Rapid advances in video, communication and networking technologies have driven up adoption of home automation and control systems considerably. Homeowners can now, more easily than ever, keep an eye or ear on their property and loved ones, through smartphone video streams, text messages or app alerts, to look or listen in on any anomalies and take control of security, safety, automation and HVAC systems in real time, on the go.

Rapid advances in video, communication and networking technologies have driven up adoption of home automation and control systems considerably. Homeowners can now, more easily than ever, keep an eye or ear on their property and loved ones, through smartphone video streams, text messages or app alerts, to look or listen in on any anomalies and take control of security, safety, automation and HVAC systems in real time, on the go.

- Globally, the home automation (HA) and control systems market is estimated to grow at a CAGR of 16.1 percent, from US$16.9 billion in 2011 to $35.6 billion in 2016, according to MarketsandMarkets' research. Over the next five years, the managed HA market will grow at a CAGR of 60 percent between 2012 and 2017, based on ABI Research estimates. Annual worldwide revenues from the residential remote video monitoring and surveillance market were projected, by IMS Research, to surpass $480 million by 2013.

- According to the US “National Crime Victimization Survey,” more than 17 million US households experienced property crimes in 2011. The US market for HA devices and systems was approximately $3.4 billion in 2011, and is expected to exceed $5.5 billion in 2016, representing a CAGR of 10.5 percent, according to an Electronics.ca Publications report; about 58 percent of the market goes to lighting, home entertainment and security systems, and the remaining 42 percent consists of HVAC and energy management.

- The growth of the APAC HA market is fueled by high-speed broadband connections, developments in home networking and advances in 3-G communications technologies, according to In-Stat. Japan and South Korea hold the leading positions, while Australia and New Zealand present high development potential. Among these, South Korea has the highest penetration of HA systems and services in the region. China, Taiwan, Thailand, Hong Kong and Singapore are potential markets.

- Remote home security is growing rapidly in Europe, at a CAGR of roughly 20 percent, as cloud-based services become more readily available to householders, according to IMS Research. Although Europe is a strong market, it is only 40 percent of the size of the Americas market. Prominent service providers include CameraManager.com, Y-Cam, NeoCam, Logitech, D-Link, VSG, IPeye, 1000eyes and Virgin Media's IP CCTV. Research from Frost & Sullivan indicates the European HA market will reach $300 million by 2015.

HA in Various Capacities

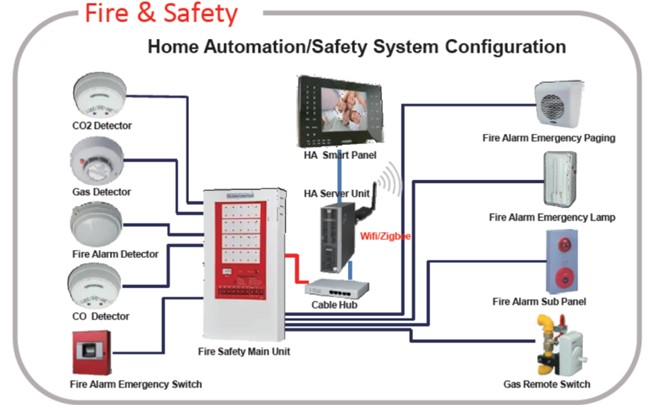

Basic integration is where a cause-and-effect relationship is established; for instance, a detector will send a signal directly to a relay that will switch something on or off. No programming is required. Full integration involves constant monitoring and controlling, and programming will be required. For instance, if an alert is sent to the control panel, the control panel will then signal the monitoring station to dispatch emergency services to your home. Most building codes today require hardwired smoke detectors be placed in homes, with battery-powered type detectors being used as backup only.

.jpg)

Geo-fences can now be set up indoors, to allow for access to specific areas of the house; this is particular useful when temporary help (such as babysitters or contractors) is needed and the homeowner is not always around. Some service providers now add two-way audio to control panels to provide verbal verification or deterrence, preventing unnecessary dispatch of first responders, which can be costly and punishable by hefty fines. Surveillance cameras are offered in advanced packages by some; any motion in the house triggers a text, app or video verification, and a prompt for proper response.

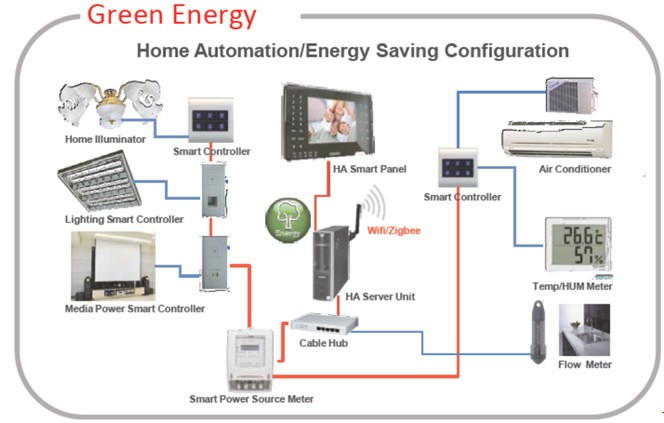

Approximately 56 percent of the average home's energy usage is on HVAC, according to the US Department of Energy. Some service providers offer more efficient energy management by connecting thermostats, refrigerators, lights and window shades to the control panel. Lighting control is another HA feature; dimmers and switches are integrated and programmed with motion detection so that lights can be automatically turned on or off wherever and whenever necessary. All the functions can be combined with physical security and intrusion detectors, and be controlled and viewed on the same control panel or a smartphone or tablet computer.

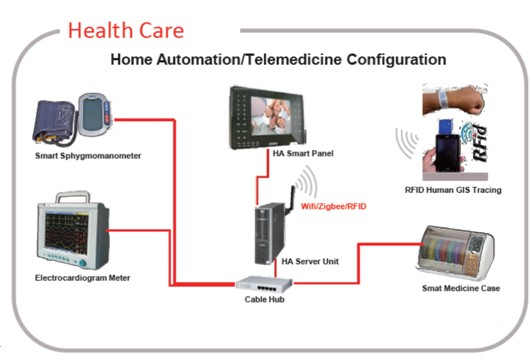

The US market for telemedicine devices and services will be worth more than $3.5 billion by 2014, according to Pike & Fischer research. A home medical-alert system includes a two-way voice intercom with a pendant. In the event of an emergency with a press on the intercom or pendant, monitoring personnel will send help, dispatch an ambulance or notify a relative or neighbor. Other processes suited for residential machine-to-machine telemedicine include diabetes, blood pressure and cardiac rhythm management monitoring. Telehealth is often less costly and produces better health results than occasional checkups and repeated hospital stays, according to a New York Times interview with Dr. Steven Landers, Head of the Cleveland Clinic's home health care unit.

.jpg)

Downs & Ups

Downs & Ups

Homeowners are staying put in the wake of the current housing market, said Sean Goldstein, VP of Marketing at Crestron. “Instead of moving, they are adding value to their homes in the form of HA. We see this as a tremendous opportunity for HA.” To maximize security, safety, convenience and energy savings, all the disparate systems should be intelligently integrated and controlled in a fundamentally different and new way.

Price is still the biggest growth inhibitor for HA systems. To manufacturers, how to keep costs down while offering quality and easy-to-use products and satisfying services should be a key development focus. At the end of the day, HA is not rocket science; with the maturation of technology and education of the market, the HA market is expected to prosper.

With larger and clearer touch screens, user can access more information without constant button-pushing or screen-sliding. Geographic-information systems (GIS) can be integrated with HA. In case of emergency, the message or alarm sent by the HA system could integrate GIS coordinates so that dispatchers can contact the proper authorities with specific directions, thus speeding up response time and minimizing damage.

Customizable HA systems are now possible, as flexible packages or personal designs are a key to winning the heart of the client. “A revolution is taking place in the appeal, deliver, support and pricing of HA systems, as the technology moves from being a high-ticket investment to becoming another newly essential monthly service,” said an ABI Research analyst. Easy, reliable and stable HA systems that are also fun to use are the key to winning greater adoption.

A Nov. 2012 study from IMS Research projects that the global market for smart-home devices will more than quadruple in the coming five years, growing from less than 20 million nodes in 2012, to more than 90 million in 2017. One of the main drivers is the increasing number of service providers branching into the managed home control space. A number of American telcos and security providers, such as ADT, Verizon, Comcast, Rogers Communications, Time Warner Cable and Cox Communications, are already offering a range of smart-home solutions via a cloud-based managed service approach.

Similar offerings are also either deployed or in the pipeline for European counterparts, such as Swisscom, Bouygues Telecom and many others. Some companies are instead opting to develop and white-label a common platform for partner companies, as Deutsche Telecom is doing with the Qivicon solution.

To date, ZigBee and Z-Wave have been favored by a number of managed service providers. According to Lisa Arrowsmith, Associate Director of Connectivity at IMS, “Z-Wave and ZigBee have both gained strong traction in the North American market, deploying in managed home systems which are predominately aimed around home monitoring — with a high number of relatively low-cost nodes, such as magnetic contacts as well as in comfort and convenience applications. In the European market, energy management is set to be the key driver of managed home system deployments, with devices such as smart plugs and HVAC controls. Here, there is a more fragmented approach to connectivity technologies, with a range of standards and proprietary technologies being used.”

To date, ZigBee and Z-Wave have been favored by a number of managed service providers. According to Lisa Arrowsmith, Associate Director of Connectivity at IMS, “Z-Wave and ZigBee have both gained strong traction in the North American market, deploying in managed home systems which are predominately aimed around home monitoring — with a high number of relatively low-cost nodes, such as magnetic contacts as well as in comfort and convenience applications. In the European market, energy management is set to be the key driver of managed home system deployments, with devices such as smart plugs and HVAC controls. Here, there is a more fragmented approach to connectivity technologies, with a range of standards and proprietary technologies being used.”

While ZigBee and Z-Wave dominate the managed service market today, a range of other low-power wireless technologies, such as EnOcean and DECT ULE, are set to take the stage as shipments of these technologies gain traction. Arrowsmith continued, “The energy-harvesting properties of EnOcean can be attractive for service providers and consumers alike, reducing maintenance and support costs. DECT ULE will also see significant uptake in managed systems, as it can enable existing DECT gateway customers to add home control functionality via an over-the-air software upgrade.”