This year’s Security 50 ranking is finally out. Which video surveillance and access control companies stayed on top? Which top brands are the newcomers?

Despite the ups and downs experienced by the physical security industry in the past years, the ranking of the top manufacturers in surveillance and access control have remained consistent except for the emergence of a newcomer, Motorola Solutions, whose influence in security will only become greater down the road.

Motorola Solutions debuts in Top 10

This year’s Top 10 biggest video surveillance and access control companies, based on their 2020 revenues, are: Hikvision Digital Technology, Dahua Technology, ASSA ABLOY, Axis Communications, Motorola Solutions, Uniview Technologies, Tiandy Technologies, Allegion and TKH Group. Hikvision and Dahua had 2020 revenues of US$8.3 billion and $3.8 billion, respectively, growing 7.73 and 1.21 percent from 2019 in spite of the pandemic. Indeed, China’s strong domestic market provides the necessary support and nutrient for Chinese companies to thrive.

Of note in this year’s Top 10 is an overdue newcomer – Motorola Solutions – who made their Security 50 debut at No. 5. The company had 2020 security equipment sales revenue of $927 million, which was a growth of 30.75 percent from 2019.

That growth is hardly surprising given their increased presence in the security arena. Motorola Solutions began as a radio equipment manufacturer. Over the years it acquired one security company after another: Avigilon in 2018,

IndigoVision in June 2020,

Pelco in August 2020, Openpath in July 2021 and now Envysion in Nov 2021 – to expand their product lines and reach to different verticals and geographic markets. Now, with video surveillance and access control solutions that complement their radio products, Motorola Solutions has become a major security player and will continue to exert its influence in the industry.

Aside from Motorola Solutions, other newcomers include Smartsens Technology, Intelbras, Gallagher, Foctek Photonics and BlueSky Technologies. Besides Intelbras (Brazil) and Gallagher (New Zealand), all the other ones are Chinese companies. It’s worth mentioning that Security 50’s scope was expanded this year to include publicly-listed domestic or multinational companies. As such, companies like Smartsens and BlueSky are included, both focusing on the Chinese market.

Security 50 Chinese companies reshuffle expected soon

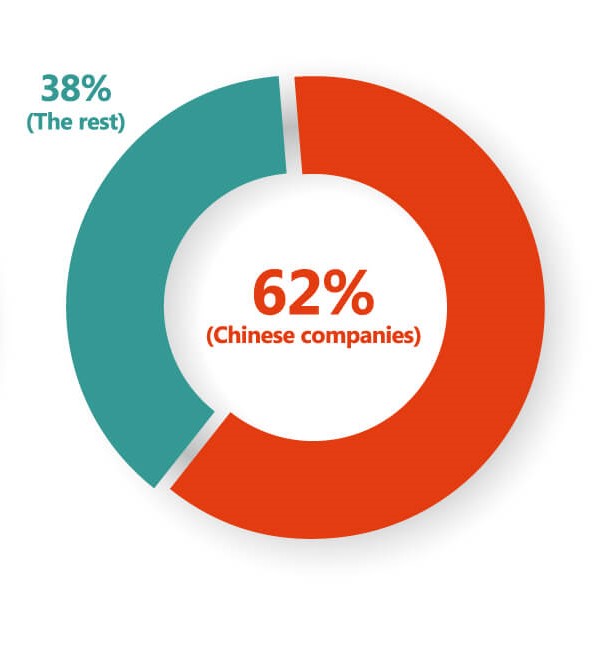

Speaking of Chinese manufacturers, they still dominate on Security 50. This year there are 16 on the list. Together, their combined 2020 revenue accounts for a huge proportion of the Security 50 total.

16 Chinese companies accounted for 62% of the total Security 50 revenue

16 Chinese companies accounted for 62% of the total Security 50 revenue

However, we did observe that some Chinese companies have shifted their focus from video surveillance to non-security solutions. Infinova, for example, now focuses mostly on digital services, with security accounting for less than 50 percent of the company’s business. Overseas, Infinova has

sold its overseas asset March Networks to Taiwan’s Delta, and has plans to sell its other overseas surveillance and home security business Swann as well. Kedacom, meanwhile, is focusing on videoconferencing solutions and has increasingly shifted away from security. A reshuffling of Chinese CCTV companies on next year’s Security 50 is all but expected.

Several companies that were on last year’s Security 50 aren’t on this year’s. This is because they either did not reply to our request for their 2020 financial figures or declined to participate this time.

Declines outnumber growth

Another noticeable part of Security 50 this year is the overwhelming number of companies reporting revenue declines for 2020. Despite the fact the 2020 Security 50 revenue total was US$25.12 billion, a growth from $24.39 billion for 2019, over half – 28 – of Security 50 companies reported year-over-year declines for 2020. This has not happened on Security 50 whereby more security brands reported revenue declines than growth.

While this is unprecedented, it’s pretty much expected, given the toll the pandemic had on the society. Budgets were constrained, spending reduced and projects delayed, all affecting security significantly. “We definitely expected that the market was going to experience significant disruptions in 2020 due to supply chain concerns, project funding, and just the halting of a huge portion of most businesses. While we did expect a very slight revenue decline in 2020, it stands to reason that top companies would have taken a hit to their largely uninterrupted growth streaks over the last decade in the industry,” said Danielle VanZandt, Industry Analyst for Security at Frost and Sullivan.

Despite that, some of the top 10 companies still showed resilience amid the downturn, reporting high growth or profit. Ensuring proper global supply chain management is key in this regard.

“The pandemic indeed still poses challenges to the whole security industry, and causes both changes in market demand patterns and supply chain shortages. To address these challenges, we have leveraged innovative technologies, products and solutions to meet the varied market demands, and worked closely with partners and suppliers globally to have maintained stability and integrity in our supply chain,” said Keen Yao, VP of Hikvision Digital Technology.

“In the face of the complex market environment changes, Dahua Technology made every effort to ensure project delivery by various means. On the one hand, it adhered to various R&D strategies to ensure stable product substitution and update; on the other hand, it maintained the stability of raw material supply by increasing inventory and strengthening strategic cooperation with suppliers. Meanwhile, Dahua kept on technological innovation, with continuous investment in core technologies, and accelerated layout of new directions and new products, greatly enriching the application scenarios of solutions,” said Fu Liquan, Chairman of Dahua Technology.

“It’s no secret that supply chains across every industry have been disrupted by working restrictions at different time in different markets. The work that Axis has undertaken over decades to build a strong supply chain – including having multiple suppliers of key components, and manufacturing centers close to suppliers – helped us mitigate some of the disruption. But we’ve definitely taken further steps to strengthen our supply chain based on the lessons from the pandemic, working closely with our suppliers around the world to support their business with us, and finding new transportation methods to reduce the risks of disruption,” said Ray Mauritsson, CEO of Axis Communications.

Offering solutions that customers need during the pandemic, like contactless access control technologies like biometrics, is also important. “We saw an increased customer need for contactless experiences early in the pandemic. Allegion quickly responded to offer a variety of new or updated door hardware solutions that would allow easier access without the need to grasp door handles and other solutions that provided automation of openings. As the pandemic progressed, Allegion focused on the development and commercialization of solutions that would allow users to easily retrofit manual door controls with automation. These solutions address not only the contactless use case but also bring great convenience – and they support Allegion’s long-term vision of “seamless access and a safer world,” said Vince Wenos, SVP and CTO of Allegion.

Industry recovery – a certainty?

As for this year and next, recovery in the video surveillance and access control market is all but certain as security projects assume amid a waning of the pandemic. “2021 was more of a year of adaptation and recovery for the industry, with many vendors offering solutions re-tooled for the pandemic era, new use-cases for already in-use technologies, and solutions that can enable an easier return-to-work as re-openings occur. Many projects which were stalled during 2020 lockdowns have re-started and are moving towards completion and many customers who may have had budget issues throughout 2020 likely saw their investment capabilities re-emerge this year. Because of this, we do expect that the industry will register about 3-5 percent annual growth; while this is not at pre-pandemic level growth rates it is a good start to recovering the ongoing trajectory that the industry was already on before the pandemic occurred. We do expect growth to slowly edge back to the same 7-10 percent growth rates by the end of 2022,” VanZandt said.

Already, companies’ 2021 first-half figures offer a glimpse of hope. “The good news is in the first half year of 2021, Dahua Technology achieved $2.09 billion in total operating revenue, with YOY growth of 37.27 percent; net profit amounted to $254 million, with YOY increase of 20.03 percent,” said Fu. “With accumulated experiences of these years, Dahua Technology has made a comprehensive breakthrough in enriching its business layout from smart products, smart home solutions, to large smart city solutions. With the development of AI and other technologies, the demands for smart solutions will increase, and this will be a very important growth support point for Dahua.”

“We see stronger demands on security in the market, and believe that new technologies will help create innovative products and solutions to meet customer’s varied needs. And yes, we are confident in the growth of industry and our businesses. There is a large market opportunity for enterprise users in terms of digital transformation, cost reduction and efficiency increase, and we also see solid demand from the SMB market for converged and more intelligent solutions,” Yao said.

Conclusion

Indeed, 2020 was an anomaly in various industries, including security. This is manifested in Security 50 this year where more companies in video surveillance and access control reported revenue losses than gains. But with flexibility, innovation and a forward-looking attitude, a lot of these companies showed resilience and weathered the shakeout, which is hopefully nearing its end. It also needs to be noted that just like other industries, security has been forever changed by the pandemic and will now cater to people’s security as well as health, digitization and remote-working needs. With security companies’ agility and responsiveness, they will surely adjust to this paradigm shift in no time, and with success.