INSIGHTS

Private equity has played a much more passive role in recent years. It has suffered as a result of the financial meltdown and has not been able to recycle through the natural process of initial public offerings (IPO). It is going through a process of restructuring and is redefining investment parameters. So, public equity will continue to dominate the M&A scene for the next two years. However, private equity has in the past been a major source of funding for acquisitions, and the pundits tell us that private equity buyouts are bouncing back. In 2011, IPO activity is likely to be concentrated in China, primarily to float the fast growing local manufacturers, but we may see more “Western” companies follow the example of Infinova's listing on the Chinese Stock Exchange.

Security Business: M&A Drivers, Valuation and Investment---Part II

Date: 2011/03/15

Source: Submitted by Memoori Business Intelligence

Cross-border transactions will also continue to be a significant driver. Exposure to US market segments has become a strategic priority for a number of European companies, but we expect that most activity under this dynamic will center on Asia and particularly China where rules on ownership have been significantly relaxed in recent times. UTC Fire & Security has made a number of strategic investments there in the last few years.

Possibly the most important driver is the result of the push to IP networking. Buyers are gradually accepting that security does not have to be a cost center, and that particularly when integrated with other services, it can increase productivity in the enterprise, made possible through convergence. While technology has been the enabler of change, the motivator now is clearly to deliver products and services that increase productivity and provide an ROI. The market is now in the process of rapidly adopting to changing requirements for more converged and integrated solutions. This is driving a need to acquire and or merge with suppliers that have IT and networking expertise.

IP-based products, be it access control, intrusion detection or particularly video, grew rapidly in 2010 and are believed to be on the verge of a strong run. Analog sales by comparison fell in 2009, but unlike IP, they did not increase their rate of growth in 2010. Falling prices and improved performance have all conspired to improve IP-based products' ROI and TCO and made it easier to install, run and service the new technology. We believe that the major emphasis in the security business will be an acceleration of shift to IP from analog, and a sharp increase in a move to managed/hosted video. With this will come more demand for companies having this expertise, and we shall see an increase in their valuation.

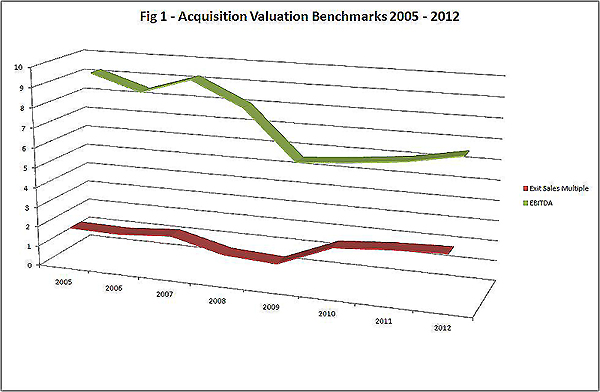

Exit Valuation

Figure 1 shows that the average valuations of security companies based on earnings before interest, taxes, depreciation and amortization (EBITDA) and revenue exit multiple fell by as much as 40 percent during the period 2008 to 2009, with 2007 being the historical high. There is a very high variation in these numbers, ranging from 0.5 to as high as 16 in the case of revenue multiple for a PSIM supplier in 2010 that just started to generate sales. EBITDA multiples have ranged between 1 and 13. We have noted higher figures being quoted in the financial press on some deals, but without details being given. The two trends that stand out from these figures are that software and biometric suppliers achieved the highest valuations in 2010, and that, in all sectors, the average valuation benchmark has gone up.

At the same time, the stock market valuations during 2010 went up from a decline that started in 2008. During 2009 and 2010, according to anecdotal information, fewer sellers were proactive in the market. It is, therefore, not surprising that valuations started to go up in 2010, and this trend is expected to continue in 2011. This rise in valuation is likely to be a gradual one because this is a competitive market with unit prices falling, and increased revenue is likely to be modest in 2011 for most companies. We estimate that the median valuation for physical security companies in 2010 was 2.2 times revenue and 5.7 times EBITDA. These figures are lower than those given by the financial experts.