Outside Interest

Excluding alarm companies, the surge in acquisition activity has been driven by companies from outside mainstream physical security. Safran, L-3 Communications, Flir Systems and 3M pulled off major deals in 2010, but mainstream suppliers like Schneider Electric, UTC Fire & Security, Honeywell Security and Bosch Security Systems have been conspicuous by their absence.

This year will be a hard act to follow, because continuing this rate of consolidation will require the merging or acquisition of large leading suppliers and their numbers are shrinking. However, this high rate of consolidation will continue, because the major suppliers absented themselves from the dealing tables in 2010 and have made claims to be active in the near future. UTC Fire & Security has made it known it intends to grow through acquisition and it is now over a year since its purchase of GE's Fire & Security division. This month,Tyco announced it set aside $500 million to acquire companies in India, Brazil, the Middle East and China to push inorganic growth in these markets.

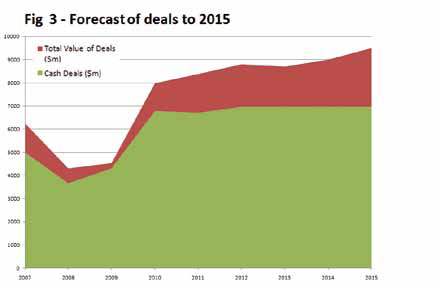

Given these facts, the continued interest for IT and communications-related companies see benefit in buying into the security business. In its current fragmented state, we forecast 20-percent growth in the value of deals over the next five years as shown in Figure 3. This illustration shows that cash deals have accounted for as much as 95 percent of transactions in 2008-2009, but this will fall as the security business is once again attracting private equity finance. Without this, the forecast growth in consolidation will be hard to achieve.

Alliance

Since 2008, the number of alliance arrangements has doubled from 45 to 91 in 2010. The most rapid growth was in 2009, when the number increased by 75 percent.

Both prior to, and in 2008 the vast majority of these arrangements related to partners coming together and making their products automatically communicate. This could be similar products such as cameras or different horizontal layers in a system such as video management and analytical software. The majority of these related to the video surveillance, particularly vendors creating software platforms such as Milestone Systems. As there is not yet a common communications standard, such alliance is vital if best-of-breed products are to flourish. The other alternative to alliance is to manufacture a complete portfolio of products that have been designed to work together. This is what the major suppliers have been doing for many years, using their own proprietary communications protocol. This method is no longer acceptable to most end users.

End users are demanding full plug-and-play seamless integration with other control infrastructures, including convergence with the business enterprise. So alliance needs to go one step further to extend the digital link and enable end-to-end communication, bringing all information together. We believe this was the reason for rapid growth in alliance activity in 2009 and its continuation in 2010.

In June 2010, 3VR certified Arecont Vision's full line of megapixel cameras as part of its SmartCam program. Arecont Vision said 3VR completed participatory testing in its MegLAB program and was certified in camera integration, feature integration and load testing. In addition to proving a degree of product differentiation, more comprehensive certification programs will be important, as network cameras and edge devices take on more features that require IT-like configuration at the time of installation or later, when users wish to make add-ons or changes. Megapixel cameras, in particular, come with features and settings that can perform differently when used with different VMS systems.

Alliance is also extending across business boarders to deliver value add solutions. A good example was the announcement in June 2010 of a partnership between Computer Network Limited (CNL) and ESRI (UK). CNL supplies physical security information management software. ESRI is a software manufacturer providing the backbone for world mapping and spatial analysis. The combination of these technologies will allow ESRI customers to bring their entire security estate into one system and CNL customers to leverage greater efficiencies and improve their operations.

Alliance is also extending across business boarders to deliver value add solutions. A good example was the announcement in June 2010 of a partnership between Computer Network Limited (CNL) and ESRI (UK). CNL supplies physical security information management software. ESRI is a software manufacturer providing the backbone for world mapping and spatial analysis. The combination of these technologies will allow ESRI customers to bring their entire security estate into one system and CNL customers to leverage greater efficiencies and improve their operations.

Both alliance and M&A will become one of the main conduits for delivering this delayering process. However some companies will elect to develop their own products. An example is Axis Communications, because it has chosen to develop its own layers, such as VMS.

Alliances for the purposes of sharing development costs or working together to explore new markets, while less frequent, is increasing. Some opportunities have been taken up by suppliers of video surveillance to join with access control and alarm manufacturers to combine Fig 3 - Forecast of Deals to 2015 22 FEB 2011 www.asmag.com 4272 information and data through a common software program and this again has extended the application for their products. This has been partly driven by the need to counter the consolidation process that is taking place across the horizontal layers of security systems.