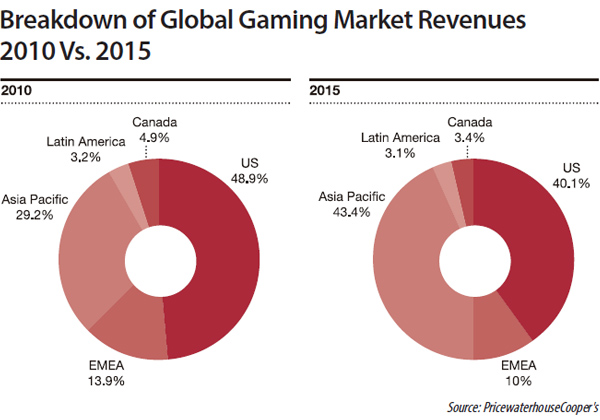

The landscape of the global casino market has dramatically changed as Asian countries are demonstrating all kinds of possibilities and surpassing major regional markets within only a few years. Despite being deeply affected by the recession, the US casino market remains the largest in the world. Meanwhile, it is forecasted that Las Vegas will no longer lead the US casino market, as more and more local casinos are emerging.

The global casino market was deeply impacted in the first few years of the global recession. Meanwhile, given the fact that online gambling started to expand at the same period, the physical casino market was even more severely compromised. The US casino market has been hit hard, and the revenues have been declining for several years. In 2010, revenues in the US casino market were flat, rising by merely 0.2 percent, which was the first increase since 2007, according to PricewaterhouseCoopers' (PwC) Global Gaming Outlook report.

EMEA, on the other hand, took the hardest hit during the last five years — not only as a result of economic downturn, but also demanding government regulations, such as a ban on smoking in European countries and limiting casinos to operate in remote areas in Russia only.

Despite the fact that these two major casino markets were terribly hurt, growth can still be seen in some other areas, especially APAC and Latin America. APAC is projected to increase from US$34.3 billion in 2010 to $79.3 billion in 2015, at a CAGR of 18.3 percent. In 2008, APAC overtook EMEA as the second largest regional casino market; and earlier this year, Macau announced that its total revenue in 2013 was seven times that of Las Vegas, rising as the largest casino market in the world.

According to Zebedo Pena, Director of Market Development and Sales at Genetec, “Because the North American casino market experienced a challenging past five or six years, investments in upgraded or new IP-based video surveillance systems were slower, despite the fact that the largest casino market in the world is still North America now. This is finally changing, and we are optimistic to see market movement. Internationally, many people are estimating that in 2015, the Macau market will overtake the entire North America casino market, which presents a good market for modern, IP-based security installations to assure casino guests have a safe and positive experience.”

US CASINO MARKET CONTINUES TO RECOVER

Despite the previous downturn, the casino industry in the U.S., in brief, has largely recovered compared to a few years ago and still remains the biggest market in the global casino industry. Not only are previously delayed projects slowly being carried out again, an increasing number of casino projects can be seen in more local areas, especially east of the Mississippi River. Expansion of newly built casino projects still can be seen in some new jurisdictions that have allowed the gaming business to set up shop in order to tax casino revenues to make it through during the recession.

Another factor that supported the recent US gaming industry growth is the boom of Indian gaming. Indian gaming was not as severely impacted by the recession — in fact, the total gross gaming revenue of Indian gaming has been growing steadily since 2003, and only suffered a minor setback during the economic downturn. The revenues generated in 2012 are the highest ever and marks the third consecutive year of growth of gross gaming revenues since the recession in 2008, as released by the National Indian Gaming Commission (NIGC). “Interestingly, expansion and new builds continue as before [in Indian gaming],” said Fernando Pires, VP of Sales and Marketing at Morse Watchmans. Government regulations have played a key role in the growth of the Indian gaming industry over the last few years. Regulations in tribal areas has been reformed to offer flexibility and consistency for tribes and tribal regulators as well as meet the diverse needs of the changing casino industry, according to NIGC.

Finally, the growth of casinos throughout the Eastern United States, with combined race tracks and casinos, has also stimulated growth in the casino industry. Due to the convenient location of casinos — for example, Pennsylvania, is close to New York City and the whole Northeast corridor, which runs from Boston to Washington D.C. — will be a very big draw for visitors to these newly built casinos, added Pena.

SOARING GROWTH IN ASIAN MARKET

APAC has overtaken EMEA as the second largest region of the casino market. In APAC, Macau, and Singapore will continue to lead growth for the next few years, while others in the region may look to boost growth in gaming in order to increase tourism and tax dollars. Most people believe that the key driver for soaring growth in the Asian casino market is the robust Chinese economy. As the GDP keeps growing, Chinese visitors are willing to spend more money on gambling, stated Riki Nishimura, GM of Visual Security Solutions Division, Professional Solutions Company of APAC at Sony Electronics. Since gaming is illegal in China, the middle class with discretionary income and very few means of gaming entertainment travel outside China to go to mega casino resorts with beautiful beaches, hotels, and restaurants. "High rollers from China, Indonesia, Japan, Taiwan, Thailand, etc. where gambling is forbidden, continue to drive the rapid growth in Asian gaming," explained John Katnic, VP of Global Gaming at Synectics. "The geographic convenience, world class resorts and attractions, high-end shopping malls, low-cost entertainment, and, of course, gaming in nearby areas such as Macau, Singapore, and the Philippines, provide the ideal playground for the region's rich and famous."

Macau Overtakes First Place

Macau's casino market surpassed its counterpart's market in Las Vegas, and taken in revenue about seven times as much as the Las Vegas Strip, crowning it the world's largest gambling hub in 2013, which rose 18.6 percent to $45.2 billion last year, reported by Bloomberg Businessweek . While the Las Vegas Strip generated $5.8 billion from January to November in 2013, Macau's casino revenues brought about $41 billion during the same period. Along with non-stop transportation and infrastructure development, it is believed that the growth rate is likely to be in the mid-teens or to rise as much as 20 percent in 2014.

In fact, since early 2008, the center of the casino and gaming market has progressively shifted from Las Vegas and Atlantic City in the U.S. to Macau in China, as more and more casinos have been built in Macau and around this area in Asia, according to ReportLinker. The casino industry experienced booming growth when they set their feet in Asia after some governments' bans on foreign investment and ownership of casinos were lifted. Mega casinos, such as Sands and Galaxy Entertainment, combined with other major entertainment elements, such as restaurants, hotels, and shopping malls, have attracted both domestic and international visitors. It is estimated by PwC that Macau will remain the largest casino gaming center in APAC, growing at a CAGR of 21.5 percent through 2015, outpacing Singapore's 20.5 percent.

Singapore Looks for Expansion

Impressively, Singapore is the third largest casino hub in the world with total revenue of $6 billion in 2013, right behind Las Vegas' $6.5 billion from merely two casinos. As a matter of fact, Singapore has been a major casino destination since Marina Bay Sands and Resorts World Sentosa started to operate in 2010. It is forecasted by PwC that Singapore will top $7.2 billion by 2015. Just a few weeks ago, Sheldon Adelson, billionaire chairman of Las Vegas Sands, asked Singaporean authorities for more land to increase rooms by about 60 percent at its resort, Marina Bay Sands, as the current occupancy rate at this resort is 98.6 percent with a daily room rate of $396 on average, according to Bloomberg Businessweek.

Japan Prepared to Enter Gaming Market

It is estimated that Japan could generate $40 billion in gaming revenues per year, based on the two large integrated resorts that are going to be set up in Tokyo and Osaka and 10 other smaller sites across the country in locations such as Hokkaido and Okinawa. This would make Japan the second-largest gambling market in Asia, behind Macau. Adelson declared earlier in February that his company has prepared to spend as much as is required in order to set up a casino in Japan. As Adelson will not be the only competitor targeting Japan, one thing for sure is that this competition is going to be fierce.

A ripple effect will course through this region if the proposed casino in Japan takes place, according to PwC's report. First of all, Japan's casino is expected to attract visitors from South Korea, diverting them from Macau. In the meantime, there were about 1.7 million tourists from Japan that visited casinos in South Korea. If casinos opened in Japan, many Japanese would stay local, causing revenues of the casinos in South Korea to be sharply declined.

CONCLUSION

In the past few years, most growth was seen not only in Asian areas such as Macau, Singapore, and Japan, but also new casino markets in the U.S. However, despite the US gaming market remaining the largest in the world, the focus of the gaming industry has been largely moved to Asia — the APAC market overtaking the US market will not be too far behind.

.jpg)