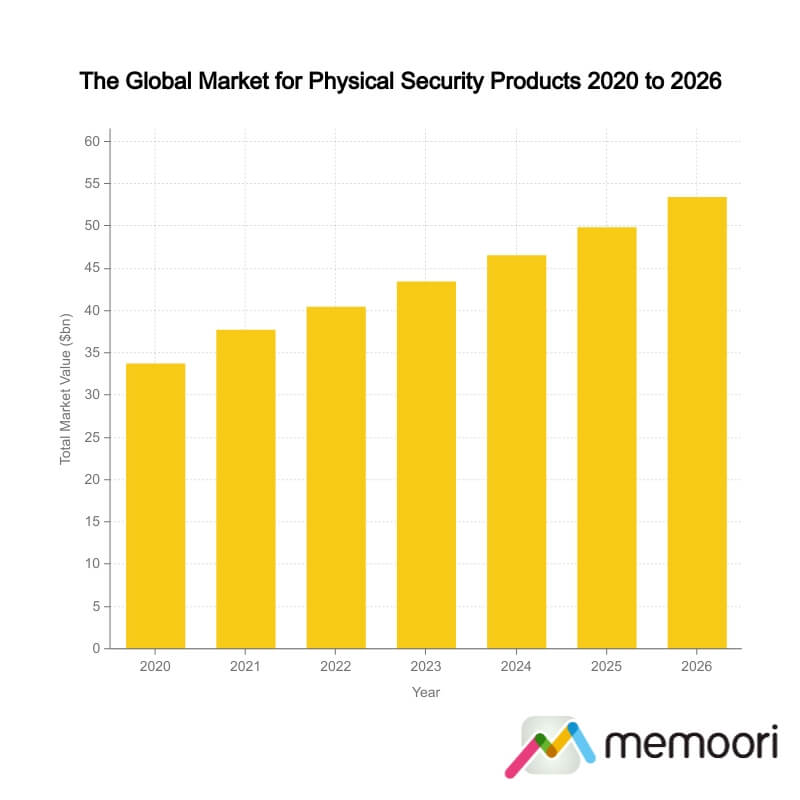

Next month Memoori will publish its latest research, estimating that all physical security product sales at factory gate prices in 2021 totaled $37.8b, a positive figure considering challenges from the ongoing pandemic. The comprehensive study also anticipates a compound annual growth rate (CAGR) of 7.2%, resulting in a market worth $53.5b by 2026 and demonstrating a strong bounce back from a COVID-19 related

Next month Memoori will publish its latest research, estimating that all physical security product sales at factory gate prices in 2021 totaled $37.8b, a positive figure considering challenges from the ongoing pandemic. The comprehensive study also anticipates a compound annual growth rate (CAGR) of 7.2%, resulting in a market worth $53.5b by 2026 and demonstrating a strong bounce back from a COVID-19 related downturn felt by almost all industries around the world. While the pandemic put a dent in physical security market growth, its quick revival has brought a new sense of optimism to the sector.

The global physical security industry actually outperformed overall performance predictions made in the crisis. This was, in part, due to a temporary spike in demand for thermal cameras for “fever screening” during global virus mitigation efforts. These “fever cameras” helped significantly in holding up video surveillance revenues in the most challenging times of 2020, with the majority being exported from Asia to Europe and the US. This has caused us to revise up our previous estimate for 2020 total physical security product sales from $32.4 billion (in our best-case scenario) to $33.8b.

While the pandemic is shifting the overall balance of priorities for many organizations, security as a whole has retained its importance, particularly for solutions that enable enhanced remote control and monitoring of sites (cloud). As the world gets more remote and automated, these features, alongside improving image resolution, power-efficiency, and intelligence (AI), will drive continued growth in the physical security space.

Despite constricted supply chains and mounting US pressure on specific companies, Chinese manufacturers actually weathered the pandemic storm well, after a slow Q1 2020 during the first wave of coronavirus they have roared back with impressive growth in the 18-months since. Margins for these vendors are somewhat lower in 2021 than the highs they hit in late 2020 but as the market settles into a new growth phase it is the impact of president Biden’s ‘Secure Equipment Act’ that will be attracting the most attention.

“The Secure Equipment Act is now the law of the land and will ensure that insecure equipment from Huawei, ZTE, and other untrustworthy entities can no longer be inserted into our communications networks,” FCC Commissioner, Brendan Carr, said in a statement. “This gear poses an unacceptable risk to our national security. I am pleased with the overwhelming support their legislation has received in Congress to close the Huawei Loophole, and for President Biden’s signature enacting this important reform.”

Cybersecurity also remains an issue for the industry, in fact, the situation has become worse during the crisis. Cybercrime is up 600% during the COVID-19 pandemic according to a 2021 PurpleSec report, and this rise is expected to cost companies around the world $10.5 trillion annually by 2025, growing from just $3 trillion in 2015 according to Cybersecurity Ventures, who claim modern cybercrime is “the greatest transfer of economic wealth in history”. Smart buildings are now in the eye of this cybersecurity storm with a number of high profile hacks as connected building systems and internet of things (IoT) devices bring digital dangers into the physical world. The culture in IoT manufacturing of ‘get to market, be first’ needs to change, products and systems need to be designed with security as a priority.

Whilst challenges remain, there is growing optimism in the market, and this has been reflected in a steady stream of M&A & investment activity in 2021. Motorola Solution’s two security acquisitions of Openpath Security and Envysion, and Flock Safety’s $150m Series D investment are representative of this trend. Indeed the $297m paid by Motorola Solutions for the 5-year-old Startup Openpath represents one of the highest valuations for a physical security company we have ever seen. Memoori’s new report will include a full analysis of M&A and investment activity.

While competition has certainly heightened in the last 3 years, wider trends suggest there is still plenty of scope for consolidation and market growth potential is high over the next five years to 2026.

Memoori’s new report “The Physical Security Business 2021 to 2026” will be published at the beginning of next month and will be a definitive resource for Access Control, Video Surveillance & Intruder Alarm / Perimeter Protection Market Research. For further details you can email support@memoori.com.