Security is a growing market in EMEA and APAC as end users deal with various security issues in the region. In EMEA, some of the top verticals include government, retail and banking. Hospitality, meanwhile, is cited as a major revenue generator for Asian SIs given regional efforts to develop tourism.

Security is a growing market in EMEA and APAC as end users deal with various security issues in the region. In EMEA, some of the top verticals include government, retail and banking. Hospitality, meanwhile, is cited as a major revenue generator for Asian SIs given regional efforts to develop tourism.

Middle East

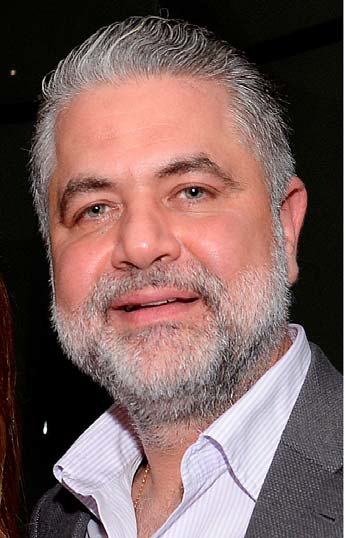

For the Middle East, the government sector also represents a major source of income due to the need to make offices and agencies secure against security risks. “Users in this sector purchase security to secure access to premises, control access limitation per user and time and monitor the access events,” said Ahmed Matari, Head of Operation and Maintenance at Kuwait-based

Ideal Information.

Ahmed Matari, Head,

Ahmed Matari, Head,

Operation and Maintenance,

Ideal Information

“We operate in Lebanon (HQ), Iraq and Nigeria. Terrorist threats drive the security needs for governments in those territories. This pushes us to deliver solutions to the highest standards with high reliability that can be counted on to mitigate any threat,” said Ziad Monla, CEO of

Guardia Systems, which had a city surveillance project in Beirut. “We have implemented a turnkey city surveillance project in a record time of one year consisting of 2,000 cameras covering 350 locations, 200 license plate recognition cameras, fiber infrastructure, two data centers with one of them modular and mobile, two 50-operator control rooms packed with the latest technologies.”

Retail, meanwhile, has been cited as another important vertical market where loss prevention is being emphasized. “Retailers need security to prevent loss and crimes by activating alarm events,” Matari said. “We provide IP surveillance, access control systems and intrusion detection systems to help them avoid problems and losses.”

Banking is also a major vertical, with users increasingly looking for integrated, command center solutions. “Banks have a need to monitor all their branches from a central location. They need to be able to live view and playback cameras, control physical access, monitor intrusion and fire alarm systems all from one location,” said Monla, whose company has a project with Al Rafidain Bank in Iraq. “We are currently implementing an Oracle Core Banking solution that will enable the bank to shift to the new era of digital banking.”

Ziad Monla, CEO,

Ziad Monla, CEO,

Guardia Systems

According to the SIs, continued growth is expected in the Middle East due to ongoing security needs. “We expect the same revenue in 2018 compared to 2017, but we expect growth in 2019 as we are introducing new services and solutions,” Monla said.

Europe

For Europe, security remains a top priority amid incidents such as the truck attack in Nice in 2016 and the London Bridge attack in 2017. This then spawns the needs for security solutions. “Demand is driven largely by reaction. Something happens, CCTV is a solution. This is not always the right time to procure CCTV or security services, but it remains the main point at which organizations contact us,” said Kevin Bowyer, Technical director of U.K.-based

NW security Group.

Kevin Bowyer,

Kevin Bowyer,

Technical director,

NW security Group

Yet more and more, end users are using security for non-security applications to increase business intelligence, improve efficiency and enhance the customer experience, Bowyer said.

He listed the following verticals – logistics and transport, leisure and tourism, and manufacturing – as examples. “Typically, our work in these sectors comes about through ongoing operational change and expansion within the organizations that we work with. A good system not only pays for itself quickly, but paves the way for improved performance and efficiencies that our customers like to embrace and implement,” he said. “We deliver solutions that … make a real difference not only to their security, but to their business.”

According to him, with security becoming more commoditized, solutions that help drive the user’s business intelligence will be a key growth driver. “We expect growth in 2019, driven by technology advancements that increasingly deliver real security and business intelligence benefits to customers, whilst pricing of these technologies is becoming more commercially realistic,” Bowyer said.

Meanwhile, GDPR, which calls for more stringent handling of personal data, is already in effect and is expected to impact end users as they handle security. As such, SIs are working together with end users to ensure that their security systems are GDPR-compliant. “The introduction of GDPR earlier in the year will lead to higher standards in the industry, something we strongly advocate,” Bowyer said. “We ensure GDPR compliance within the system delivered over the long term.”

APAC

Sovan Hok,

Sovan Hok,

Technical Director,

NKTech

The Asia Pacific is a growth market, with economies in the region expected to achieve GDP growth of anywhere between 4.1 and 6.9 percent this year, according to World Bank forecasts. This will leave end users with more money to spend on security, which is highly demanded given the threat landscape of the region.

“Growth this year will be higher compared to 2017, as demand is increasing. Hopefully, 2019 will see growth as well because security is essential this time,” said Vincent San Diego, VP of

HYE Enterprises, a Philippines-based systems integrator.

Security is also driven by government regulations. The No CCTV No Permit rule in the Philippines, for example, calls for installation of video surveillance as a prerequisite for business permit application or renewal. In many APAC countries, new buildings are required to install fire safety systems that meet a certain standard. “To be regulation compliant is definitely a key need that that prompts users to spend on security,” said Sovan Hok, Technical Director at

NKTech, a Cambodia-based systems integrator.

Hospitality is cited as a major revenue generator for SIs given regional efforts to develop tourism. According to the World Travel and Tourism Council, travel and tourism investment in Southeast Asia in 2017 was US$48.8 billion, or 6.4 percent of total investment, and the figure is expected to reach $86.8 billion by 2028. Against this backdrop, more and more hotels and casinos are being built, triggering security needs.

Vincent San Diego,

Vincent San Diego,

VP, HYE Enterprises

Hok cites hotels and casinos as a major vertical market for them. “The needs of end users in those sectors include surveillance of people activities, proof recording and safety. We offer video surveillance system, access control, light automation and car parking systems to suit their needs,” he said.

Commercial buildings are another strong vertical. Specifically, a construction boom in the APAC region is further driving growth in this sector. “Fast growth of construction is definitely seen in our country,” Hok said. “We expect revenue to be higher this year than 2017, due to the rapidly grow of construction industry with foreign investors.”