Memoori’s 2017 Annual Report shows that the total value of physical security products at factory gate prices in 2017 was US$29.2 billion, an increase of approximately 5 percent on 2016. This is a decline in growth from its peak in 2014 but an increase on the last two years.

Memoori’s 2017 Annual Report shows that the total value of physical security products at factory gate prices in 2017 was US$29.2 billion, an increase of approximately 5 percent on 2016.

This is a decline in growth from its peak in 2014 but an increase on the last two years. Over the last 8 years the market has grown by a compound annual growth rate of 6.4 percent and Memoori forecasts the market will reach $41.3 billion in 2022 at a CAGR of 7.2 percent.

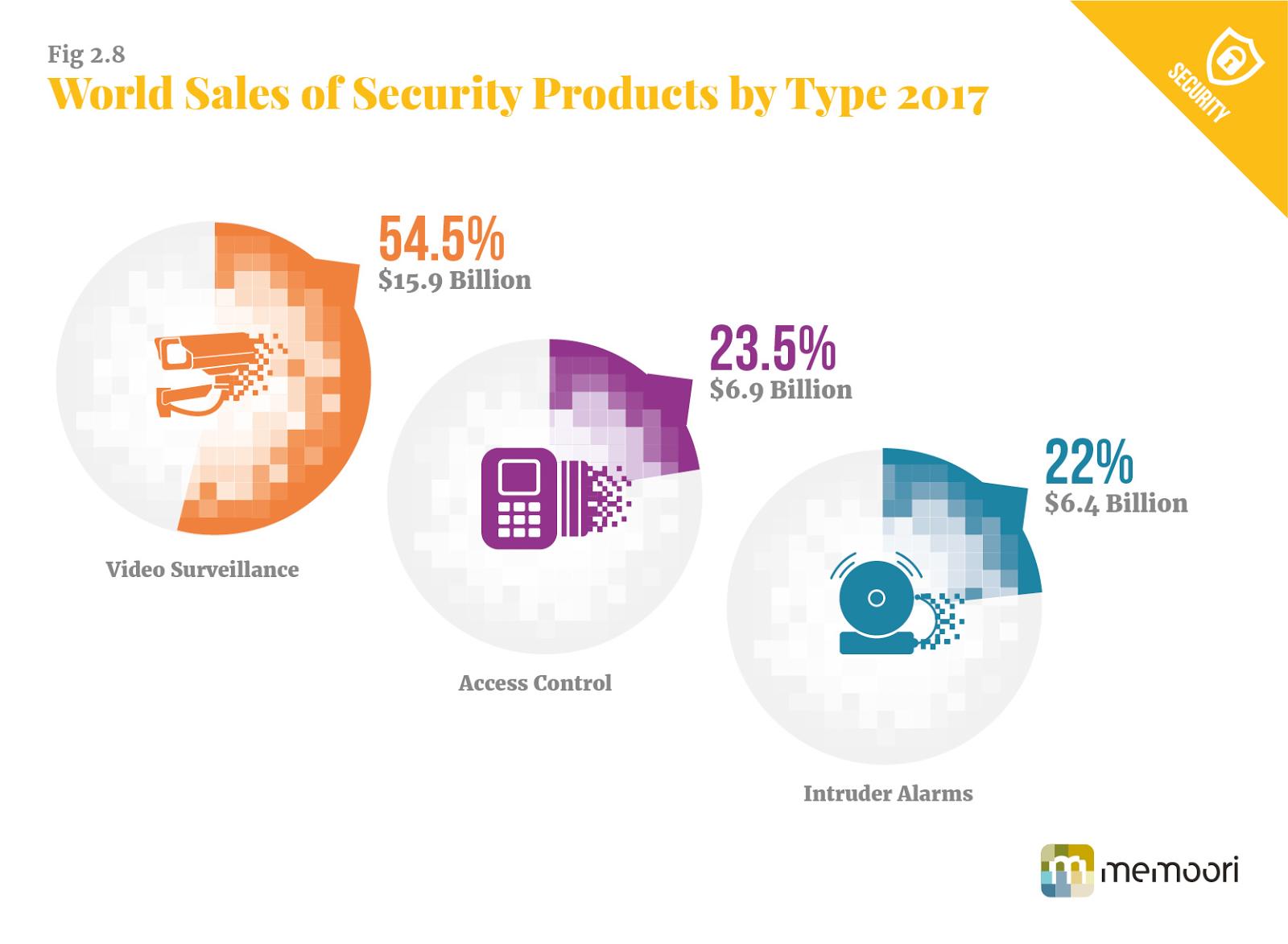

Of the three subsectors within security, access control has maintained its average growth of approximately 7 percent over the last three years, and takes a share of 23.5 percent.

The drivers that have delivered this growth are increased penetration of IP network systems, further advances into biometric readers, identity management and wireless locking systems. This is the second consecutive year that it has turned in the highest rate of growth of the three businesses. However there is some evidence that price pressures are starting to bite and this will eventually have a negative effect on growth when measured by value.

There appears to be reluctance by manufacturers to support open standards in order to protect their heritage business. This could damage their long-term future and open the way for Chinese manufactures to take up the initiative and make a strong push into the business they have recently targeted.

The intruder system business takes a 22 percent share. It is the “father” of the physical security industry and has long since reached maturity but its increasing use of radar and thermal cameras, has contributed to growth edging up to 2.5 percent in 2017.

The use of radar, advances in sensor technologies, wireless technology and the integration with video surveillance, access and outdoor lighting have all contributed to its growth.

In 2017 the market for video surveillance products was $15.9 billion a growth of 5.9 percent on 2016 and takes a 54.5 percent share of the physical security business. This level of growth looks disappointing compared with growth over the previous 5 years that averaged around 9.7 percent. However this has been a relief to many suppliers who believed that 2017 would struggle to improve on 2016 if the drastic fall in camera prices over the previous two years continued.

This has put a great deal of stress on profitability particularly for manufacturers in the western world. This problem is not going to go away and the majority of manufacturers in the video surveillance industry need to review their business strategies. We expect that the demand for branded products in the enterprise market will run at higher levels due to integration across all three security services and other building automation systems (BAS) services and convergence with IT. This should ensure that the market will be worth $22.8 billion in 2022.

Size can be critical

2017 has delivered an improved and more stable performance and now all the main drivers for growth are now firmly ready to match the performance realized in the Halcyon days of profitable growth between 2010 and 2014. However there are major technical and commercial challenges ahead that will stress the supply side and the shape and structure of the business will change significantly over the next five years.

Allan McHale, Director, Memoori Research

Allan McHale, Director, Memoori Research

The one that currently preoccupies most companies is how can we operate profitably during the “race to the bottom” and survive.

The gap between the major suppliers and the many hundreds of smaller suppliers gets wider every year, whilst at the same time profit margins are falling increasing the minimum economic size to operate profitably in this industry. This already applies to the video surveillance business and within the next five years it will take hold in the access control and intruder alarms businesses.

In the video surveillance business two Chinese manufacturers have adopted the strategy of disrupting the industry by undercutting the profit margin of incumbents, whilst at the same time expanding markets and rapidly growing market share. They have built up volume and the gap in size between them today and the next tier of western companies is so wide that it looks highly improbable that it can be reversed and certainly not by western companies competing solely on price. This gives them a dominant hold today on the mainstream business.

Strategies to meet the challenge

As commoditization of video surveillance products continues to take hold it requires a strategy that broadly focuses on either going for volume through the small-to-medium business (SMB) market or brand through the enterprise business. We believe that no more than five companies by 2022 will thrive by operating in both at the same time.

Major companies such as Axis Communications, Avigilon, Bosch, Panasonic and Hanwha are in a position to reduce their margins sufficient to hang on to their share. But to continue growing their share they need to invest more in innovative products that offer a better total cost of ownership (TCO) metric but with depleted margins they would need to increase their financial resources.

The difference between them now in market share measured by volume is enormous and it would not be a credible strategy to achieve parity of size in the short term. However a number of these companies have improved their growth and financial performance this year. They have adopted over many years a strategy of developing strong brands with end-to-end solutions focused on a number of vertical markets and having strong alliances with companies in other BAS services. So this is an option that is proving viable for some suppliers to ensure a profitable future.

Merger and acquisition between the leading western manufacturers is seen as a possible solution to match the size of Chinese suppliers, but at best, in the short term, it could only slow down further widening of the gap. Strategic alliances that share the cost of developing and marketing new products could help and there are examples of this taking place today.

Specialization in a number of vertical markets is a practical strategy to more than survive, particularly now that the Building Internet of Things is gaining traction, but this may seduce companies to sell direct to the end user and ultimately become systems integrators where the demand for their services is rapidly expanding.

This article has just dealt with one factor. There are other important factors that are changing the business landscape that can either be a threat or an opportunity including; cybersecurity, software services including deep learning and artificial intelligence software and big data, integration and IT convergence and IoT technology. Keeping abreast of all these matters and their interaction is complex but makes this industry both interesting and challenging.

This article has been taken from the 9th edition of Memoori’s Annual Report “The Physical Security Business 2017 – 2022”