Costar Technologies announced its financial results for the second quarter ended June 30, 2018 that have been reviewed by the independent accounting firm BKD, LLP.

Costar Technologies announced its financial results for the second quarter ended June 30, 2018 that have been reviewed by the independent accounting firm BKD, LLP.

Financial results for the second quarter ended June 30, 2018

- Revenue of $11,987, an increase of $1,705 or 16.6% from the quarter ended June 30, 2017.

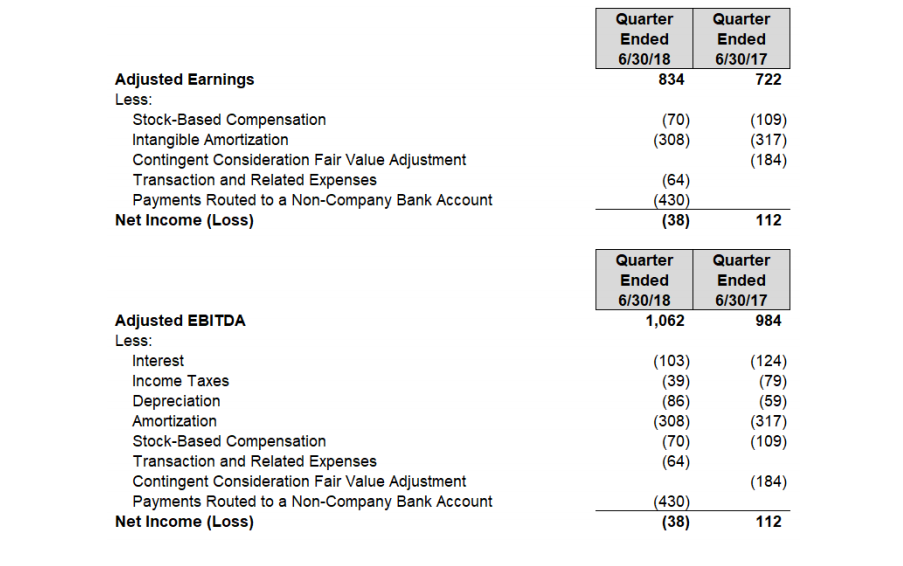

- GAAP net loss of $38 or ($0.02) per share based on 1,546 fully diluted shares outstanding, compared to GAAP net income of $112 or $0.07 per share based on 1,567 fully diluted shares for the quarter ended June, 2017.

- Adjusted earnings of $834 or $0.54 per diluted share compared to $722 or $0.46 per diluted share for the quarter ended June 30, 2017, an increase per share of 17.4%. (Adjusted earnings, a non-GAAP measure, is defined below.)

- Adjusted EBITDA of $1,062 compared to $984 for the quarter ended June 30, 2017, an increase of 7.9%. (Adjusted EBITDA, a non-GAAP measure, is defined below.)

- The Company increased its allowance for doubtful accounts by $430K due to a customer’s payments that were routed to a non-company bank account as the result of a phishing incident with one employee’s email.

“Increases in demand for our products in the traffic, critical infrastructure, and retail market segments resulted in the highest second quarter revenue the Company has ever seen,” said James Pritchett, the Company’s President and CEO. “Specifically, Innotech had the highest revenue quarter since we acquired them at the end of 2016. The product mix combined with component cost increases led to a slight decline in gross profit margin, but we expect a rebound in the third quarter. We are taking the recent unauthorized access to a company email account very seriously and are acting to mitigate the effects and implement controls to ensure that it is not repeated.” Mr. Pritchett went on to say, “With another strong quarter of adjusted earnings the Company is strategically positioned for success that should be further enhanced by our acquisition of Arecont Vision.”

The Company’s outside independent auditors completed their analysis of the Company’s financial condition. The Independent Auditor’s Review Report, including financial statements and applicable footnote disclosures, is available on our website at www.costartechnologies.com.

Non-GAAP financial measures

The Company defines adjusted earnings, a non-GAAP measure, as net income excluding stock-based compensation, amortization of acquisition-related intangible assets, adjustments to the fair value of acquisition-related contingent consideration, transaction related expenses and payments routed to a non-company bank account. The Company defines adjusted EBITDA, a non-GAAP measure, as earnings before interest, taxes, depreciation, amortization, stock-based compensation, transaction and related expenses, adjustments to the fair value of acquisition-related contingent consideration and payments routed to a non-company bank account. The following tables reconcile the non-GAAP financial measures disclosed in this release to GAAP net income (loss):

These reconciliations of GAAP to non-GAAP measures should be considered together with the Company’s financial statements. These non-GAAP measures are not meant as a substitute for GAAP, but are included solely for informational and comparative purposes. The Company's management believes that this information can assist investors in evaluating the Company’s operational trends, financial performance, and cash generating capacity. Management believes these non-GAAP measures allow investors to evaluate the Company’s financial performance using some of the same measures as management. However, the non-GAAP financial measures should not be regarded as a replacement for (or superior to) corresponding, similarly captioned, GAAP measures.