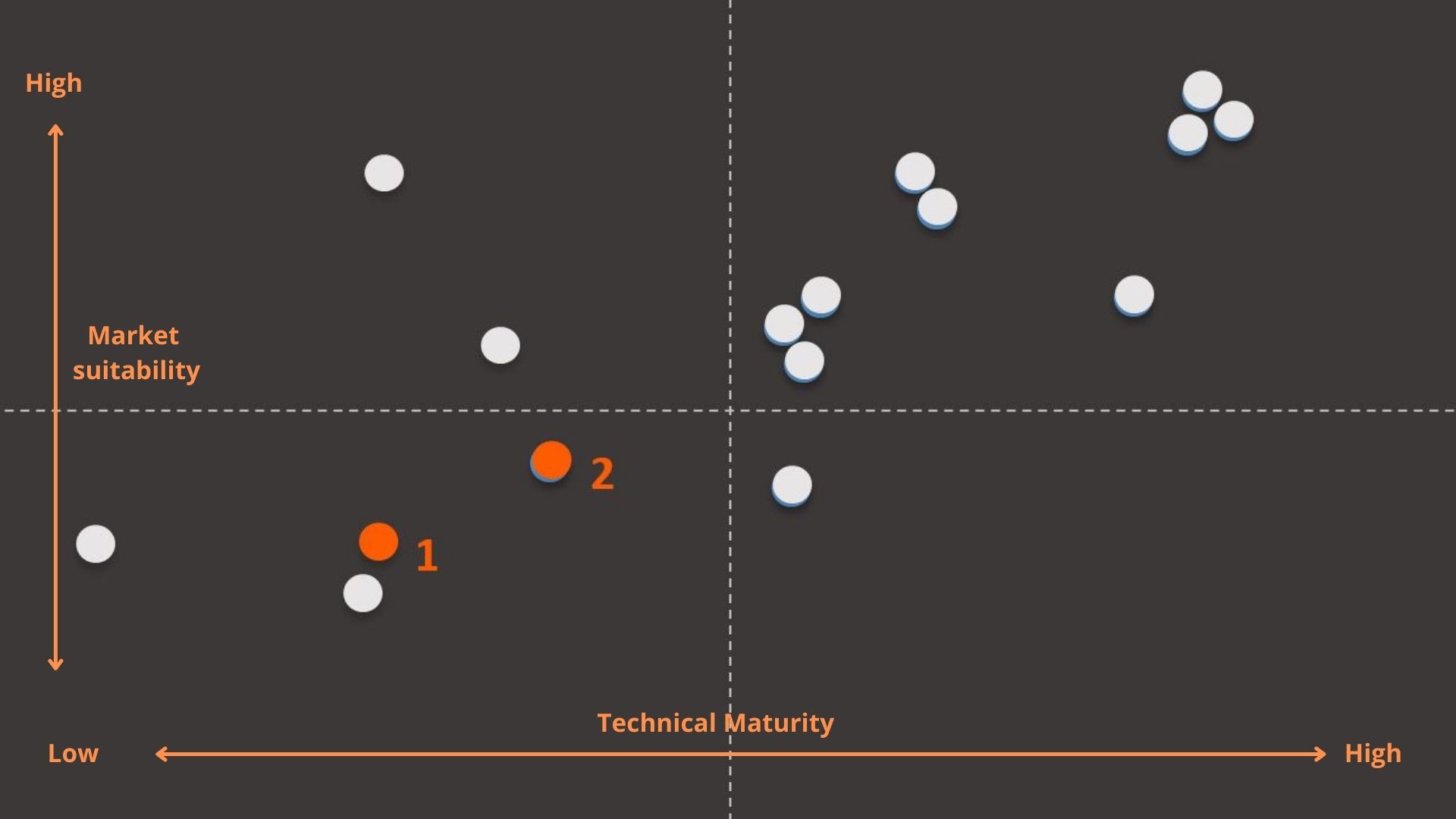

New camera compression standards like H.266 and MPEG5 codes are being explored and have been regarded as very suitable for the industry (see Figure 1), but codec complexity and video resolution/frame rates would be leveled up, potentially upping up challenges to existing encoding solutions and traditional servers.

Figure 1: Suitable but not mature: (1) H.266, MPEG5 codecs (2) 5G wireless communication

Figure 1: Suitable but not mature: (1) H.266, MPEG5 codecs (2) 5G wireless communication

3. Increased migration to the cloud and hybrid cloud

From a security market perspective, we could see more demand for video surveillance, intelligent IoT solutions, and cloud services grow in the following year. Cloud, in particular, could see increased demand as technology becomes more reliable and affordable.

"Cloud-based video surveillance is a highly valuable option across several vertical markets," explains Nigel Waterton, CRO of Arcules. "The cloud has proven to be a highly functional, flexible, and convenient method for businesses looking to leverage as part of their strategies to protect and modernize their facilities. The cloud enables organizations to enhance operations and create a proactive and reliable data strategy to mitigate risk and make intelligent decisions when properly managed."

This corresponds with the results of our cloud security market earlier this year (see figure 2). The survey showed a strong interest among industry channel players to employ cloud service – 42% of respondents said that they are already deploying cloud project with a significant number replying in the affirmative when asked if they were likely to adopt cloud services for their business in the coming year (45% for cloud video surveillance and 34% for cloud access control).

Some experts also feel that hybrid-cloud technology could be more popular than pure cloud-based solutions. A hybrid cloud deployment makes a lot of sense for many customers because it gives them the best of both worlds.

"Hybrid cloud adds greater flexibility and disaster recovery, makes it easy to federate in remote sites on a single platform quickly and is probably the best way to comply with any retention policy," Villeneuve said. "It offers a great balance between the performance and feature set of on-premises systems and the ease of deployment of cloud solutions.”

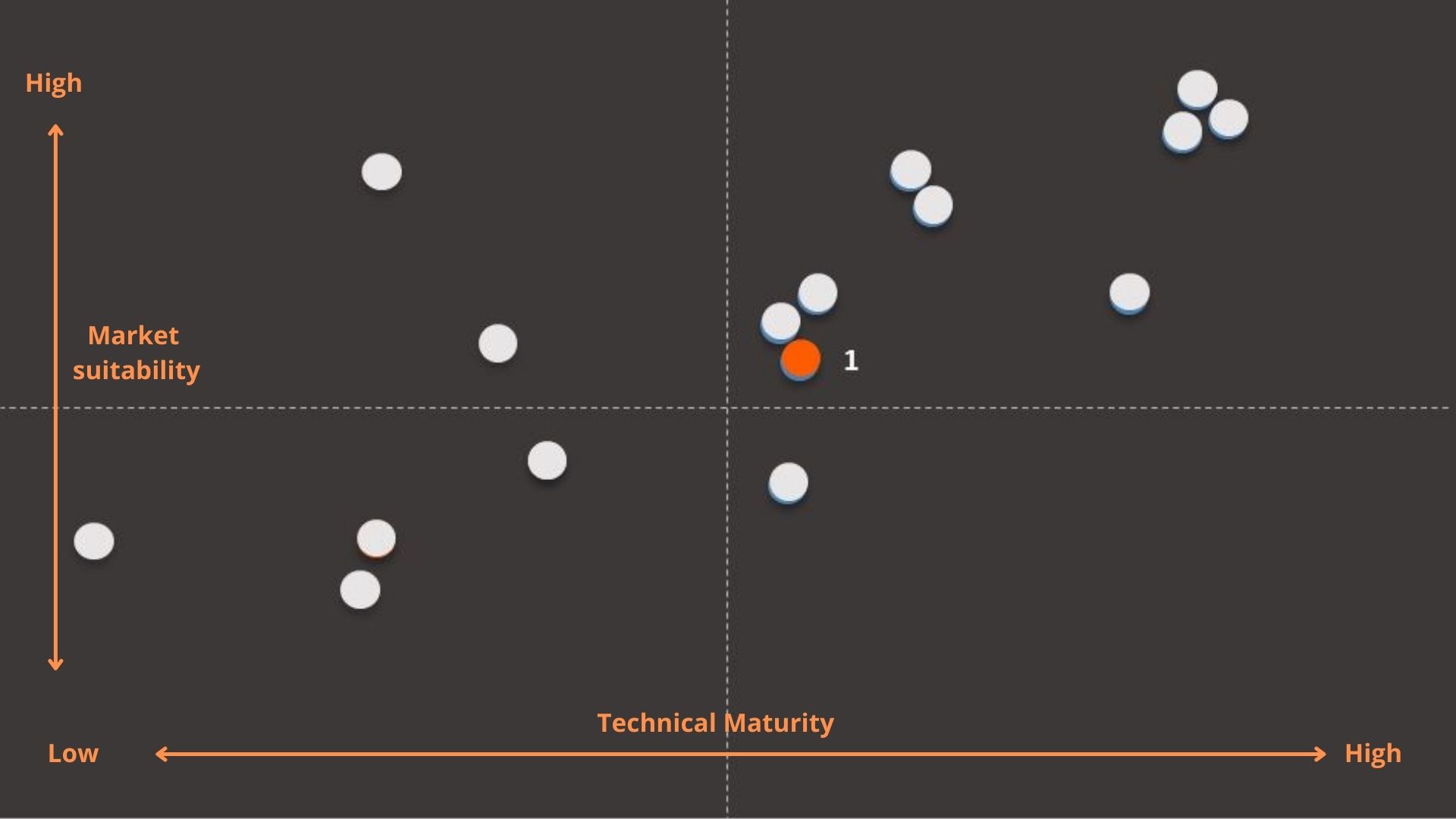

One interesting result of note from our survey, Video surveillance as a service (VSaaS) was ranked only slightly above the average level for suitability and maturity (see figure 3), relatively lower compared to AI-related technologies.

Figure 3: Mature and Suitable: VSaaS

Figure 3: Mature and Suitable: VSaaS

4. More automation and use of analytics

2022 is also looking to be a promising year for automation and intelligence. Now that video analytics and other video automation capabilities are becoming more and more commonplace, this could be a major area of innovation for physical security solutions.

"AI is also expected to be a key component of video surveillance in the coming year," explains Matt Tengwall, General Manager, Fraud and Security Solutions at Verint. "It helps users capture critical information to understand security risks and customer sentiment better. Organizations need to assess AI and video analytics to ensure their strategy aligns with the business goals."

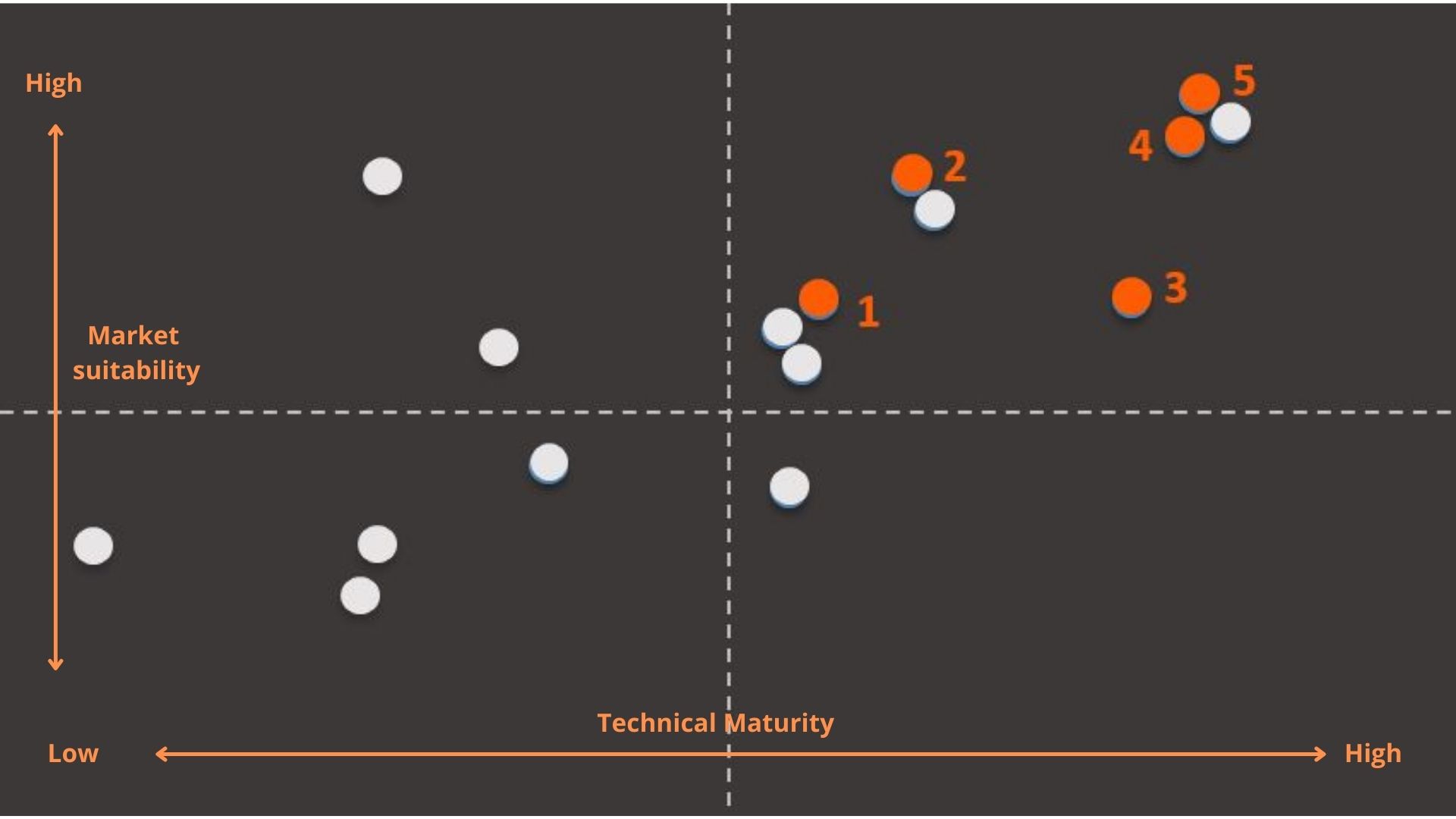

The trend survey saw AI analytics-related technologies, such as AI forensic research, business intelligence, object detection and bandwidth, considered both suitable and mature enough for use by industry channel players (see figure 4).

Figure 4: Overall, AI analytics-related technologies are considered both mature and suitable by industry players.

Figure 4: Overall, AI analytics-related technologies are considered both mature and suitable by industry players.

(1) AI-controlled bandwidth (2) AI object detection (3) AI-driven business intelligence

(4) High speed LPR (5) AI forensic research

Security analytics has significantly advanced in recent years as technology capabilities have increased. Analytics can now help end users identify trends in building usage, drive business outcomes like demonstrating industry compliance and help increase building safety.

According to Angadi, the technology has gone beyond a single feature in a physical video camera to show the value of integrated security systems.

"At Honeywell, we're focused on using tools like artificial intelligence (AI) and machine learning (ML) to constantly improve our analytics and the data we collect," Angadi said. "This can not only help customers create a high-quality security system but also help manage their data in a way that helps them achieve their security goals. As the cameras themselves continue to become smarter, we'll see an increase in implementation into security systems. Customers will see a lower cost to deploy and install, as well as faster analysis of data collected, which ultimately helps them better prepare for and react to security incidents."

Fabio Marti, VP of Marketing at the Bosch-funded Azena, agrees, adding that the increase of cameras and video footage necessitates pre-analyzing for relevant events and information to give human operators the ability to determine the most appropriate response to the situation.

"Video analytics helps to isolate the most relevant events to the operators' attention and provide additional information to support decision making," Marti said. "For example, in the case of an intrusion, any of the following analytics could help evaluate the scene for further action: was there a weapon detected, how many people were detected, has there been other suspicious behavior, car model recognition, speed of movement, etc."

By matching these initiatives to actual business outcomes and getting serious about data and video quality, organizations then have the potential to power next-level customer engagement.

5. Bigger steps in cybersecurity

Villeneuve expects more changes in cybersecurity in the coming year. Security solutions are under more scrutiny than ever, so they will need to evolve to match the market's expectations and higher standards in terms of cybersecurity and privacy.

"Our customers are now putting people's safety and privacy first, and having the right products is essential for them to build trust with people who interact with their environment or technology," Villeneuve said.

Others agree. John Rezzonico, Founder and CEO of Surveill, said that cybersecurity would continue to be top of mind, especially in light of the well-publicized breaches organizations experienced over the past 12 months.

"Physical security vendors have to be sure they are following cybersecurity best practices to ensure the utmost protection for their end customers," Rezzonico said. "But this takes the form of a significant shift. When you think of a video surveillance system, cybersecurity may not immediately come to mind."

Hacking and malware are often considered separate from physical security devices. But the two have become intertwined, as bad actors are starting to use more sophisticated and unique methods to gain access to networks, data, and assets. As more physical security devices become connected through the IoT, encryption and vulnerability testing are essential to ensure secure data transfer.

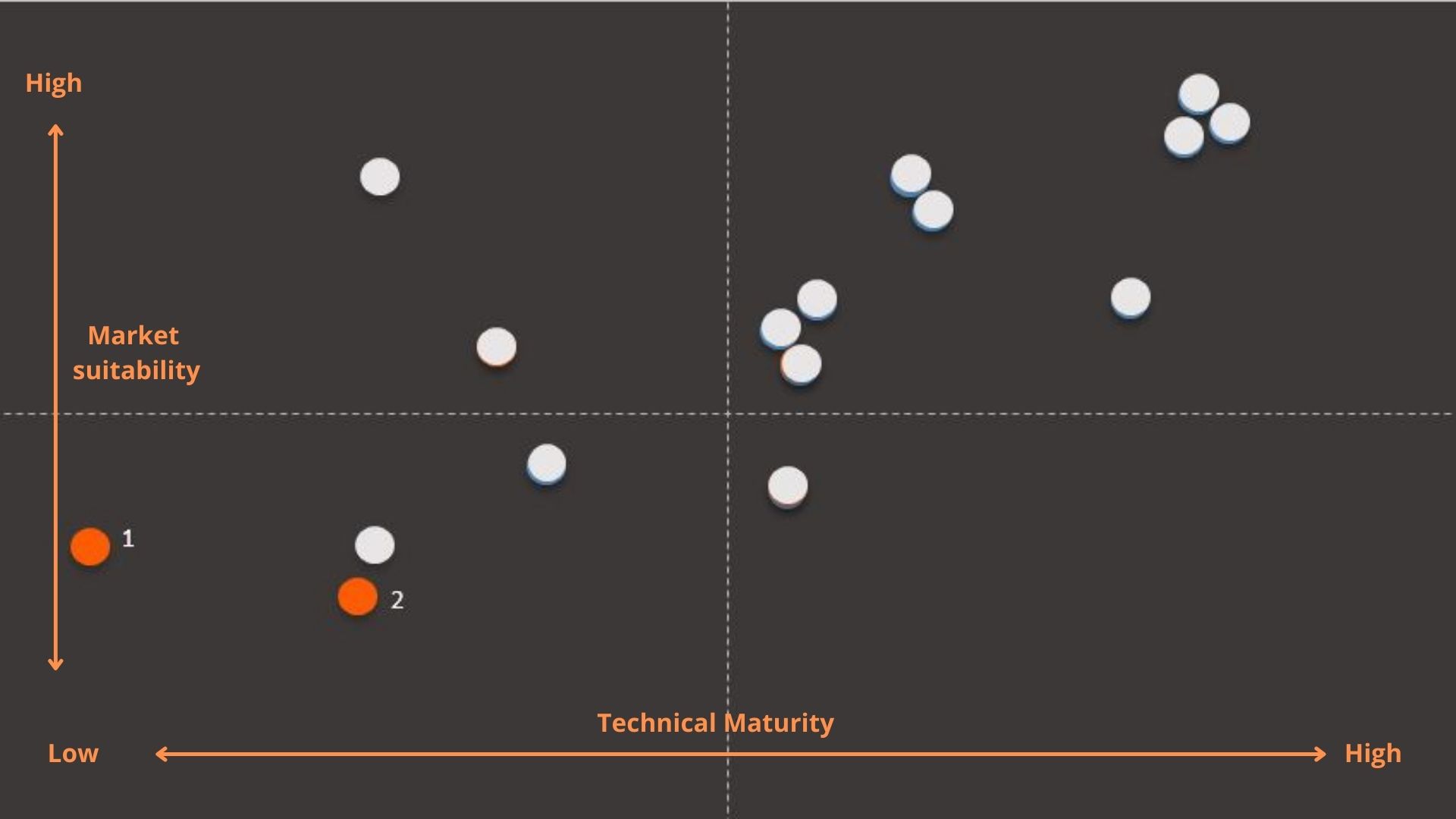

Blockchain technology and containerized applications have been subjects of interest in the industry for its many features including their potential to enhance data security, as a decentralized infrastructure can aid in footage encryption and minimizing data forgery. The survey cited both as being not mature nor suitable for the industry as of yet (see figure 5). This is not surprising as adoption have been said to be challenging, with lack of knowledge and the struggle of designing a comprehensive strategy to best implement this without disrupting current operations cited as additional limitations to implementation.

Figure 5: Not mature nor suitable: (1) Blockchain technology (2) Containerized applications

Figure 5: Not mature nor suitable: (1) Blockchain technology (2) Containerized applications

6. More mobile applications

Industry experts expect significant improvements in web and mobile applications in 2022. They should be able to present the same kind of rich information beyond traditional video sharing and playback.

"Whether it's through map or dashboard interfaces, they are becoming powerful tools for live response and investigation tasks, and users will be able to perform just as many operations on a phone or remotely on a laptop as they would in a control room," said Villeneuve.

Some of the top access control companies expect mobile credential-based solutions to become popular as well. John Becker, VP of Global Sales at AMAG, said that the pandemic highlighted and excelled the need for mobile credentials. Installing Bluetooth readers and using a mobile phone as an access card is a natural progression that limits the spread of COVID-19.

"Users can set up their credentials on their own and no longer need to physically go to a badging office," Becker said. "Cards are eliminated, saving money; and replacement cards are no longer needed when an employee forgets their badge at home."

7. Radar and Lidar not ready yet, but has potential

Although the survey showed Radar and Lidar to be least ready for the market (see figure 6), Angadi suggests that some unique benefits make them suited for certain verticals.

"LiDAR sensors can be deployed in security systems for a wide range of applications and use cases, including outdoor/indoor surveillance and public safety, border control, intruder detection, access control, and perimeter defense," Angadi said. "For Honeywell, critical infrastructure represents the largest security market for LiDAR with verticals such as data centers, energy generation and distribution, water and utilities, nuclear facilities, and oil and gas as the main segments."

LiDAR can coexist with biometrics sensors in many environments to offer a full range of security features stretching from early, long-range detection to facial recognition. For many customers, LiDAR would not replace the use of cameras but rather complement video networks.

Figure 6: Not mature nor suitable: (1) Unmanned security platforms (2) Radar and Lidar

Figure 6: Not mature nor suitable: (1) Unmanned security platforms (2) Radar and Lidar

Conclusion

In 2022, we could expect a steady recovery from the pandemic-induced slowdown. Many of the technologies that became popular because of the pandemic would continue to be in demand. Verticals that support these solutions could be drivers of growth for the industry.

The industry will definitely see more innovation in the coming years as customer requirements change and companies look to offer better solutions. But not all the new technologies that come into the market may be useful. Knowing what works and pursuing them is critical to organic growth.

About the survey:

The tech trends reader survey was conducted by asmag.com in Aug 2021 with 339 industry players worldwide providing their feedback. Our respondents mainly consisted of system integrators/installers (34%), distributors (24%), consultants (17%), manufacturers (16%) and end users (6%). Asia was strongly represented (53%), followed by EMEA (32%), Americas (13%) and Oceania (2%).

The full results of the survey will be released on the 2021 Security 50 ranking page coming soon.