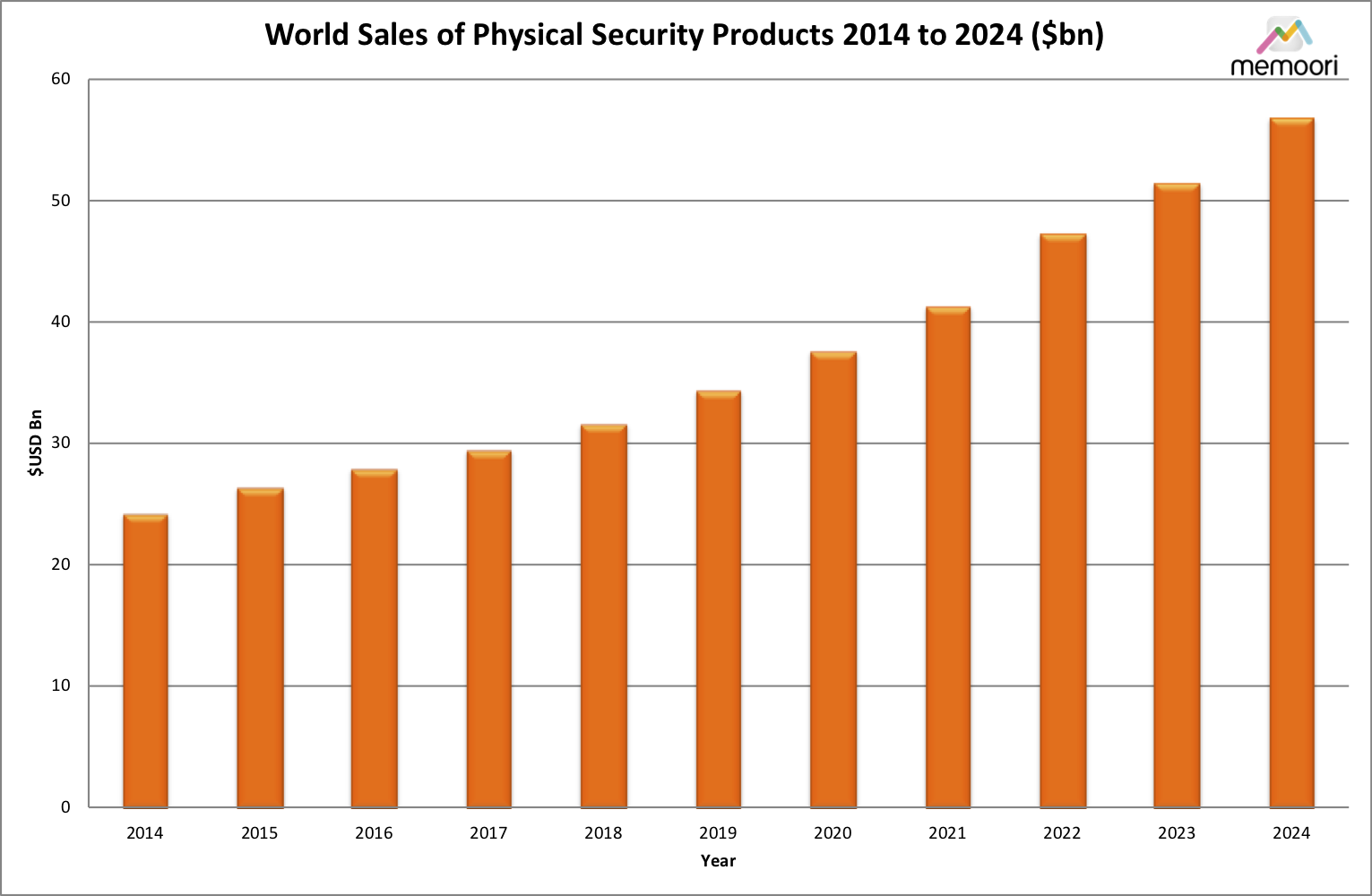

Memoori’s 2019 annual report on the physical security business will show that the total value of world production of physical security products at factory gate prices in 2019 was US$34.31 billion, an increase of 8.5 percent on 2018, whist the compound annual growth over the last 5 years was 7.24 percent.

Memoori’s 2019 annual report on the physical security business will show that the total value of world production of physical security products at factory gate prices in 2019 was US$34.31 billion, an increase of 8.5 percent on 2018, whist the compound annual growth over the last 5 years was 7.24 percent.

This is remarkable growth given that world GDP growth averaged around 2.7 percent from 2012 to 2017, so growth in the physical security business has outperformed it by a factor of 2.6.

Over the last 10 years the market has grown by a compound annual growth rate of 6.27 percent. We forecast the market will reach $56.76 billion in 2024 at a CAGR of 10.72 percent, however significantly different rates of growth will apply in each of the three businesses (access control, video surveillance, intruder alarm) and geographic regions.

Video surveillance

Video surveillance had the highest rate of growth at 9.74 percent over the last 3 years as Western manufacturers fought back against the Chinese competition, but they still have little possibility of penetrating the Chinese public sector business. China is by far the largest single market probably accounting for 35 to 40 percent of world demand.

Access control was expected to deliver a slightly higher performance than 8.2 percent as it further expanded the IP network business, advancing deeper into biometric, identity management, wireless locking systems and

ACaaS. This would have been the third consecutive year that it turned in the highest rate of growth of the three businesses, but price pressures are starting to bite, partially through consolidation and weaknesses in the supply chain. This has reduced growth when measured by value.

The

intruder system business, the father of the physical security business, has long since reached maturity but its increasing use of radar, thermal and multi-sensor cameras, has contributed to growth of 3.8 percent in 2019. In addition, advances in sensor technologies, wireless technology and the integration with video surveillance, access and outdoor lighting have all contributed to its growth. We accept that there could be some video surveillance products that are being installed in PP/IA projects but are not being counted in this sector and this could have distorted growth in the sector.

Demand structure in the video surveillance business is unbalanced and unhealthy

We have shown in our report that the problem for overseas manufacturers getting a piece of the China market is not about technology or performance, at its core it is a political and geopolitical challenge.

The reason is that the communist political party has some control over even private video surveillance manufacturing companies and if they want public sector business (which today accounts for more than 50 percent of the Chinese’s video surveillance market) and support with long term cheap loans then they must comply with the states requirements and wishes.

For this the state ensures that foreign equipment will not be used on public sector projects. Not surprising this arrangement has distorted any possibility of “open trade” and further has allowed the two major Chinese manufactures (Hikvision & Dahua) to build up 40 percent of the worlds video camera business, in part by operating a “race to the bottom “ on lowering prices that no other manufacturers could sustain because they don’t have the volume of production.

However there could be a sting in the tail. On the horizon are other Chinese companies that want a part of the massive investment in the public sector safe city projects. Huawei, one of the world’s largest communication companies, have announced a major push into video cameras and the new startup Megvii in AI video analytics intends to offer complete video surveillance solutions. There is no doubt they will eventually get established in the public sector market and take share from the two present incumbents, and this could at least reduce the pressure on non-Chinese manufacturers operating in the more open world market.

Market forecast to 2024

Our forecast for the next 5 years to 2024 takes into account that there will be no improvement in world trade and little growth in GDP for the next two years. The last 5 years shows that the physical security business can achieve solid growth in an underperforming economic climate, because new technology is improving product performance and continually reducing the cost of ownership.

Terrorist activities is unlikely to be quelled during the next 5 years and government budgets to counter this will rise with consequent benefit to the physical security business. In the commercial world the demand for more comprehensive connectivity across all 3 of the branches of the physical security business and the business enterprise will grow, aided by IoT technology. This will become evident by the end 2020 with a solid acceleration of growth through the following 4 years.

We forecast a CAGR of 10.7 percent in terms of value over the next 5 year period from 2019 to 2024. The main drivers will be AI video analytics software accelerating to a potential of $3.5 billion by the end of 2024 from a miniscule size today and also creating further demand for more video surveillance hardware.

This has been taken from the eleventh edition of Memoori’s Annual Report “The Physical Security Business 2019 – 2024.”