On average, the 50 companies recorded a growth of 9.3 percent from 2018. China, despite the trade war and cybersecurity issues, remains security’s top manufacturer, and that status is unlikely to change in the years to come.

Overall, the global security industry had a good 2019 (this was before COVID, of course), in which 37 of the

Top 50 companies in security registered growth. On average, the 50 companies recorded a growth of 9.3 percent from 2018.

The Top 10 on this year’s Security 50, as ranked by their 2019 revenue, are: Hikvision, Dahua, ASSA ABLOY, Bosch Security Systems, Axis Communications, Uniview Technologies, Tiandy Technologies, Allegion, Hanwha Techwin and TKH Group. There weren’t a lot of major changes compared to last year’s ranking, except for FLIR Systems, whose position dropped from No. 6 last year to No. 13 this year after a revenue decline from the company’s commercial business unit.

Together Security 50 companies had a total 2019 revenue of US$25.84 billion and registered an average growth of 9.3 percent from 2018.

Among the newcomers making their debut on Security 50 this year are: BCD International, Fujian Forecam Optics, Spica International, Streamax Technology, Yutong Optical Technology, Zenitel and ZKTeco. Together they had roughly US$937 million in revenue, about 3.6 percent of the Security 50 total.

“Perhaps what drives us is that we are never satisfied, nor do we rest on our laurels. By listening to our customers and sharing technology philosophies with our vendor partners, we can push the envelope, or what we consider be a ‘positive technology disruptor.’ Their talent led to the development of intellectual properties, such as our recent DELL iDRAC and VMware integrations into Genetec Security Center, both allowing single pane of glass server management from the desktop, not the IT server room,” said Jeff Burgess, CEO of BCD International.

“Špica is traditionally present in the Adriatic region, and most of our revenue is coming from this area. But international markets (presence in 25 countries, outside of Adriatic) is building our results in last years. After a boom in Middle East, now we are more focused on developing markets in Africa and CEE region, where we have a great and successful cooperation with Microsoft,” said Tone Stanovnik, CEO of Spica International. “Also, our cloud solutions are opening new, Western markets, like Baltics, Sweden and U.S. In 2019 we opened our US office in New York.”

The top 10 companies with highest 2018-2019 growth are Wanjiaan, C-PRO Electronics, Zeno Videopark, BCDVideo, Streamax Technology, Infinova, VIVOTEK, Yutong Optical Technology, Zenitel and Uniview Technologies.

Chinese strong domestic market

In the lead-up to Security 50’s release, we had been waiting to see whether the still ongoing

U.S.-China trade war had any effect on Chinese security companies. Based on a close analysis of the figures, we can say the impact was offset by their domestic revenue.

One component of the trade war, the US National Defense Authorization Act (NDAA) bans the US federal government from using security products or components made by Hikvision, Dahua and Huawei, the last of which produces Hisilicon chipsets that are used in a wide variety of IP cameras today. That notwithstanding, Hikvision and Dahua solidly retained their No. 1 and 2 spots with revenues of $7.7 billion and $3.8 billion, respectively.

A closer examination of the numbers finds that both companies’ 2018-2019 growth figures, 13.16 percent and 10.5 percent, have shrunk somewhat, from 17.14 percent and 25.58 percent between 2017 and 2018. It showed that the two companies’ revenues were influenced by the US-China competition.

Similarly, Chinese companies that are purely or mostly exports-/OEM-driven suffered the impact of the trade war more. TVT for example reported revenue growth of 4.3 percent from 2018 to 2019. The same situation can be seen by many other medium to small Chinese suppliers.

But then, any negative impact from the trade war has been offset by China’s strong and solid domestic demand. Indeed, during China’s Political Consultative Conference in May and Politburo meeting in July, Chinese leaders made it clear to use domestic demand as the engine to drive growth in the years to come, amid external uncertainties. And this policy has produced good results thus far: Recently, China reported a GDP growth of 4.9 percent year-on-year for the third quarter of 2020, due largely in part to domestic demand, while the rest of the world were struggling with covid-19.

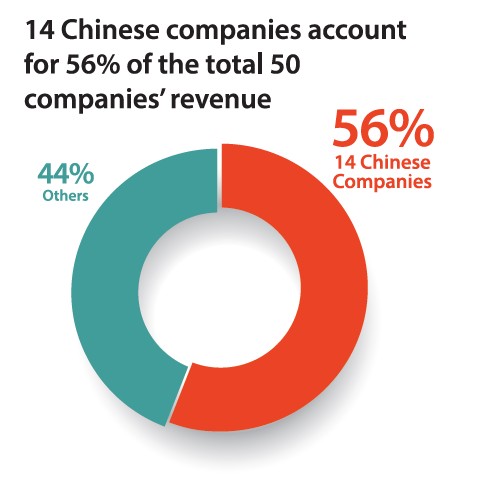

The robust domestic demand in China is well reflected in Security 50. On this year’s list, there are a total of 14 Chinese companies, yet they have a combined revenue of $14.5 billion, which accounts for over half, 56 percent to be exact, of the Security 50 total. Further, they achieved an average growth of 20 percent from 2018 to 2019 during the height of the trade war. Hikvision and Dahua aside, most of these Chinese companies, such as Uniview, Kedacom, and Tiandy, have sizable business and projects in China.

Of the 14 Chinese companies, 13 focus on video surveillance. Needless to say,

video surveillance technology has become quite advanced in China due to the adoption by the government and the private sector.

In the end, in 2019, before covid threw everyone off balance, the winning streak in security continued. It’s worth to note that over half of that revenue came from companies in China, whose domestic market has proven to be too strong for the US-China trade war to produce any meaningful impact on Chinese security companies. With few other countries – if any – able to achieve the kind of domestic demand, manufacturing scale and cost-down capabilities as China, we can expect China’s leading status in security to remain unchanged in the near term.