“The first quarter showed a continued very good performance for ASSA ABLOY, with an increase in sales of 13% and an improvement of a full 12% in operating income,” says Johan Molin, President and CEO.

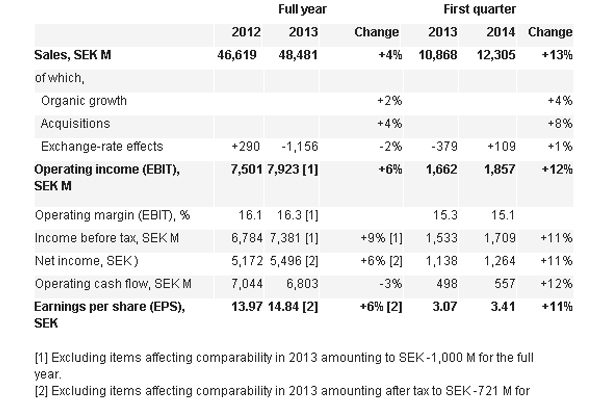

* Sales increased by 13% in the quarter, with 4% organic growth, and totaled $1,185 M (SEK 12,305 M)

* Strong growth in EMEA and good growth in Entrance Systems.

* Global Technologies, Asia Pacific and Americas showed growth.

* Four minor acquisitions made this year, with expected annual sales totaling about $61 M (SEK 400 M).

* Operating income (EBIT) amounted to $284 (SEK 1,857 M). The operating margin was 15.1%.

* Net income amounted to $ 193 (SEK 1,264 M).

* Earnings per share rose by 11% to $0.48 (SEK 3.41)

* Cash flow was normal for the season and amounted to $85 M(SEK 557 M).

SALES AND INCOME

COMMENTS BY THE PRESIDENT AND CEO

“The first quarter showed a continued very good performance for ASSA ABLOY, with an increase in sales of 13% and an improvement of a full 12% in operating income,” says Johan Molin, President and CEO.

“The global economy remains uncertain. The first quarter was characterized by a clear improvement in Europe, helped to some extent by the effect of Easter, but some weakening in the USA, probably due to the very cold weather. The performance of the emerging markets continued to be very good in South America and Africa, while Asia showed lower growth. “The Group's organic growth was a good 4%, while acquired sales rose by 8%, mainly through the acquisitions of Ameristar, Amarr and Mercor.

“The acquisition activity has continued at a high level in 2014, with four new minor acquisitions which add a further $61 M (SEK 400 M) to sales. Particularly exciting was the acquisition of Lumidigm in America, which brings us unique expertise and patented technology in biometry.

“Operating income continued to improve, by a full 12%. This was due to increased efficiency, good sales of new products and positive savings from the restructuring programs we have carried out. The improvement was very pleasing considering that several acquired units with low profitability were consolidated during the quarter.

“The successes of our new products continued and the Group won several prizes at the USA's largest security exhibition, ISC West. We are also seeing a strong trend on the hotel side towards lock systems controlled by virtual keys – a field in which ASSA ABLOY has taken the lead in innovation.

“My judgment is that the world economy is slowly on the way to improving, although still affected by the budget cutbacks that many countries are making. Our strategy therefore remains unchanged, to reduce our dependence on mature markets and to expand strongly in the emerging markets, which are expected to go on growing well. Another continuing priority will be investments in new products, especially in the growth area of electromechanics.”

FIRST QUARTER

The Group's sales totaled $1879 M (SEK 12,305 M). Organic growth for comparable units was 4%. Acquired units contributed 8%. Exchange-rate effects had a positive impact of $17 M (SEK 109 M) on sales, that is 1%. Operating income before depreciation, EBITDA, amounted to $326 M (SEK 2,135 M). The corresponding EBITDA margin was 17.3%. The Group's operating income, EBIT, amounted to $284 M (SEK 1,857 M). The operating margin was 15.1%.

Net financial items amounted to -$23 M (SEK -148 M). The Group's income before tax amounted to $261 M (SEK 1,709 M), an improvement of 11% compared with the previous year. Exchange-rate effects had an impact of $2M (SEK 13 M) on the Group's income before tax. The profit margin was 13.9%. The underlying effective tax rate on an annual basis amounted to 26%. Earnings per share amounted to $0.5 (SEK 3.41).

RESTRUCTURING MEASURES

Payments related to all existing restructuring programs amounted to $13 M (SEK 87 M) in the quarter. The restructuring programs proceeded according to plan and led to a reduction in personnel of 123 people during the quarter and 8,481 people since the projects began. At the end of the quarter provisions of $195 (SEK 1,279 M) remained in the balance sheet for carrying out the programs.

COMMENTS BY DIVISION

EMEA

Sales for the quarter in EMEA division totaled $539 M (SEK 3,511 M), with organic growth of 5%. The markets in Scandinavia, Germany, Africa and eastern Europe showed strong growth. Britain, Benelux, France and Iberia showed good growth. Sales were stable in Italy and Finland but the trend was negative in Israel. Acquired growth amounted to 3%. Operating income totaled $86 M (SEK 565 M), which represented an operating margin (EBIT) of 16.1%. Return on capital employed amounted to 19.8%. Operating cash flow before interest paid totaled $40 M(SEK 261 M).

AMERICAS

Sales for the quarter in Americas division totaled $408 M (SEK 2,673 M) with organic growth of 2%. The sales trends for the residential market and Latin America were strong, while electromechanical products and security doors had good growth. Sales were also stable for traditional lock products, but slightly down for high-security products and Canada. Acquired growth amounted to 12%. Operating income totaled $86 M (SEK 563 M) and the operating margin was 21.1%. Return on capital employed amounted to 20.9%. Operating cash flow before interest paid totaled $18 M (SEK 116 M).

ASIA PACIFIC

Sales for the quarter in Asia Pacific division totaled $217 M (SEK 1,420 M), with organic growth of 3%. Australia and New Zealand showed strong growth. The market in China showed a stable trend, with good growth in fire and security doors, while South Korea showed good growth. South-East Asia showed a negative trend. Acquired growth amounted to 3%. Operating income totaled $ 23 M (SEK 151 M), giving an operating margin (EBIT) of 10.6%. The quarter's return on capital employed amounted to 7.7%. Operating cash flow before interest paid totaled -$21 M (SEK -138 M)

GLOBAL TECHNOLOGIES

Sales for the quarter in Global Technologies division totaled $232 M (SEK 1,519 M), with organic growth of 3%. HID had good growth in access control, logical access and in identification technology. Government ID and project orders showed a negative trend. Hospitality showed continued strong growth, mainly from the important renovation market. Acquired growth amounted to 2%. The division's operating income amounted to $40 M (SEK 260 M), with an operating margin (EBIT) of 17.1%. Return on capital employed amounted to 15.7%. Operating cash flow before interest paid totaled $10 M (SEK 67 M).

ENTRANCE SYSTEMS

Sales for the quarter in Entrance Systems division totaled $520 M (SEK 3,405 M), with organic growth of 4%. There was strong growth for the industrial and high-speed door segments and for Flexiforce. Growth was good for door automation and docking systems, but there was a slightly negative sales trend for doors for the private residential segment and at Ditec. Acquired growth amounted to 17%. Operating income totaled $60 M (SEK 394 M), giving an operating margin of 11.6%. Acquisition dilution affected the operating margin by a net -1.4 percentage points. Return on capital employed amounted to 10.4%. Operating cash flow before interest paid totaled $62 M (SEK 403 M).

ACQUISITIONS AND DIVESTMENTS

During the quarter a total of six acquisitions were consolidated. The combined acquisition price for the six companies acquired this year amounted to $233 M (SEK 1,527 M), and preliminary acquisition analyses indicate that goodwill and other intangible assets with indefinite useful life amount to $211 M (SEK 1,384 M). The acquisition price is adjusted for acquired net debt and estimated earn outs. Estimated earn-outs amount to $ 74 M (SEK 486 M).

SUSTAINABLE DEVELOPMENT

ASSA ABLOY's Sustainability Report for 2013 was published on 26 March 2014. The Report showed that the majority of the key indicators are continuing to move in a positive direction, not least in the area of health and safety.

Evaluation of the Group's suppliers in low-cost countries remains a prioritized area. In 2013, 885 assessments of suppliers in these countries were carried out, an increase of 11 percent. From having mainly concentrated on China, the assessments have now progressively broadened out to cover several low-cost countries.

72 internal assessors were trained in the Group in 2013, which is nearly double the figure for 2012. The number of reporting units involved in the sustainability reporting has risen to 327, and a new Group-wide reporting system for sustainable development was introduced during 2013.

PARENT COMPANY

Other operating income for the Parent company ASSA ABLOY AB totaled $46 M (SEK 299 M) for the first quarter. Income before tax amounted to -$18 M (SEK -119 M). Investments in tangible and intangible assets totaled $0 M (SEK 0 M). Liquidity is good and the equity ratio was 42.1%.

ACCOUNTING PRINCIPLES

ASSA ABLOY applies International Financial Reporting Standards (IFRS) as endorsed by the European Union. Significant accounting and valuation principles are detailed on pages 90-95 of the 2013 Annual Report.

This Interim Report was prepared in accordance with IAS 34 ‘Interim Financial Reporting' and the Annual Accounts Act. The Interim Report for the Parent company was prepared in accordance with the Annual Accounts Act and RFR 2 ‘Reporting by a Legal Entity'.

TRANSACTIONS WITH RELATED PARTIES

No transactions that significantly affected the company's position and income have taken place between ASSA ABLOY and related parties.

RISKS AND UNCERTAINTY FACTORS

As an international Group with a wide geographic spread, ASSA ABLOY is exposed to a number of business and financial risks. The business risks can be divided into strategic, operational and legal risks. The financial risks are related to such factors as exchange rates, interest rates, liquidity, the giving of credit, raw materials and financial instruments. Risk management in ASSA ABLOY aims to identify, control and reduce risks. This work begins with an assessment of the probability of risks occurring and their potential effect on the Group. For a more detailed description of risks and risk management, see the 2013 Annual Report. No significant risks other than the risks described there are judged to have occurred.