Looking back, the true impact of the 2008-2009 economic recession was not felt until months later. Limited supplies and services, growing costs and dormant buyers all contributed to a challenging year. As the world takes small recovery steps, the top 10 revenue growers share how they managed to perform so strongly in 2009.

.jpg) Looking back, the true impact of the 2008-2009 economic recession was not felt until months later. Limited supplies and services, growing costs and dormant buyers all contributed to a challenging year. As the world takes small recovery steps, the top 10 revenue growers share how they managed to perform so strongly in 2009.

Looking back, the true impact of the 2008-2009 economic recession was not felt until months later. Limited supplies and services, growing costs and dormant buyers all contributed to a challenging year. As the world takes small recovery steps, the top 10 revenue growers share how they managed to perform so strongly in 2009.

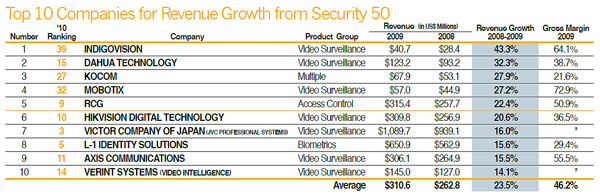

Despite an unfavorable economic climate and project delays, the majority of the top 10 revenue growers completed large-scale projects in transportation, government, education, city/public surveillance and entertainment.

Large-scale public projects funded by government or city administration bodies were able to continue, even when budgets are cut. Privately funded projects had more financial concerns, as Axis Communications found the slumped economy was one of the main reasons some customers deferred decisions regarding installations. Infrastructure is going strong in China and South America, with South America seeing an increase in city surveillance projects, said Ray Mauritsson, CEO of Axis. Mobotix completed several projects in Germany and abroad, including a sports stadium in Ukraine and a library in Vatican City.

Even in retail, the need for security installations resulted in positive growth. “The retail market has also contributed to the growth in revenue due to the fact that retailers face overwhelming security and loss prevention challenges, necessitating a more intelligent and efficient method of assessing and identifying site-related activities that result in these losses,” said Kenneth Tsang, Technical Director of APAC for Verint Systems.

Even in retail, the need for security installations resulted in positive growth. “The retail market has also contributed to the growth in revenue due to the fact that retailers face overwhelming security and loss prevention challenges, necessitating a more intelligent and efficient method of assessing and identifying site-related activities that result in these losses,” said Kenneth Tsang, Technical Director of APAC for Verint Systems.

According to the 2009 Global Retail Theft Barometer conducted by the Center for Retail Research, the first half of 2009 saw significant drop in security spending in the retail sector, predominantly as a direct result of the recession. By the end of the survey period, 15.9 percent of retailers surveyed had already installed new video surveillance systems and 28.7 percent planned to do the same. The 2010 survey showed a 29-percent increase in security equipment installations starting from the second half of 2009.

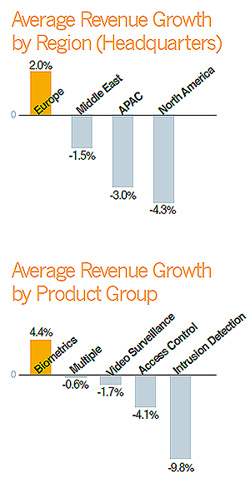

Geographical Divide

Some other revenue growers concentrated on making business advancements by region, and not necessarily by vertical, to boost sales activity.

Some other revenue growers concentrated on making business advancements by region, and not necessarily by vertical, to boost sales activity.

Dato' Lee Boon Han, CEO of RCG, said in 2009 the company focused on regions less affected by the recession, namely Southeast Asia, Greater China and the Middle East, which contributed to most of the company's revenue.

For customers in various regional markets, Dahua Technology adopted different strategies. It provided OEM equipment for the European and American markets, while promoting Dahua's branded solutions for the South American and Indian markets. Tony Yang, International Marketing Director of Hikvision Digital Technology, noticed that the US and European markets were affected more in comparison to the rest of the world by the recession. IndigoVision's regional growth in Latin America more than doubled. Similarly, Mobotix considered export business a growth driver in 2009, suggesting the German company found ample opportunities abroad.

Analog-IP Shift

The migration from analog to IP technology continued throughout 2009. Despite the fact that many larger players such as Pelco and Bosch Security Systems have now joined the IP race, existing manufacturers like IndigoVision, Axis and Mobotix are confident about the added competition. “The video surveillance market is fragmented in a way that there is room for growth in many different concentrations, so the induction of larger players into the IP market has not affected us in any significant way,” Mauritsson said. “Analog also experienced decline in 2009, which allowed the transition from analog to IP to continue.”

Both Mauritsson and Oliver Vellacott, CEO of IndigoVision, noticed that growth in the IP segment had accelerated since the slowdown in 2009. Even with several Asian IP manufacturers bringing lower-cost products into the market, the IP-driven revenue growers believed that the market was big enough for everyone. Standards bodies ONVIF and PSIA were important to IP revenue growers in 2009, as compliant solutions enabled greater compatRay Mauritsson, ibility and use with existing systems.

Outstanding Issues

With fewer projects and limited spending, the revenue growers continued to launch new products in 2009. Some took the opportunity to complete their product lines, offering a wider range to customers who might have otherwise considered another vendor. Axis observed that although interest in products remained high, customers' decision to invest was not as favorable as before. Despite this observation, all 10 makers — including Axis — believed that bringing new products into the market consistently remains a strong advantage and barrier over its competition.

With fewer projects and limited spending, the revenue growers continued to launch new products in 2009. Some took the opportunity to complete their product lines, offering a wider range to customers who might have otherwise considered another vendor. Axis observed that although interest in products remained high, customers' decision to invest was not as favorable as before. Despite this observation, all 10 makers — including Axis — believed that bringing new products into the market consistently remains a strong advantage and barrier over its competition.

To use new launches to increase market share, revenue growers did not reduce their budgets for R&D. As a core department in any enterprise, all 10 manufacturers devoted the same — if not more — resources and manpower to their R&D departments. Investments into R&D ranged between 10 to 13 percent of annual revenue. The ability to do so suggests that R&D resources should not be slashed even in critical times, where cost savings are a primary concern.

When choosing channel partners, distinguishing between the ones from a traditional security background or others savvy in IP was unnecessary, as manufacturers usually provide extensive training to partners. “We don't have any preference on whether the partners are IP-savvy, although it surely will add value,” Tsang said.

When choosing channel partners, distinguishing between the ones from a traditional security background or others savvy in IP was unnecessary, as manufacturers usually provide extensive training to partners. “We don't have any preference on whether the partners are IP-savvy, although it surely will add value,” Tsang said.

Even if a channel partner understands networking, the partner might be familiar with a product's functions, but not necessarily its installation and applications. “We provide training for all channel partners to make sure that they understand and are able to provide customers with application-driven services,” Mauritsson said.

A raw material shortage coupled with logistics costs was another major challenge to some revenue growers. Component lead time was extended, sometimes up to a full year, and sufficient planning for earlier deliveries needed to be incorporated into logistics and strategy meeting schedules. “We have been shipping far more by sea this year, by planning ahead to get the right stock in place in our regional hubs,” Vellacott said.

Rosy Front

With the experience gained from the hard times, this year's revenue growers are optimistic about the recovery and have already embarked on new projects and R&D efforts. Remaining flexible, controlling costs prudently and adjusting business plans accordingly were essential for the revenue growers to scale new heights. “Keep moving forward,” Vellacott said. “We see plenty of opportunities ahead.”

With the experience gained from the hard times, this year's revenue growers are optimistic about the recovery and have already embarked on new projects and R&D efforts. Remaining flexible, controlling costs prudently and adjusting business plans accordingly were essential for the revenue growers to scale new heights. “Keep moving forward,” Vellacott said. “We see plenty of opportunities ahead.”

Find More 2010 Security 50 Articles :

● Asia Weathers the Storm

● Growing Profits in Lean Times Part Ⅱ

● Growing Profits in Lean Times Part Ⅱ

● Growing Profits in Lean Times PartⅠ

● Security 50's Top Performers Rise Above the Fray Part Ⅱ

● Security 50's Top Performers Rise Above the Fray Part Ⅰ