2009 witnessed a soft market, slow construction and tight security budgets. Despite tough conditions, 10 companies managed to beat the market with robust revenues. A&S examines how they performed and where  they found blue oceans.

they found blue oceans.

In the wake of 2008's Lehman Brothers collapse, 2009 was a grim year. A record number of banks closed and businesses went bust. Consumer spending dropped to all-time lows, with new construction and employment opportunities growing scarce.

As this year's Security 50 ranking reviews financial reports from 2009, the mood was somber for electronic security. Six of the top 10 performers suffered revenue losses, while the other four posted double-digit growth.

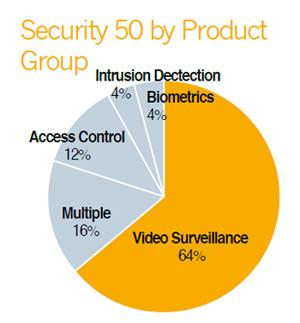

Of the four manufacturers who grew, two were video surveillance providers: Victor Company of Japan (JVC Professional Systems) and Hikvision Digital Technology. The remaining companies in the black were access control solution providers RCG and L-1 Identity Solutions — the latter was sold to BAE Systems and Safran in September.

The reasons why these four companies grew are varied, but do not mean they were immune to the recession. “The global recession in 2009 has affected our growth projections,” said Tony Yang, International Marketing Director for Hikvision Digital Technology. “We did grow overall, but not as much as expected.”

A complete camera lineup complementing its surveillance solutions helped Hikvision increase revenue. “While most of the overseas markets were hit harder by the recession in 2009, the domestic market in China still maintained its strong growth from policy-driven projects,” Yang said.

A holistic-solution approach helped RCG weather the storm. “For 2009, growth was driven by execution of strategies to face challenges caused by the financial crisis; RCG has recorded revenue growth by focusing on solutions projects, as well as the areas that were less affected such as Southeast Asia, China and the Middle East,” said Dato' Lee Boon Han, CEO of RCG. “The impact of the financial slowdown was fortunately not too significant, as RCG has been focusing on numerous verticals supported by government stimulus packages.”

L-1 Identity Solutions grew 15.6 percent in 2009, which was slower compared to its 44.5-percent jump in 2008. “During 2009, L-1 was awarded 19 of 20 competitive credentialing procurements and booked approximately US$289 million in global driver's license extensions and new contracts,” the company said in a prepared statement.

Hampered Sales

Hampered Sales

Thermal surveillance provider Flir Systems suffered a modest revenue loss of 3.2 percent in 2009, maintaining steady sales. “Flir has experienced excellent growth as measured in both revenue and unit volume for our thermal security cameras over the past two years,” said Bill Klink, VP of Security and Surveillance, Flir Systems. The company is offering cameras at lower prices, with increased uptake by industrial, federal, municipal, recreational and residential end users.

Government mandates also softened the recession's effect. “Many federal regulations require increased perimeter security of critical infrastructure, and these regulations drive demand for security cameras,” Klink said.

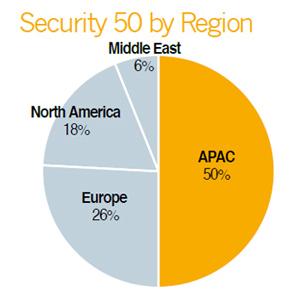

Bosch Security Systems fell 5 percent by nominal revenue, with currency effects pushing it down 7 percent from 2008. “The global market for security technology fell by 13 percent, and this downturn was particularly severe in Western European countries,” said Gert van Iperen, President of Bosch Security Systems. “These countries saw declines in double digits, with the market in Europe shrinking by 17 percent and in North America by 13 percent. The reluctance of investors and the suffering construction industry were key factors for declined sales.”

Assa Abloy's Global Technologies division had a soft landing, with revenue dipping 2.1 percent. “The underlying trends and growing uncertainty in the world put security high on the agenda, driving the development of increasingly advanced solutions and upgrades of existing security systems,” the company said in a prepared statement.

ADT's product sales fell $382 million or 19.8 percent in 2009, primarily due to reduced volume. “The remaining decrease is related to the unfavorable impact of changes in foreign-currency exchange rates of $122 million,” ADT said in a prepared statement.

Key Verticals and Regions

Most of the Security 50 participants saw growth in public projects, particularly in emerging markets. The commercial segment for retail and banking remained sluggish, with replacement cycles or expansion plans on hold.

US sales held steady for Flir Systems. “Balanced execution across all of our primary vertical markets — government, commercial, critical infrastructure and residential — and our broad product mix ensure that we have a solution for all challenging imaging situations,” Klink said.

US sales held steady for Flir Systems. “Balanced execution across all of our primary vertical markets — government, commercial, critical infrastructure and residential — and our broad product mix ensure that we have a solution for all challenging imaging situations,” Klink said.

Bosch did well in critical infrastructure, transportation, and public order and safety. Entertainment also had strong growth.

“In APAC, we are expecting a welcome rejuvenation in the market development, which is expected to grow by 14 percent in 2010,” van Iperen said. “Latin America will grow by 11 percent. Even in EMEA, a turnaround has been achieved, and we expect slow but positive growth of 1 percent. In Eastern Europe, we are seeing market growth of 4 percent.”

RCG benefited from public projects as well. “On the one hand, we have increased the number of government-based contracts, which is visible even in the future,” Lee said. “On the other hand, we combine cutting-edge technologies — biometrics, RFID, wireless technology and new technologies like the Internet of things or machineto- machine — with our unique ability to develop solutions that suit customer needs, ensuring sales and new revenue streams.”

America's reduced spending power affected ADT. “The electronic security business decrease was primarily due to the slowdown in the retail sector, as retail capital projects and new store openings were canceled or delayed,” the company said in a prepared statement.

Emerging markets made up nearly 17 percent of Assa Abloy's sales, up from 9 percent five years ago. “The group is deliberately focusing on increasing its presence in the emerging markets in Asia, Eastern Europe, the Middle East, Africa and South America,” said Johan Molin, President and CEO of Assa Abloy, in a prepared statement.

“The 18-percent mark was passed toward the end of the year as Asian markets showed good growth again, while North American sales continued to decline and European sales were stable,” Molin said in a prepared statement.

“The 18-percent mark was passed toward the end of the year as Asian markets showed good growth again, while North American sales continued to decline and European sales were stable,” Molin said in a prepared statement.

Asia was a high point for Aiphone, particularly China, due to economic stimulus projects, said Shusaku Ichikawa, President and CEO of Aiphone, in a prepared statement. Europe and the North American markets are seeing gradual movement.

The government market was crucial to L-1, which made more than 95 percent of its sales to federal, state, local and foreign governments and government agencies. “Sales to customers outside the U.S. accounted for 41 percent of our revenue in 2009,” the company said in a prepared statement.

Ove rcast in Land of the Rising Sun

While the recession pounded While the recession pounded markets the world over, it hit a weak Japan even harder. Despite the odds, the Top 10 performers included three companies from the world's secondlargest economy: JVC, Tamron and Aiphone.

Currency valuations had a negative effect, with the yen appreciating faster than the US dollar and the euro. “The Japanese economy remained sluggish, as the capital investment and employment situation remained at a low level and consumer confidence continued to be stagnant,” said Morio Ono, President and CEO of Tamron, in a prepared statement.

Tamron's revenue fell 20.2 percent, witnessing improvement in the fourth quarter of 2009.

Some economic measures have stimulated demand at home, showing signs of recovery, Ichikawa said.

However, Aiphone fell 13.9 percent due to the economic downturn, amid increased insecurity about employment and consumer spending in the future.

In the professional AV systems business, where JVC regards security as its highest priority business, it is striving to win more orders by introducing new products lineups that utilize its camera and mechatronic technologies, the company said in a prepared statement.

Find More 2010 Security 50 Articles :

● Asia Weathers the Storm

● Growing Profits in Lean Times Part Ⅱ

● Growing Profits in Lean Times Part Ⅱ

● Growing Profits in Lean Times PartⅠ

● Bucking the Downward Trend: Top 10 Revenue Growers of 2009

● Security 50's Top Performers Rise Above the Fray Part Ⅱ