This Report is the New 2020 Definitive Resource for Access Control, Video Surveillance & Intruder Alarm / Perimeter Protection Market Research.

This Report is the New 2020 Definitive Resource for Access Control, Video Surveillance & Intruder Alarm / Perimeter Protection Market Research.

In March 2020, The World Health Organization declared COVID-19 a global pandemic. Within a few weeks it was clear that the pandemic was highly likely to cause the world’s worst recession in the last 100 years. In June 2020, the World Bank published a baseline forecast envisioning a 5.2 percent contraction in global GDP in 2020.

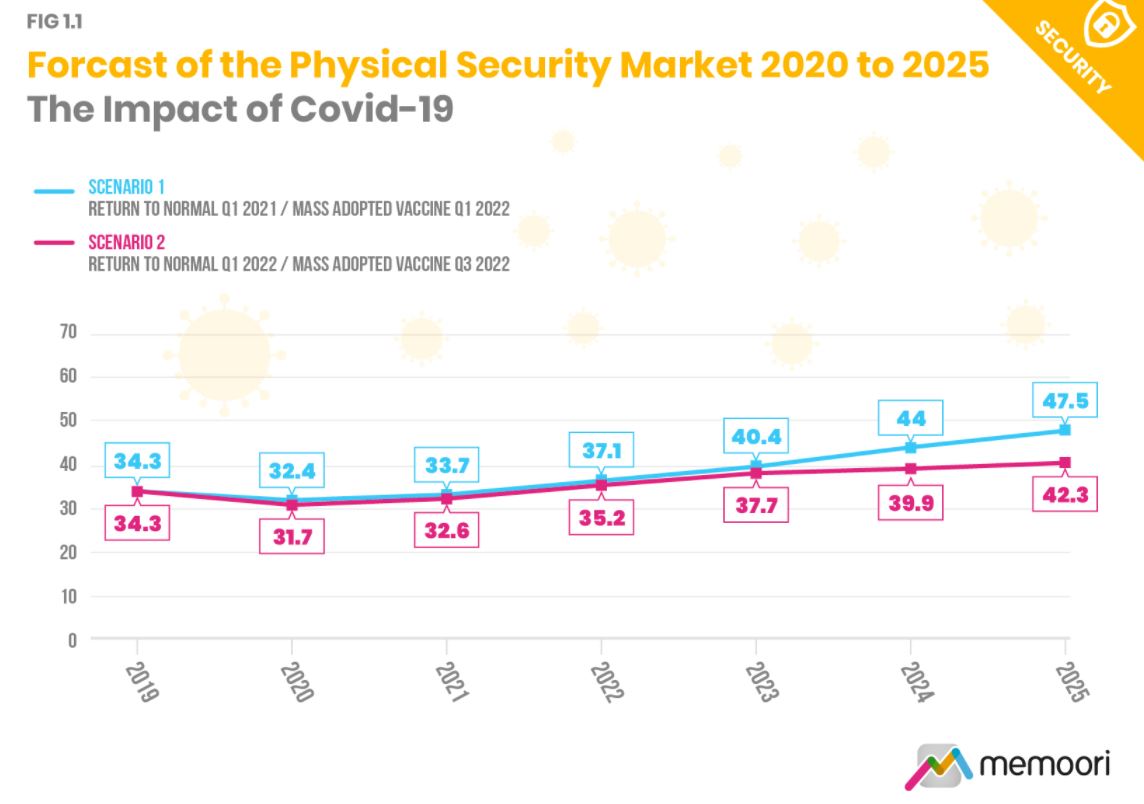

Against this backdrop, our report delivers a best estimate of the

global market for physical security products going forward to 2025 based on two scenarios. At this time, COVID-19 has been having second spikes in Q3 / Q4 and several countries are experiencing rolling lockdowns. We believe our 2nd scenario looks more feasible where global markets take around a year to return to some normality and mass global adoption of a vaccine is achieved within 18 months. We believe this has a probability of 65 percent.

Despite all this we are still confident of the industries robustness and prospects for growth over the medium to long term. Market drivers like the threat from terrorism and crime are unlikely to abate, whilst urbanization and smart infrastructure will further drive demand for more and better security systems.

This report is our 12th annual detailed analysis that brings together all the factors that influence this industry’s future. To do this we assess the structure and size of the combined physical security industry then break down by size of product, sales by major sector and geographic region and forecast sales to 2025.

What impact has the COVID-19 pandemic had on this business?

- Above all the COVID-19 outbreak will force suppliers to radically rethink how they operate their business, in particular resilience to externalities. In parallel, there will be lessons to learn on having a more coordinated and resilient supply chain. The Video Surveillance business is too dependent on Chinese OEM’s and component manufacturers. With many of these factories closed for the first two months of 2020, it caused temporary supply chain issues.

- The pandemic has created demand for new solutions to help control the spread of the virus. Physical security products have risen to the challenge, helping to implement social distancing protocols through existing access and video systems with AI-powered analytics. Thermal cameras have also been deployed to measure people’s temperature, with demand being strong. However their usefulness has been questioned, with the World Health Organisation saying that on its own temperature screening “may not be very effective”.

- We estimate that the total value of world production of Physical Security products at factory gate prices in 2020 will be $31.7Bn, a decline of over 7.5 percent on 2019. Sales declined over the first 3 quarters of 2020 as a result of COVID-19. This has stopped 11 consecutive years of growth.

Based on our Scenario 2, growth will recover by Q3 2021 and by the end of that year it will have grown by nearly 3 percent, however different rates of growth apply in each of the 3 businesses and geographic territories. We forecast the market will reach over $42Bn by the end of 2025 at a CAGR of 6 percent over the next 5 years.

China continues to increase its share of the physical security product market. The Chinese market has grown rapidly through a boom in new construction and ‘Sharp Eyes’ surveillance projects driven by the public sector. However very little of this vast expanding market is accessible to overseas manufacturers, nor is it likely to be in the foreseeable future, with ongoing political and trade tensions between the US and China.

Within its 324 pages and 31 charts and tables, the report presents all the key facts and draws conclusions, so you can understand what is shaping the future of the physical security industry;

- As we move forward Post-COVID, vendors will need to investigate customer’s requirements thoroughly, particularly those businesses that have been severely damaged by COVID-19. It will be more difficult for these customers to find the budget to invest and therefore they have to be convinced of a return on their investment. ACaaS and VSaaS can provide a solution to this problem and there is evidence of significant accelerating growth in cloud services.

- Software has always been an important factor in the development and growth of the Physical Security business. We are now entering a new epoch in the Video surveillance business driven by Artificial Intelligence (AI). AI Technology can and will make a direct and massive contribution to increasing the performance and value of video surveillance solutions However security systems are by no means an island and in many cases they will ultimately need to be connected with the wider IoT, if all the information is to be converted into actionable data.

- The average annual value of M&A deals over the last 13 years is $6,717m. In 2020 we identified 20 deals compared with 26 in the previous year. And in 2020 the value of mergers and acquisitions was $5,285m an increase on 2019 but still below the 13 year average. M&A measured by value is currently in a cycle of decline.

Starting at only USD $1,995 for a Single User License, this report provides valuable information into how Physical Security companies can develop their business strategy through Merger, Acquisition and Alliance.

This article was originally posted on www.memoori.com