The overall home automation systems market in the Asia Pacific region has substantial growth potential, primarily fueled by robust economic growth, a rising population, and rapid urbanization, which contribute to enhanced infrastructure.

A home automation system is a dwelling equipped with internet-connected appliances and devices that can be controlled remotely using a smartphone, tablet, or other networked device. This allows homeowners to manage features like security, lighting, temperature, and entertainment systems from anywhere with an internet connection. According to MarketsandMarkets, the

global home automation systems market was valued at US$52.65 billion in 2024 and is projected to reach $66.45 billion by 2029; it is expected to register a CAGR of 4.8 percent during the forecast period. The growth of the market is driven by factors such as the increasing importance of home monitoring in remote locations; the rising need for energy-saving and low-carbon emission-oriented solutions; the rapid proliferation of smartphones and smart gadgets; the large number of manufacturers expanding their home automation system product portfolios; and the growing awareness among masses about their safety, security, and convenience.

In 2023, the Asia Pacific region ranked second, after North America, holding approximately 30 percent of the global home automation systems market. There is significant demand for home automation in several Asia Pacific countries, particularly Japan, South Korea, and China. South Korea, in particular, is seen as a major market for home automation systems, driven by a high demand for various control devices related to lighting and entertainment.

China accounted for the largest share of the Asia Pacific market, approximately 10 percent, followed by Japan and South Korea. With its rapidly growing economy and population, China is heavily investing in energy-efficiency initiatives. Meanwhile, South Korea is recognized as a leader in the home automation systems market for home appliances. Major South Korean manufacturers, such as LG Electronics and Samsung Electronics, are at the forefront of technology development in the smart appliances sector. Additionally, the high internet penetration rate in Japanese households is anticipated to be a key factor driving the growth of the home automation systems market in the Asia Pacific.

The overall home automation systems market in the Asia Pacific region has substantial growth potential, primarily fueled by robust economic growth, a rising population, and rapid urbanization, which contribute to enhanced infrastructure. Advancements in technology within Japan and South Korea are pivotal to Japan's strong position in the market. However, China is expected to experience the highest CAGR during the forecast period, driven by increasing automation demand for a large number of new and existing residential projects.

China's inflation rate for 2023 was 0.2 percent, a notable decrease from 2.0 percent in 2022. This decline had a positive impact on the economy, as the lower inflation rate in 2023 contributed to more stable conditions compared to the previous year. The government implemented various policy measures aimed at boosting consumption, stimulating private sector activity, and supporting the property market. However, the property sector faced challenges, and consumer confidence remained low, which limited overall growth potential. The policy measures included easing mortgage rates and reducing down payment requirements, but fiscal and monetary easing were constrained due to concerns about financial stability and currency depreciation. Meanwhile, countries like Japan, South Korea, Australia, Indonesia, and New Zealand experienced improved growth forecasts, driven by rising commodity prices and increased domestic consumption.

Additionally, Knight Frank's Prime International Residential Index (PIRI) reported impressive growth in the Asia Pacific luxury residential market, which surpassed other regions with a 3.8 percent increase.

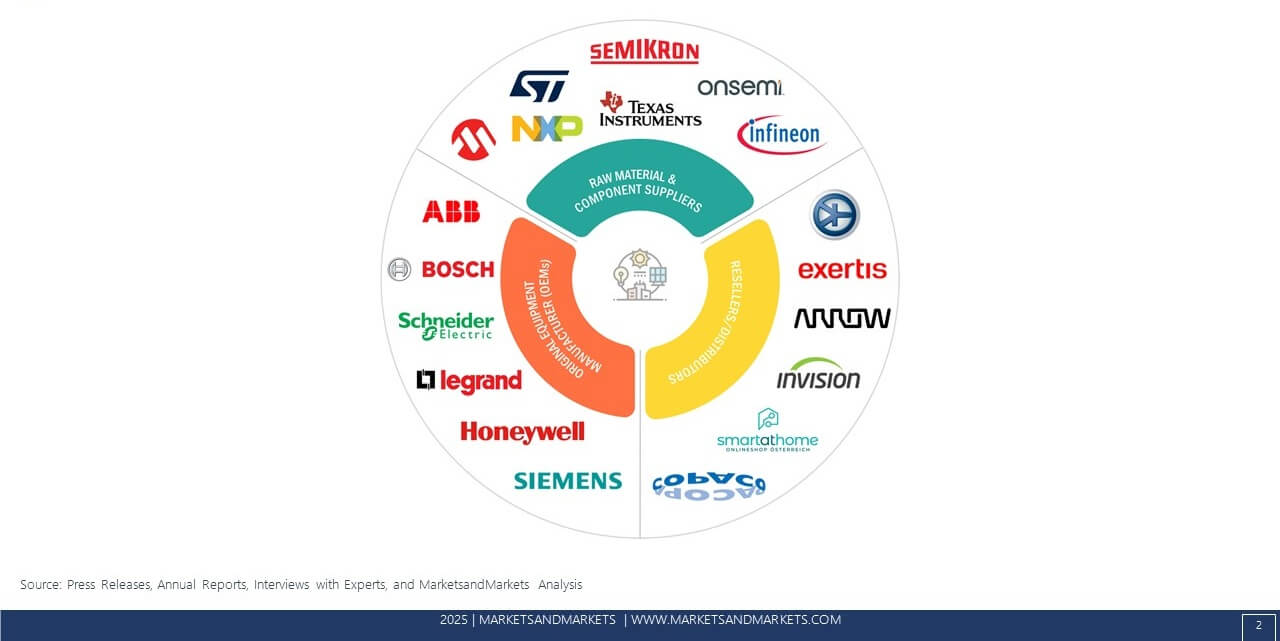

Key players in the home automation ecosystem

Key players in the home automation ecosystem

Home automation systems are built around a specific protocol or technology. They include both wired and wireless protocols. Different protocols also define the compatibility for different types of home automation control systems — on-premises (centralized connectivity) or cloud-based (remote connectivity). Suppliers provide hardware components, such as sensors, timers, and dimmers, for home automation systems. The finished product is distributed through a supply chain network. The supplier ecosystem and supply chain network depend on the type of home automation products manufactured and distributed. For instance, DIY home automation systems are often mass-produced and are available from a variety of third-party retailers. Luxury home automation systems, on the other hand, have exclusive distribution channels and are tailor-made to the client's needs. With Al, home automation moves beyond basic programmable functions to deliver personalized, predictive, and self-optimizing environments. Al algorithms can learn from the behavior of occupants, adjusting lighting, climate, and even security protocols based on usage patterns. For instance, a smart thermostat with Al can learn a household's preferred temperature patterns and make autonomous adjustments, saving energy and enhancing comfort without manual input. Similarly, Al-driven lighting systems can sense occupancy, ambient light levels, and user preferences, dynamically adjusting lighting to fit mood and activity, all while optimizing for energy savings.

Al's ability to integrate with a variety of devices and platforms also creates a centralized ecosystem that simplifies home management. Virtual assistants like Alexa, Google Assistant, and Sid are increasingly equipped with Al-powered functionality that enables seamless, voice-controlled interaction with various connected devices. Moreover, Al-driven insights are essential for detecting anomalies in energy consumption, appliance health, or security, allowing users to pre-emptively address issues before they escalate into costly problems. In addition, predictive analytics powered by Al are opening new frontiers in preventive maintenance and safety. For instance, Al can analyze data from connected devices to predict failures or maintenance needs, such as detecting fluctuations in water heater temperatures that might signal a potential failure. For security, Al enhances surveillance systems by using facial recognition, motion detection, and behavioral pattern analysis to identify potential security threats. These systems can send real-time alerts or notifications to homeowners, offering an additional layer of proactive safety and control. Overall, Al integration in home automation systems not only simplifies routine tasks but also creates a more intuitive, adaptive, and efficient living environment that enhances both comfort and security.