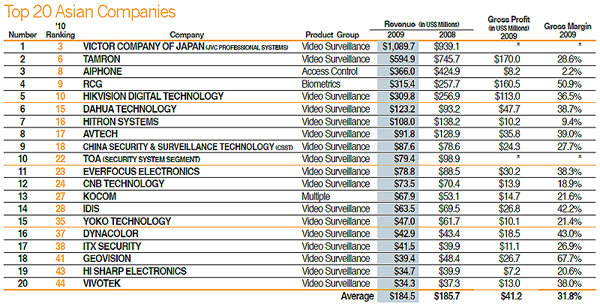

For this year’s Security 50 ranking, five Asian manufacturers made it into the top 10, while others peppered across the rest of the ranking. In general, losses outweighed gains, yet the top 20 Asian manufacturers remain firm and strong amidst the economic storm.

For this year's Security 50 ranking, five Asian manufacturers made it into the top 10, while others peppered across the rest of the ranking. In general, losses outweighed gains, yet the top 20 Asian manufacturers remain firm and strong amidst the economic storm.

With the recession cited as the main reason for revenue and profit declines, the top 20 Asian manufacturers averaged negative growth. Chinese manufacturers — including RCG from Hong Kong — were the only black sheep, experiencing double-digit revenue growth. Japanese and Taiwanese manufacturers either hit flat growth or declined, whereas Korean makers were divided between doubledigit growth or slumped revenues. In this feature, A&S talks to the top 20 Asian manufacturers about their experiences in 2009 and how they view opportunities in 2010.

With the recession cited as the main reason for revenue and profit declines, the top 20 Asian manufacturers averaged negative growth. Chinese manufacturers — including RCG from Hong Kong — were the only black sheep, experiencing double-digit revenue growth. Japanese and Taiwanese manufacturers either hit flat growth or declined, whereas Korean makers were divided between doubledigit growth or slumped revenues. In this feature, A&S talks to the top 20 Asian manufacturers about their experiences in 2009 and how they view opportunities in 2010.

Growth Factors

Growth Factors

Providing total solutions to customers spurred growth. In recent years, more manufacturers shifted from pure hardware providers to solution providers offering both hardware and software. RCG, Dahua Technology and China Security & Surveillance Technology (CSST) all attest to this winning factor. “Although the overall market environment remained challenging in 2009, we continued to expand our market share in the system integration field, coupled with encouraging growth in our manufacturing and distribution segments,” said Terence Yap, Vice Chairman and CFO of CSST. “We positioned ourselves as an integrated one-stop shop for surveillance and safety solutions in China.”

This is not to say that the OEM business was not without results. Large-scale OEM orders continued despite the global slowdown in 2009, which assisted with sales growth, said Tony Suh, Senior Sales Manager of ITX Security. Dahua also earned revenue from the European and US markets by taking on OEM orders.

Loss Factors Several Asian makers witnessed firsthand the recession's toll on their sales. “The security markets around the world were affected due to soft capital expenditures and an overall downturn in the global economy,” said George Tai,CEO of GeoVision.

Loss Factors Several Asian makers witnessed firsthand the recession's toll on their sales. “The security markets around the world were affected due to soft capital expenditures and an overall downturn in the global economy,” said George Tai,CEO of GeoVision.

Aiphone attributed its sales and profit losses to the slow recovery of sales in the world markets, particularly in Europe and the U.S., said Shusaku Ichikawa, President and CEO of Aiphone, in a prepared statement.

Customers hesitant to place orders also affected sales for Yoko Technology, DynaColor and AVTech. "By providing total solutions, the effect was fortunately minimized," said Andy Lee, Marketing Manager of AVTech.

Customers hesitant to place orders also affected sales for Yoko Technology, DynaColor and AVTech. "By providing total solutions, the effect was fortunately minimized," said Andy Lee, Marketing Manager of AVTech.

In the immediate aftermath of the financial downturn, a growing emphasis on capability versus price resulted in buyers replacing Tier 1 brands with more affordable solutions, which provided immense opportunities to other manufacturers and solution providers, observed DynaColor.

Competition remained fierce among Asian manufacturers. “A price war, coupled with the declining market growth and lower unit prices for analog cameras and DVRs, created a challenging environment for us,” said Roger Ho, Deputy Sales Director of Yoko.

New Markets

New Markets

Developing emerging markets was a major goal for all manufacturers in 2009. Projects in China, India, the Middle East and South America were among the hottest regions. Different product packages helped boost sales in pricesensitive markets such as China and South America, although moderate price adjustments had to be made, Tai said.

Yoko established service centers and production in China and Brazil to further penetrate local markets and increase market share. It should be noted that in emerging markets, manufacturers are adamant about establishing their own brands, partly to establish brand recognition in new markets and to avoid pricing issues with local resellers. RCG and Dahua explored opportunities in these regions, which yielded revenue growth.

Persis tence in Times of Uncertain ty In spite of revenue growth or loss, R&D remained a core asset for all manufacturers. Budgets set aside for R&D department were not only maintained during the market slowdown, but some even increased, as was the case at GeoVision. Innovative products with advanced technology added value and strengthened a company's competitiveness.

Persis tence in Times of Uncertain ty In spite of revenue growth or loss, R&D remained a core asset for all manufacturers. Budgets set aside for R&D department were not only maintained during the market slowdown, but some even increased, as was the case at GeoVision. Innovative products with advanced technology added value and strengthened a company's competitiveness.

Manufacturers continued to launch new products in 2009, including HD and megapixel cameras, network cameras with enhanced night visibility and embedded DVRs. Some makers, such as GeoVision and AVTech, developed midto high-end hardware and solutions, promoting brand value. “We maintained our strategy of becoming a total solution provider in IP surveillance,” said William Ku, Brand Business Division Director of VIVOTEK. “Instead of simply lowering prices, we wanted to offer products with higher quality and added value.”

A Refreshing 2010

A Refreshing 2010

Manufacturers were eager to begin projects at the end of 2009 to carry into 2010. HD was expected to become mainstream soon. “With the advanced development of video monitors today, technical development of and demand for HD — even full HD — will increase significantly,” Ho said. “Devoting resources to further developing this technology is essential.”

Moreover, several manufacturers are optimistic about the continued expansion of the IP market. “Analog will still have an edge in some enclosed surveillance areas, and the IP market will continue to expand,” Tai said. “The emergence of hybrid video has made it possible to merge analog and IP segments, which is both cost-saving and inline with technological advancements.”

Despite conservative observations on the HDcctv standard by most manufacturers, others feel it is the way forward. “HDcctv adopts the HD-SDI technology, which will remove several existing problems, such as time delays, network bandwidth shortage and incompatibility with current IP HD  products,” said James Wang, Overseas Product Manager of Dahua. The company plans to launch a complete lineup of HDcctv video surveillance solutions by the end of the year.

products,” said James Wang, Overseas Product Manager of Dahua. The company plans to launch a complete lineup of HDcctv video surveillance solutions by the end of the year.

Close observation of the market for uncontrollable risks and changes is required for any smart manufacturer. An understanding of the needs of the customers, along with a complete range of products to offer, is another must. Finally, clear road maps backed by strong R&D were what kept the top 20 Asian manufacturers going. More than just a production center, cost-effective innovations as well as a huge user base will give Asia a head start in financial recovery when Europe continues to suffer and the U.S. is just starting to come out of the funk. With hard lessons learned in 2009, Asian makers are already tackling the challenges ahead.

Find More 2010 Security 50 Articles :

● Growing Profits in Lean Times Part Ⅱ

● Growing Profits in Lean Times Part Ⅱ

● Growing Profits in Lean Times PartⅠ

● Bucking the Downward Trend: Top 10 Revenue Growers of 2009

● Security 50's Top Performers Rise Above the Fray Part Ⅱ

● Security 50's Top Performers Rise Above the Fray Part Ⅰ