The new top 10 video surveillance company ranking for 2021 is out! Click here for updated list.

The Top 10 video surveillance companies on this year’s

Security 50 form the lion’s share of the total video surveillance revenue, indicating the dominance of top brands in video surveillance is well established and is likely to continue in the near term.

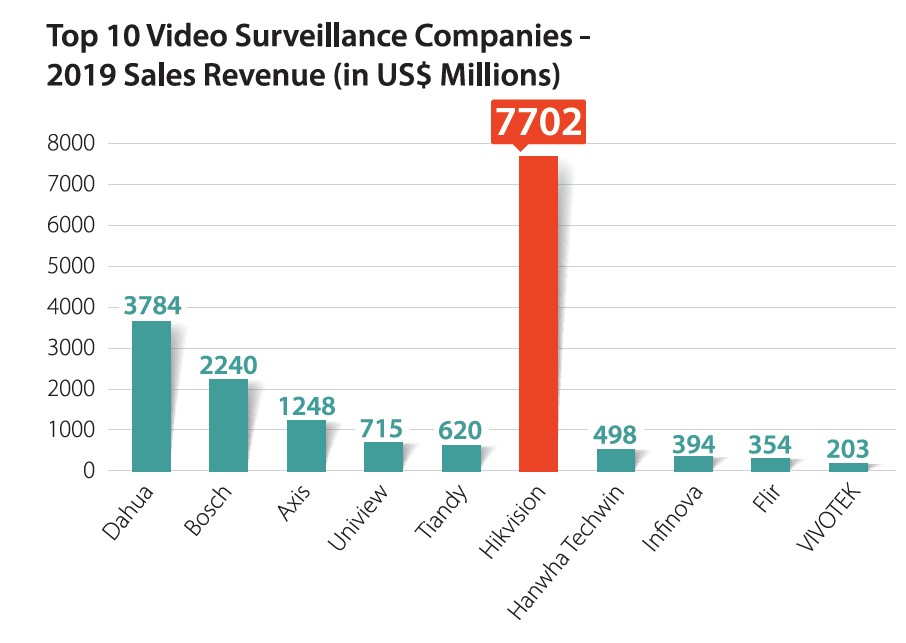

Again, video surveillance represents the biggest product category on Security 50 this year. Altogether, there are 38 companies that have all or some of their business focusing on video surveillance. Together, they made a total revenue of US$20.8 billion in 2019.

It’s interesting to point out, however, that while the Top 10 represent less than a third of the total video surveillance companies, their revenue is anything but. Together, the Top 10 had a total revenue of roughly $17.76 billion, or 85.5 percent of the $20.8 billion combine total.

The Top 10 video surveillance companies are the familiar large brands: Hikvision, Dahua, Bosch, Axis, Uniview, Tiandy, Hanwha Techwin, Infinova, FLIR and VIVOTEK. On a year-on-year basis, this year’s Top 10 remain pretty much unchanged from 2019. What’s changed, though, is their revenue which only grew larger.

It’s safe to assume that, with their sheer revenue size, wide reach in the market, ecosystem of partners and technology capability, these large companies will continue to dominate in video surveillance in the years to come.

Promising future of video surveillance

It has become more obvious that the top video surveillance companies have shifted away from single product sales. Rather they focus on solutions or projects in various verticals, for example government, smart city and transportation, to name a few, to increase revenue streams.

In a similar vein, video surveillance companies that focus on niche-specific, vertical-driven solutions tend to do better than those focusing purely on single products. For example, China-based Streamax Technology, ranked No. 15 and a newcomer to Security 50, focuses on mobile video surveillance solutions. The company achieved 2019 revenue growth of 32.2 percent. Similarly, Taiwan’s Hi Sharp, which also focuses on mobile video surveillance, achieved a growth of 8.13 percent, comparatively better than its Taiwan peers.

AI, analytics gain importance amid covid

Already,

AI and analytics play a major role in video surveillance, helping end users with security and operational objectives for example detecting abnormal behavior, recognizing VIPs or dispatching additional staff when the line is too long. Now, during the pandemic, analytics and AI can

help with disease prevention and control as well, and this is expected to become a trend in the post-pandemic world.

“This is the new normal. The economic and social damage already forced government spending on attempting to reduce the possibility of a second wave, and this should see demand of COVID products at public facilities and especially for schools and borders,” said Munyaradzi Maponga, GM of Safeguard Alarms. “CCTV integrated with AI to track people movements and behavior and provide data on risk of the potential spread of contamination will be more common.”

“Regarding technology segments, the pandemic is actually causing renewed interest in multiple technology capabilities, ranging from video surveillance and analytics, to identity and access management solutions that include both digital and physical access, and in event management and security operations center (SOC) solutions,” said Danielle VanZandt, Industry Analyst for Security at Frost & Sullivan. “Video surveillance, particularly those systems that include integrated analytics solutions, will be critical to enabling customers to reopen physical locations for employees or customers, while also ensuring that public health protocols regarding distancing or occupancy limits can be actively monitored. Analytics solutions that can serve multiple use cases – that is, counting analytics that can measure distances and number of people within a specified area — will be some of the top solutions in consideration, as many security teams will be much more particular about the security technology purchases they are looking to make.”

NEW: Check Out asmag.com's Cloud and Hybrid Video Surveillance Guide (Updated 2021)