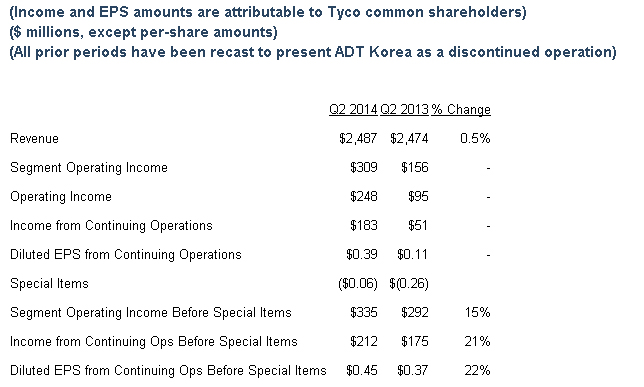

Tyco reported $0.39 in GAAP diluted earnings per share (EPS) from continuing operations for the fiscal second quarter of 2014 and diluted EPS from continuing operations before special items of $0.45. Revenue in the quarter increased 0.5% versus the prior year to $2.5 billion. Organic revenue grew 2% in the quarter, with 1.5% growth in service, 1% growth in installation and 2% growth in products

* Revenue of $2.5 billion with organic growth of 2%

* Before special items, segment operating income increases 15% and operating margin improves 170 basis points to 13.5%

* Diluted EPS from continuing operations before special items increases 22%

* The Company announced the divestiture of its ADT Korea security business and completed the sale of its minority interest in Atkore International

* The Company's Board of Directors approved an additional $1.75 billion authorization for share repurchases, bringing the total authorization to $2 billion

Tyco reported $0.39 in GAAP diluted earnings per share (EPS) from continuing operations for the fiscal second quarter of 2014 and diluted EPS from continuing operations before special items of $0.45. Revenue in the quarter increased 0.5% versus the prior year to $2.5 billion. Organic revenue grew 2% in the quarter, with 1.5% growth in service, 1% growth in installation and 2% growth in products. Acquisitions contributed two percentage points of growth, which was more than offset by the impact of divestitures and changes in foreign currency exchange rates.

Tyco Chief Executive Officer George Oliver said, "We had another strong performance in the second quarter, demonstrating our ongoing effectiveness at executing on our growth strategy and operational improvement initiatives. We are starting to see an uplift in the top line, as continued growth in service and products revenue is now being supplemented with growth in installation revenue.

"Looking forward, the announced divestiture of our ADT Korea business and the sale of our remaining interest in Atkore provide an opportunity to redeploy significant capital to maximize long-term shareholder value. At the halfway point in our three year growth strategy outlined at our 2012 Investor Day, we are well positioned to deliver on our 15% EPS CAGR target through 2015."

Organic revenue, free cash flow, operating income, segment operating income, and diluted EPS from continuing operations before special items are non-GAAP financial measures and are described below. For a reconciliation of these non-GAAP measures, see the attached tables. Additional schedules as well as second quarter review slides can be found in the Investor Relations section of Tyco's website. Certain tables contain the symbol "-" to denote that the percentage change is not meaningful.

SEGMENT RESULTS

The financial results presented in the tables below are in accordance with GAAP unless otherwise indicated. All dollar amounts are pre-tax and stated in millions. As announced on March 3, 2014, Tyco reached a definitive agreement to sell its South Korean security business, ADT Korea. As such, beginning in the second fiscal quarter, the company has classified this business as a discontinued operation. The revenue and operating income results shown below have been adjusted to reflect this change in all periods presented. All comparisons are to the fiscal second quarter of 2013 unless otherwise indicated.

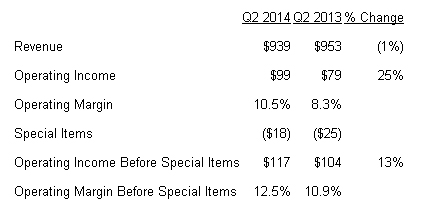

North America Installation & Services

Revenue of $939 million decreased 1% in the quarter due to the divestiture of the guarding business and unfavorable changes in foreign currency exchange rates. Organic revenue increased 1%, as 2% growth in service was partially offset by a 1% decline in installation revenue. Backlog of $2.4 billion was consistent with the prior year. On a quarter sequential basis, backlog increased 2%, excluding the impact of foreign currency.

Operating income for the quarter was $99 million and the operating margin was 10.5%. Special items of $18 million consisted primarily of separation charges. Before special items, operating income was $117 million and the operating margin was 12.5%. The 160 basis point improvement in operating margin before special items resulted from a higher mix of service revenue, improved execution in installation and productivity benefits.

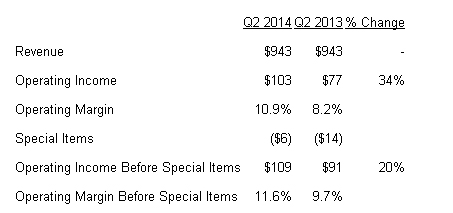

Rest of World Installation & Services

Revenue of $943 million was consistent with the prior year. Organic revenue growth of 2% consisted of 1% growth in service and 3% growth in installation revenue. Acquisitions contributed 4% to revenue growth, which was more than offset by the impact of divestitures and changes in foreign currency exchange rates. Backlog of $2.3 billion increased 11% year over year and 4% on a quarter sequential basis, excluding the impact of foreign currency.

Operating income for the quarter was $103 million and the operating margin was 10.9%. Special items of $6 million consisted primarily of restructuring charges. Before special items, operating income was $109 million, and the operating margin increased 190 basis points to 11.6%. This quarter's operating income includes a $21 million insurance recovery related to improper recording of revenue in China, which was disclosed in 2012. The benefit of this recovery more than offset the softness in Australia and incremental investments in our Growth Markets.

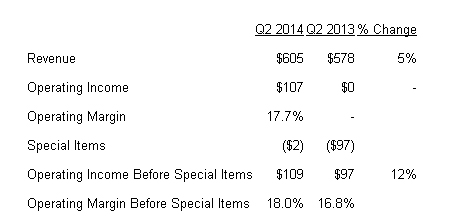

Revenue of $605 million increased 5% in the quarter, including a 3% benefit from acquisitions. Organic revenue grew 2%.

Global Products

Operating income for the quarter was $107 million and the operating margin was 17.7%. Special items of $2 million consisted of restructuring charges. Before special items, operating income was $109 million and the operating margin increased 120 basis points to 18.0%. Operating leverage on increased revenue coupled with a greater mix of higher margin products as well as productivity benefits more than offset non-cash purchase accounting, which negatively impacted the operating margin by 30 basis points. The prior year's operating income included a $94 million pre-tax legacy environmental charge.

OTHER ITEMS

* Cash from operating activities was $262 million and free cash flow was $187 million, which included a cash outflow of $133 million, primarily related to sharing of a recovery from a legacy matter, environmental, restructuring and separation activities. Adjusted free cash flow for the quarter was $320 million. The Company completed the quarter with $495 million in cash and cash equivalents.

* Corporate expense before special items was $54 million for the quarter and $61 million on a GAAP basis.

* The tax rate before special items was 16.9% for the quarter.

* As previously disclosed, the Company's Board of Directors approved an additional $1.75 billion authorization for share repurchases. Combined with the remaining $250 million from the previous authorization, the total share repurchase authorization is now $2 billion.

* As previously disclosed, during the quarter the Company reached a definitive agreement to divest its South Korean security business, ADT Korea, in a cash transaction valued at approximately $1.93 billion. The results of this business are reflected in discontinued operations for all periods presented.

* As previously disclosed on April 9, 2014, the Company's remaining stake in Atkore International, Tyco's former electrical and metal products business, was redeemed by Atkore in a cash transaction for $250 million.