- Company reports second quarter revenue of $2.6 billion, with 3% revenue growth and 2% organic growth

- Segment operating margin before special items improves 90 basis points on a normalized basis*

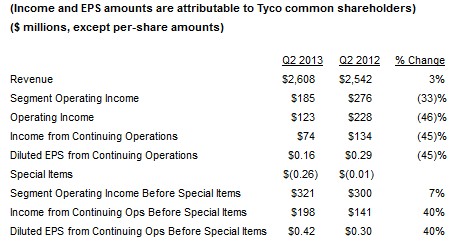

- GAAP income from continuing operations of $74 million includes $124 million of charges related to special items

- Diluted EPS from continuing operations before special items increases 20% over normalized second quarter 2012 results*

- Company completes $150 million of share buybacks, announces two acquisitions, and reaches definitive agreement to divest North America guarding business

- Company reports second quarter revenue of $2.6 billion, with 3% revenue growth and 2% organic growth

- Segment operating margin before special items improves 90 basis points on a normalized basis*

- GAAP income from continuing operations of $74 million includes $124 million of charges related to special items

- Diluted EPS from continuing operations before special items increases 20% over normalized second quarter 2012 results*

- Company completes $150 million of share buybacks, announces two acquisitions, and reaches definitive agreement to divest North America guarding business

*Normalized second quarter 2012 results reflect pro forma adjustments to corporate and interest expense to reflect the impact of the separation, and include dis-synergy costs associated with the separation of the Company's North American security operations from ADT. See Non-GAAP reconciliations.

Tyco reported $0.16 in GAAP diluted earnings per share (EPS) from continuing operations for the fiscal second quarter of 2013 and diluted EPS from continuing operations before special items of $0.42. Revenue in the quarter increased 3% versus the prior year to $2.6 billion. Organic revenue grew 2% in the quarter with 7% growth in products, 3% growth in service and a 3% decline in installation revenue.

Income from continuing operations in the second quarter was negatively impacted by special items totaling $124 million after-tax or $0.26 per share, of which $0.12 was related to a legacy environmental matter at a Global Products facility in Marinette, Wisconsin. Due to unanticipated results from treatability studies completed in the fiscal second quarter of 2013, additional environmental reserves were recorded for this site primarily related to expanded treatment and offsite disposal of contaminated river sediment that will be required. The remaining special items were primarily related to separation and restructuring.

"Tyco delivered a solid quarter operationally with accelerated service growth and operating margin expansion, driving a 20% year-over-year increase in normalized earnings per share," said Tyco Chief Executive Officer George Oliver. "Our financial performance and strong balance sheet provides us with the flexibility to continue to fund our organic and inorganic growth initiatives while returning capital to shareholders."

"During the quarter we announced two acquisitions that strengthen our position in core platforms by broadening our product and service offerings to customers. First City Care expands our security offerings in the banking vertical and National Fire Solutions Group complements our existing position in the Australian fire protection market. During the quarter, we also continued to return capital to shareholders by repurchasing $150 million of shares under the existing $750 million share repurchase authority."

Segment Results

The financial results presented in the tables below are in accordance with GAAP unless otherwise indicated. All dollar amounts are pre-tax and stated in millions. All comparisons are to the fiscal second quarter of 2012 unless otherwise indicated.

.jpg)

Revenue of $953 million included service growth of 2% and an installation decline of 3% year-over-year. Backlog of $2.5 billion increased 2% on a quarter sequential basis, excluding the impact of foreign currency. Sequentially, the dollar value of installation orders has stabilized and service orders have accelerated.

Operating income for the quarter was $79 million and the operating margin was 8.3%. Special items of $25 million consisted primarily of separation and restructuring charges. Operating income before special items was $104 million and the operating margin improved 120 basis points to 10.9%. This year-over-year margin improvement was driven by a higher mix of service revenue, improved execution in installation, and productivity benefits, partly offset by dis-synergy costs associated with the separation of our North America commercial security business, Tyco Integrated Security, from ADT.