Technological trends have become easier to adopt in oil and gas (O&G) with connectivity now reaching further than ever, which is also making different types of technology more readily available.

Technological trends have become easier to adopt in oil and gas (O&G) with connectivity now reaching further than ever, which is also making different types of technology more readily available.

“Gone are the days when the oil company needed its own towers,” explained Hari Dutt, Senior Product Manager for

Seven Lakes Technologies. “Today, sensors can talk through LTE connectivity or Wi-Fi hotspots available out in the field.”

Cloud computing is another trend allowing O&G companies to integrate seamlessly across multiple platforms. It also brings all information under one dashboard to create actionable knowledge, Dutt said.

Joe McMullen, Marketing Director at

Schneider Electric, pointed to how cloud computing and predictive analytics are allowing companies to process large amounts of data, cost-effectively. “Refineries have always had access to this data — today that information can be better utilized and acted upon in a way that was previously not possible,” he said. “Refiners stand to get the quickest return on investment because of the technology they already have in place — sensors, instrumentation, data historians, dynamic process models, etc.”

As IoT has become more ubiquitous, it has also become increasingly economical to implement automation processes to lower-producing wells with sensors, which allows for better well management.

“The democratization of automation and IoT is driven by the need to operate in these lower margin environments. This requires the industry to become more innovative and take bold, new steps toward automation,” Dutt said.

Dutt outlined five main ways he believes automation and IoT will create value in the oil and gas sector.

- Routeless Fields: Dynamically routing lease operators across the field to tackle issues at high-value assets will lead to significant efficiency gain.

- Self-Healing Wells: With affordable IoT, wells will be able to diagnose themselves and reach out for help when the data tells them that something is about to go wrong. Combined with routeless fields, this concept will become the norm.

- Hauling Automation: Tanks will be able to call transporters and purchasers to generate their own run tickets based on measurements in the tank.

- Safer Operations: Sensors will be able to warn lease operators of potentially hazardous situations.

- Autonomous Decision Making: With deep neural net decisions that took people days to make, can now be made within a matter of minutes, vastly improving the efficiency of the entire operations workflow.

Challenges in Reducing Cost and Increasing Speed

Reducing costs and increasing productivity seem like no-brainers, but it is not always as simple as it sounds. In the in O&G industry, these two things are especially critical for low-cost players. Companies are looking for ways to lower the cost of labor and increase the speed of decision making, according to Dutt. Unfortunately, adoption of automation comes with challenges, such as a lack of executive sponsorship, funding and expert vendors.

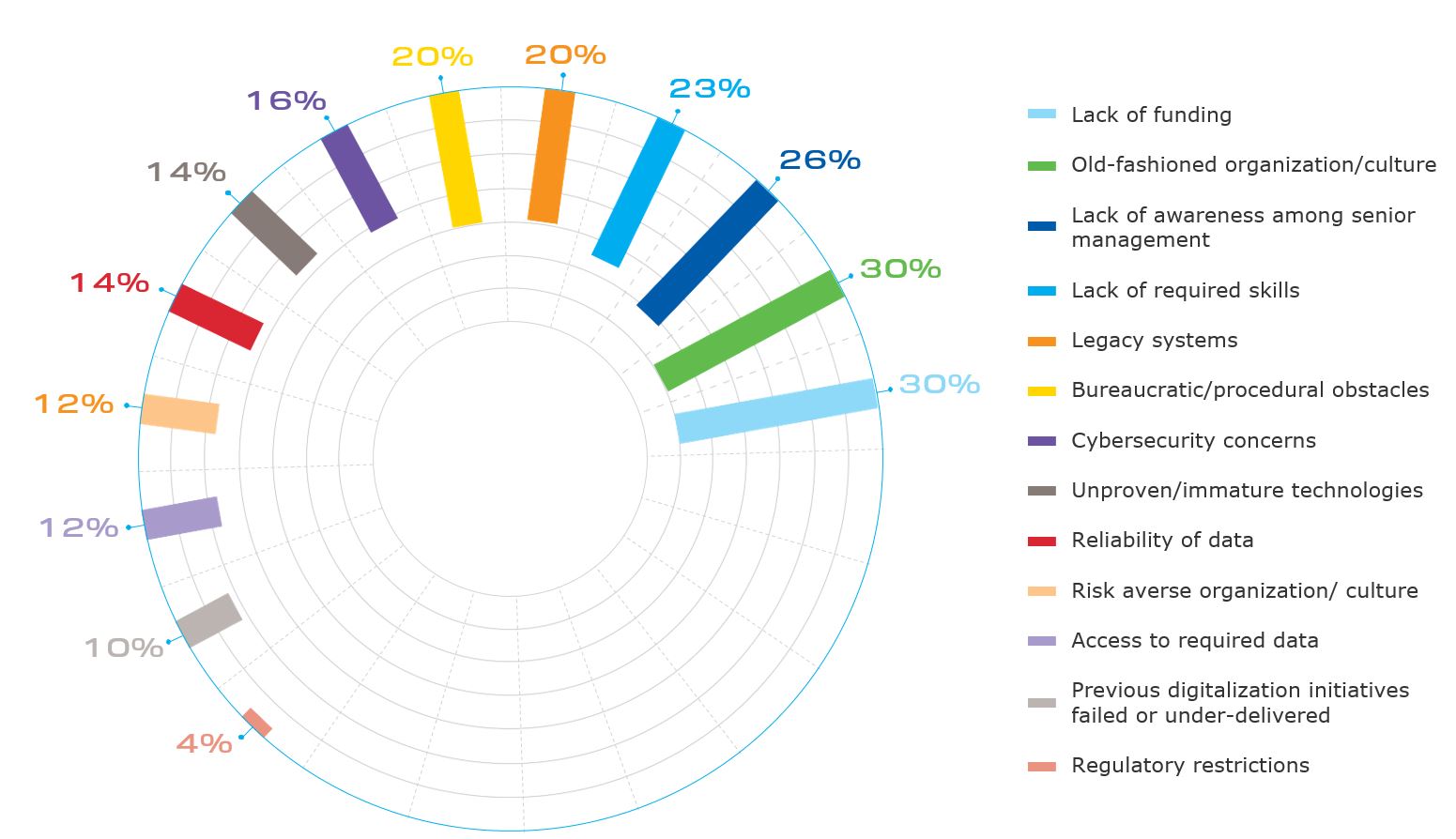

According to DNV GL’s annual benchmark study on the outlook of the oil and gas industry, 30 percent of those surveyed cite funding and the presence of an old-fashioned organizational culture as the two biggest obstacles for digitalization. In addition to these two obstacles a lack of awareness among senior management about digitalization and the potential benefits, a lack of the required skills, and bureaucratic/procedural obstacles are also hindering adoption.

“Funding is, by some margin, the leading barrier among board members, directors and c-suite executives. For the heads of business units, however, the top barrier is the lack of awareness among senior management. For managers further down, an old-fashioned culture is by far the greatest barrier,” explained Magne Berg, Global Head for Processes and Systems at

DNV GL. McMullen pointed to two factors hindering adoption of automation and the IoT: the first being capital investment and perception that point solutions are sufficient.

“For example, refineries use many different software products for different roles and processes in the plant. Proving the value of a unified automation/IoT framework can meet resistance as a change the status quo — yet that is exactly what is needed as these organizations work through their respective digital transformations,” McMullen said.

Dutt also addressed this need “to do business as usual, and not innovate enough to do business as it should be.”

However, those willing to take the risk will come out on top. “The first movers will have a significant advantage in becoming low-cost players and quickly rising up the learning curve of efficiently rolling out and enhancing their operations with new technology,” McMullen added.

Top primary barriers to greater digitalization include issues relating to lack of funding and old-fashioned organization and culture.

Top primary barriers to greater digitalization include issues relating to lack of funding and old-fashioned organization and culture.

Source: DNV GL Industry Outlook 2017

Oil and Gas Fields New Entrants

With the use of automation on the rise, new companies are looking to get in on the game. Traditional vendors in the oil and gas industry may not be up to the challenges of new technology, thus leaving room for new companies to enter the market.

“There are many new entrants to the field, but only those that provide real value to their clients will thrive in this low-margin environment. Many pivoted out of the industry back in early 2016, but some have remained steadfast,” said Dutt. “As more startups disrupt this space, expertise in this area will only boom, helping companies realize the full potential of this technology confluence.”

These new solution suppliers usually provide data entry solutions, some provide sensors, and some provide the algorithms to use this information effectively, he added.

Staying Ahead of the Game

The best way to increase margins and stay ahead of the game is to embrace new technologies and change with the tide. It is also important to keep economics in mind.

“Inevitably, technology becomes obsolete as new capabilities become available. The key consideration to make is to keep the economics of the asset in full view when making decisions about moving in a new direction,” Dutt advised.

He recommends experimenting with new technologies frequently. “As newer technology becomes available, companies should invest in PoCs to ensure feasibility and viability of the new technology for themselves.”

It is also important to “recognize that engineers with domain knowledge in oil and gas operations are critical to complement and unlock the value from the data analytics approach. Data and domain knowledge should not be separated,” Berg said.

Working with solution providers to see what options exist is also a crucial step. “The Industrial IoT is not a ‘one size fits all’… rather, it is a collection of technologies that can be strategically applied to drive results, provided the right steps are taken to achieve the best return on investment,” McMullen explained. Ideally it is best to find a provider specializing in serving the O&G industry.

Ultimately, digitalization, automation and IoT are all going to become more ubiquitous in O&G. With the price of oil remaining low, companies will need to do everything they can to make their operations as efficient as possible. This means truly embracing the digital age and not shying away from change.