Italian security encompasses the complete range of product segments. Possibly the most distinctive segment is alarm and intrusion, which Italian security revolves around.Traditional anti-intrusion sensors have suffered from a lack of ideas and a true killer application. In spite of IP and wireless development, the prevalent trend is still hybrid solutions.

Alarm and Intrusion

Italian security encompasses the complete range of product segments. Possibly the most distinctive segment is alarm and intrusion, which Italian security revolves around.

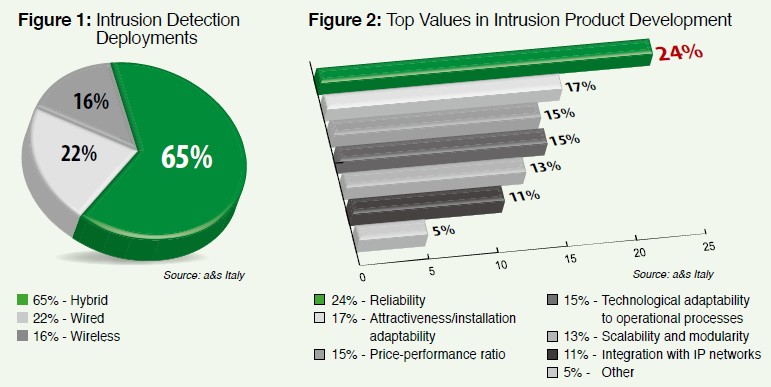

Traditional anti-intrusion sensors have suffered from a lack of ideas and a true killer application. In spite of IP and wireless development, the prevalent trend is still hybrid solutions.

Reducing false alarms remains the No. 1 priority, as seen in figures 1 and 2. As the next recession is all but imminent, the intrusion industry is focusing on alarm integration with video through smartphones. Other developments include perimeter protection, requiring uncommon expertise. Finally, greater integration with HA through IP networks are developing as well.

Access Control

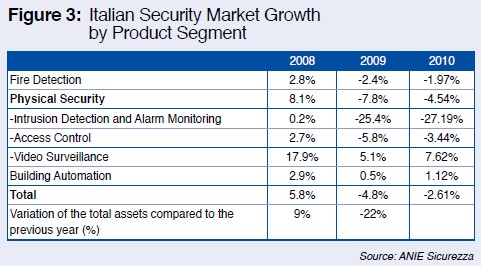

The Italian physical access control market involves different solutions, such as ID cards, RFID transponders, biometrics, and time and attendance systems. In 2009, after a decade of growth, the Italian professional access control market reversed the trend. Turnover decreased, profits collapsed and net assets dropped. Small companies were the ones that suffered most during the crisis.

a&s Italy made a Top 15 list of Italian electronic access control companies, which reflects the diverse offerings in this market. According to its estimates, access control makes up 55 percent of the industry, while the remaining 45 percent is composed of intrusion detection and large-scale management. IMS Research found the Italian access control market was worth $25 million in 2010. Newer technologies have not been as popular in Italy, compared to the rest of EMEA. However, IP is one of the driving forces in Italian access control.

Video Surveillance

Video surveillance has achieved the most brilliant results over the last 10 years and is still playing a major role in reinvigorating the whole Italian security industry.

In 2010 or the depths of the global recession, the Italian video surveillance market showed resistance to the crisis by growing 7.6 percent compared to 2009. Both supply and demand are facilitating the growth of this market.

In terms of supply, video manufacturers have developed more advanced products that are application-specific. Value features prominently in new product design, with greater attention to customer ROI through more value-added features and increased user-friendliness. As IP grows, products are designed for easy integration by complying with interoperability standards, making the lives of end users easier.

.jpg)

IP Migration

The Italian video surveillance market was worth $780 million in 2010, according to ANIE Sicurezza. Recently, it has embraced all-IP video solutions, with network video equipment representing more than 30 percent of sales, which is expected to reach 60 percent by 2014, said IMS Research. The Italian video surveillance equipment market is forecast to grow nearly 8 percent per year until 2014. This growth rate is higher than the U.K.; Benelux made up of Belgium, the Netherlands and Luxembourg; and the Iberian region of Spain and Portugal.

However, an a&s Italy survey found most users are still experiencing a gradual migration to IP. The actual percentage of all-IP deployments is still low, but nearly all companies admit they use hybrid systems. IP adoption is hindered factors by culture, the technological complexity of IP and cost. Moreover, Italy is suffering from digital divide, even in its most productive areas. It is not by chance that HD-SDI technology is arousing interest, particularly in the medium-range market.

While adoption of IP slowed during the financial crisis, sales of network cameras are picking up. Growth was roughly 20 percent in 2011, which is expected to continue in 2012.

HD

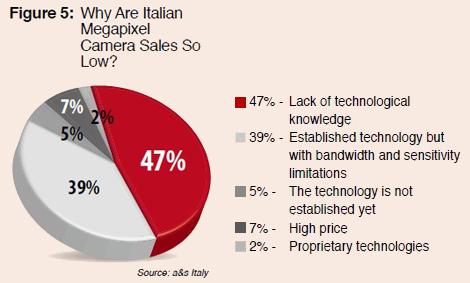

Megapixel cameras were the primary driver for IP adoption, according to an a&s Italy survey (figure 4). While megapixel sales volume is relatively low and deployments are confined to detail oriented applications such as LPR or airports, falling prices are a promising sign of increased uptake.

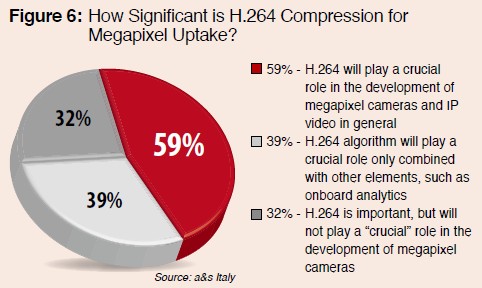

However, technological limits still must be overcome by HD cameras. The first is limited bandwidth for full-size streaming. The second is image sensor sensitivity in low light (figure5). Effective compression techniques using H.264 will play a crucial role in the development of megapixel cameras (figure 6).

What's Hot in Italy

The most popular technologies in video surveillance are related to HD and video content analysis (VCA). This includes:

1. Hybrid DVRs

2. Network cameras (particularly megapixel cameras)

3. Video management software

4. Mobile cameras

5. VCA

Until a few years ago, VCA generated tremendous interest, but users and security professionals lost interest due to high error rates. More attention has been directed to HD network cameras, which are expected to increase substantially over the coming years. However, the higher prices of HD DVRs may slow growth.

Since Italy has a high prevalence of smartphones and tablets, video surveillance and intrusion detection will develop solutions for mobile devices. More than 20 million Italians owned a next-generation smartphone, representing 52 percent of the population in the first quarter of 2011, according to a Nielsen Italy poll.