Video analytics has eaten a lot of free lunches during the last 15 years, but artificial intelligence (AI) applied to video analytics is now well on course to deliver a major breakthrough in the video surveillance business.

However there is still much to be done particularly in proving to customers that these new solutions are both robust and cost effective before they have the confidence to invest heavily in them. Sadly some AI facial recognition products have been brought to market before full beta testing and have failed to impress and this has not helped its cause. Nevertheless new chip architectures combined with intelligent video analytics software when put to work on the gargantuan volumes of data will improve the security, safety and performance of people, buildings and the business enterprise, and these relatively minor blips may delay but will not stop the goal of delivering a major boost to the video surveillance ecosystem.

Memoori’s report, “

The Global Market for AI Video Analytics 2018 to 2023,” identifies a number of reasons why we are about to cross the Rubicon. The first is that major advances in semiconductor architecture are now enabling much faster processing, empowering “deep learning” and “machine learning” algorithms to process/analyze data many times faster than was previously possible.

AI video analytic solutions are driven by “deep learning and “machine learning” algorithms and at this time operated through new GPU semiconductor architecture. The reason for this is the computer chip manufacturers have now found that new architectures can deliver a much better performance for AI chip applications. This initiative has come from relatively smaller chip manufacturers that are now developing AI chips and analytic software products.

The venture capital business is now pouring billions of dollars into financing these companies. We have identified 128 companies across the world that are now in some way helping (hardware and software) to deliver AI Video Analytic solutions.

But to develop and perfect this technology will require major investment in new business processes, people and innovation. This report shows that billions of dollars have been invested already and more is currently being ploughed in; and there seems to be no sign that this mountain of cash will dry up soon.

There is still much to be done in perfecting the technology and getting it to market, but new tools and processes have opened up the opportunity to bring AI products to the video analytics market, potentially revolutionizing its performance and capability.

In 2018, there is now a strong belief that video analytics is moving well beyond what can be achieved through conventional rule-based systems. New AI platforms have the capacity and capability together with machine and deep learning algorithms to deliver video surveillance solutions that are intelligent. This will further drive demand for AI video analytics not just for new projects but open up a vast latent potential for retrofitting millions of existing video surveillance installations.

The practical aspects of getting AI solutions to market will be challenging and it will require more than a little tinkering with the established routes of distribution and installation.

Video surveillance systems generate vast amounts of data but sadly it is currently not being utilized. Yet it is estimated that the millions of video cameras that are in operation today accounts for 60 percent of the input of data, more than any other sensor in buildings, campuses and cities. So there is huge potential to maximize the value of this data by converting it from “dumb to actionable.” The material is already out there just waiting to be mined.

The enterprise sector, across a number of the most important vertical markets for the video surveillance business is now making very significant investments in AI video analytic solutions. The point of inflexion on the growth curve could be reached within the next 18 months, but that would require a major effort.

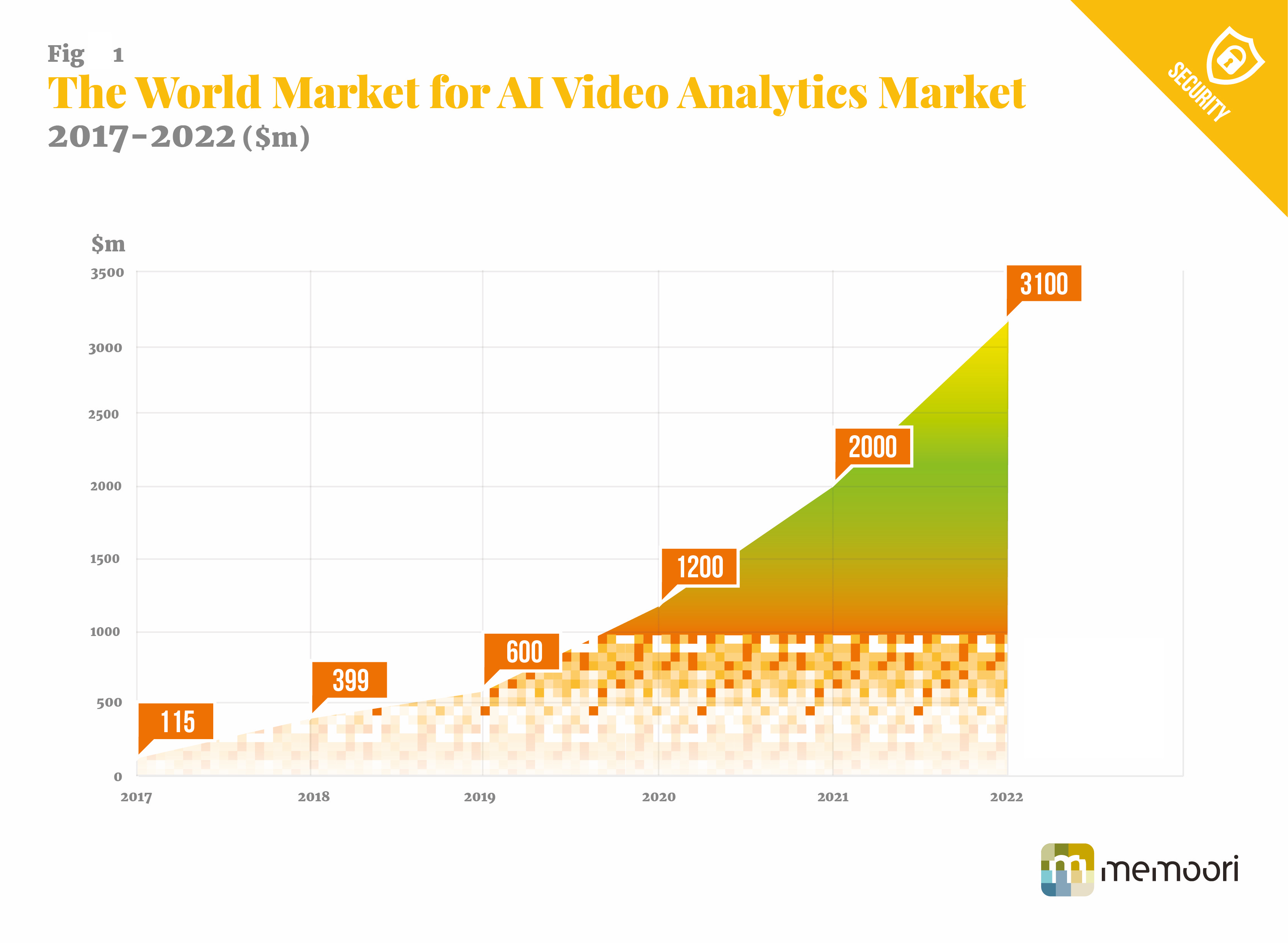

The world market for AI video analytics

The market for AI video analytics is in its premature phase and there are few statistics that can give a guide to its current size. Our best estimate is that the global sales of AI video analytic solutions in 2017 including beta test products was approximately US$115 million with much of this being installed in China.

Source: Memoori

Source: Memoori

We also believe the current market for conventional rule-based systems in 2017 would be double this at around $250 million. However with the advent of AI systems its size will now decline over the next three years as AI video analytics takes over its share of the video analytics business. Compared with annual sales of VMS software in 2017 at $1.4 billion and forecast it will reach $3.1 billion by the end of 2022 we expect that by that year AI video analytics will have caught up VMS. However from that point AI video analytics will race ahead continuing its rapid growth for at least two more decades.

In Figure 1 we forecast that demand for AI video analytics to 2022. This shows that starting in 2017 at revenue of $115 million we forecast that it will grow by CAGR of 90 percent over the next five years and will reach sales of $3.1 billion in 2022. This is an ambitious forecast but we think realistic but will require AI Video Analytics making a sustained progress in its development meeting full the end users buying propositions within the next eighteen months.

The calculations are based on a model of the world’s population of video cameras of around 600 million in 2017 excluding the residential market and making allowances for small single buildings, which are unlikely to install AI video analytic systems for some time. It takes into account sales revenues from both retrofitting existing video surveillance and new installations.

We estimate that the technical market potential for applying AI video analytics in existing installations could be around $65 billion and we assume it could take up to 30 years for this to be exhausted. To this we have added the cost of applying AI video analytics to new installations to arrive at the total technical market potential.

These figures are nothing more than our best estimate but do provide a scale on which to judge the potential size of AI video analytics market.

In 2017 the world market for video surveillance products was $15.87 billion and the estimated revenue from AI video analytics was $115 million. This would mean that AI video analytics accounted for only a miniscule proportion of the total video surveillance market that year.

We estimate that by 2022 it would account for approximately 13 percent of the video surveillance market, provided that within the next 12 months all the routes to market are fully developed and AI video analytics products are available that meet the demands of customers.

This has been taken from Memoori’s Report “The Global Market for Intelligent Video Analytics 2018 to 2023” (https://www.memoori.com/portfolio/global-market-video-analytics-2018/).