At the wake of the recession, Securitas takes a bold leap, acquiring multiple small- and large-scale security services companies from 2009 to now. A&S takes a look at Securitas’ speedy growth and how it sustains and profits in 40 countries.

At the wake of the recession, Securitas takes a bold leap, acquiring multiple small- and large-scale security services companies from 2009 to now. A&S takes a look at Securitas' speedy growth and how it sustains and profits in 40 countries.

In 2009 alone, Swedish Securitas, one of the world's largest private security services companies, took the security world by storm, buying 15 companies with a total of 14,000 employees and sales of US$190.7 million (1,300 million Kronor). In a November 2009 press release, Securitas announced that it had purchased “75 percent of the shares in security services company GMCE Gardiennage in Morocco.” Depending on company performance, the company might acquire the remaining 25 percent in the upcoming years.

December 2009 also saw the acquisitions of several small security services companies around the world, including Dora Security in the Czech Republic and Grupo Argos in Mexico; these two acquisitions made Securitas the largest and second largest private security provider in the two countries, respectively. Securitas' last acquisition of the year ended with a 49-percent share of Long Hai Security, the first privately owned security company in Vietnam. In 2010, Securitas earmarked a staggering $146.8-million budget for further acquisitions.

According to Alf G?ransson, President and CEO of Securitas, development in some countries remains difficult to predict, despite the financial recovery. “The Securitas strategy...has been successful in various business cycles. In the first nine months of 2010, improvement in operating income continued and amounted to 6-percent growth. The operating margin improved in all business segments.”

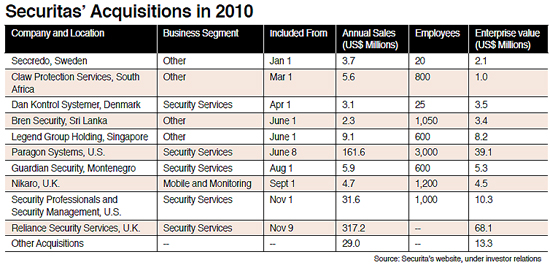

2010 Acquisitions

In early November, the Swedish solution provider acquired Reliance Security Services in the U.K. with annual sales of approximately $317.2 million. The enterprise value is estimated to $68.1 million.

In the same month, Securitas also acquired two security service companies in Chicago and one in Poland. The acquisitions of Security Professionals and Security Management made Securitas the largest supplier of security services in the Chicago area. These companies have combined annual sales of $31.6 million.

Nordserwis is an established security services company in the northeastern region of Poland. With a well-diversified customer portfolio, Nordserwis offers services including mobile services, and has annual sales of approximately $2.3 million and 250 employees.

Continued Expansion

Beyond acquisitions, the company is also simultaneously expanding into different verticals. It believes that expansion is the key to serve customers that have global operations and prefer to deal with one solution provider.

On June 30, Pinkerton Government Services, a company within the Securitas Group, acquired the security services company Paragon Systems in the U.S., enabling Securitas' expansion in the primary government security services market.

In a prepared statement, G?ransson said, “Paragon is one of the leading companies in the prime government sector in the U.S. The acquisition is in line with the Securitas Group's specialization strategy of acquiring high-quality security providers that bring knowledge and experience from specialized customer segments.”

Securitas' success and continued growth are opportunities stemmed from the global recession. As solution providers in mature markets such as North America and Europe are struggling for profits and earnings, Securitas' expansion and acquisition strategies in emerging markets have become significant and potentially game-changing. However, similar approaches have been taken by Securitas' biggest competitors such as ADT and G4S, and it remains to be seen how things will pan out for these security service providers.