M&A in 2010 and Forecast to 2015

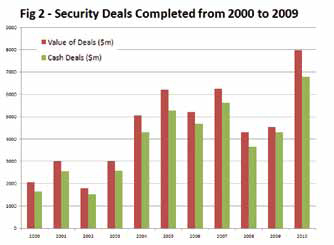

Figures 2 and 3 show security deals completed from 2000 to 2010 and Memoori's forecast to 2015. The value of 2010 deals was $7.98 billion, growing almost 75 percent from 2009. This is the highest value ever recorded and is 28 percent higher than the previous record set in 2005 and 2007. This is startling, not least because it is in stark contrast to what has happened in similar businesses. So what has caused such a surge in consolidation, at a time when the global market for physical security equipment has experienced little growth?

In 2009 we identified 77 acquisitions compared with 80 in 2010. So the almost doubling in value is not the result of more transactions. The reason is that this year, consolidation has been much more focused at the top end of the business, between established large companies. The buying price for just three deals amounted to $4.3 billion, some 54 percent of the total business transacted. Another seven companies paid more than $250 million to complete deals.

The drivers to achieve growth are to deliver products and services that increase productivity and provide ROI. IT convergence and integrated solutions are the way forward. For companies to deliver such systems, many have decided it is necessary to acquire expertise.

One example is the need to join physical security with identity management and biometrics. Some of the largest acquisitions in 2010 were in this area. HID Global, 3M and Hewlett-Packard have all bought big in the last four months of 2010.

We identified 17 significant deals for alarm installation and monitoring companies, netting a value of $4.18 billion. This segment has attracted 52 percent of the total spend on acquisitions. So why has alarm monitoring, long the fragmented and low-growth sector of the security industry — but cash cow provider — undergone such a surge in acquisition activity? On first observation, cash flow in the difficult trading conditions of the last two years appears to be the main driver. However just removing the surface layer reveals that integration of different security services delivered through SaaS enables more comprehensive and cost-effective service to both residential and commercial customers. The need to scale up quickly is driving consolidation.

We identified 17 significant deals for alarm installation and monitoring companies, netting a value of $4.18 billion. This segment has attracted 52 percent of the total spend on acquisitions. So why has alarm monitoring, long the fragmented and low-growth sector of the security industry — but cash cow provider — undergone such a surge in acquisition activity? On first observation, cash flow in the difficult trading conditions of the last two years appears to be the main driver. However just removing the surface layer reveals that integration of different security services delivered through SaaS enables more comprehensive and cost-effective service to both residential and commercial customers. The need to scale up quickly is driving consolidation.

There have been major landmarks during the last 12 months. In January 2010, Tyco International purchased Broadview Security for $2 billion. This was followed in April with GTCR's purchase of Protection One for $828 million. In September, Safran bought L1-Identity Solutions for $1.1 billion and in December, Monitronics was acquired by Ascent Media Corporation for $1.2 billion.