Merger and acquisition activity continues in security. Allan McHale, Director of Memoori, looks back at 2009 and what it portends for the future.

Merger and acquisition activity continues in security. Allan McHale, Director of Memoori, looks back at 2009 and what it portends for the future.

Memoori forecast for 2009 a slowdown in merger and acquisition activity, but more stock-for-stock deals and a significant growth in alliances. Alliance arrangements have grown in abundance and stock-for-stock mergers have increased, but not to the extent anticipated. The volume of mergers measured by value has increased by approximately 5 percent, compared to our forecast drop of 30 percent. Our forecast would have been almost spot-on, except for the mega acquisition of GE Fire & Security by UTC in November 2009. This acquisition has not only changed the numbers for 2009, but will impact the consolidation process over the next two years.

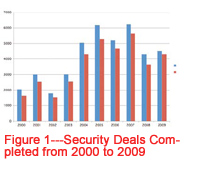

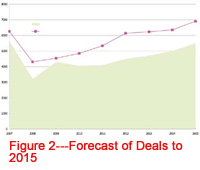

Figure 1 shows the value of security deals from 2000 to 2009, while Figure 2 charts our forecast to 2015. Looking at the future, we forecast 50 percent growth in the value of deals completed in the first half of the new decade. This may seem bullish, as we expect 2010 to realize only marginal growth. But the volume of business in 2015 would be only 10 percent more than that achieved in 2007, which was the peak year so far for acquisitions.

Our forecast is based on a number of factors, with market fragmentation being the most important one. Even at the current rate of M&A activity, it will take more than a decade before consolidation brings about a well structured business. Closely connected with this is the drive to increase market share. The other major global players will not sit back and let UTC dominate the market. Growth in market share is not going to be achieved organically by these companies in the present economic climate. The reverse is more likely to apply.

There is a significant interest from the IT industry in the physical security business, particularly networking and audiovisual companies, along with distributors. The grass always looks greener from the other side. They are attracted because there is heightened global awareness for better security, as terrorist attacks are sadly occurring worldwide. They see a growth opportunity and a way of leveraging their client base.

The market is rapidly adapting to changing requirements for converged and integrated solutions. Security is driven to join physical security with identity management and information security. Moving forward requires convergence to take in all aspects of the business enterprise. This has made CIOs take on an important role in the specification and purchase of security equipment. Their professional relationships tend to favor IT network installers in the bid selection process, bringing about partnerships between leading suppliers from both camps.

The importance of knowledge and experience in vertical markets, particularly transportation and health care, has driven a number of high profile acquisitions in the last two years. This is particularly true when associated with geographic coverage in fast growing markets.

The demand for IP-based security solutions will grow rapidly over the next five years. This is almost unstoppable, not only making the IP leaders desirable, but also companies with a sizable heritage estate mainly built on analog technology. For now, this is a captive market waiting to be updated. While UTC's purchase of GE Security did not land it leading-edge video surveillance, it did inherit a substantial heritage estate.

Technological development and its continual advancement is a major driver of acquisition. Technologies — such as biometrics, megapixel, compression, storage, data association and management software, RFID and contactless smart cards — are much in demand. There are plenty of reasons to go out and acquire, or indeed be acquired, but where is the money coming from in today's difficult economy?

We believe that it's precisely because of the present economic climate that merger activity will grow. In our report "Survey of the Security Industry 2009 – Shape Structure & Consolidation," we show how valuations of companies have fallen significantly during 2009. The lack of finances is driving more companies to look proactively for a solution through merger or acquisition. There is plenty of anecdotal evidence from major suppliers about being approached more regularly by companies or their agents to sell, compared to the beginning of 2009.

In the last two years, merger and acquisition activity has been driven by strategic buyers, particularly major global security and defense companies. This dynamic  will continue in 2010. The reason for this is private equity has suffered from the financial meltdown and has been unable to recycle through IPOs. This business is going through a process of restructuring by redefining investment parameters. Private equity will take a more diminished role in buying and a more dominant one in selling during the next few years.

will continue in 2010. The reason for this is private equity has suffered from the financial meltdown and has been unable to recycle through IPOs. This business is going through a process of restructuring by redefining investment parameters. Private equity will take a more diminished role in buying and a more dominant one in selling during the next few years.

It is expected that defense companies and multinational security companies will engage in more transformational transactions, commonly referred to as landscape altering deals. These acquisitions gain entry into the security market or radically expand existing activities. Examples in the last two years include Safran's purchase of GE Homeland Protection, Schneider Electric's acquisition of Pelco and UTC's buy of GE Fire & Security.

Cross-border transactions will continue to be a significant driver. Exposure to US markets has become a priority for a number of European companies. However, we expect most cross-border deals will center on Asia and particularly China, where ownership rules have been significantly relaxed. UTC Fire & Security have made a number of strategic investments in the last three years in China.

Conglomerates active in security have shifted strategic direction, with security taking priority and viewed as a growth vehicle. The Stanley Works is a good example and others may follow.

Over the last two years, the defense industry has entered the commercial security business through a combination of high technology products and strategic acquisitions. We expect this convergence process will continue, blurring the lines between security and defense. General Dynamics, BAE Systems, FLIR and Thales have entered the fray, with a number of others that could follow. Some defense companies may prefer to buy system-based solution providers that are service-focused.

Merger and acquisition activity is now certainly on the rebound.

This review is based on Memoori's report "Survey of the Security Business 2009 – Shape Structure and Consolidation." For report details, contact support@ memoori.com or visit http://webbasedbuildingtechnologies.blogspot.com/.