The Turkish fire and security market survived the financial crisis, with new construction driving growth for 2011. Sister publication a&s Türkiye talks to local players about what’s ahead in product trends, markets and challenges.

The Turkish fire and security market survived the financial crisis, with new construction driving growth for 2011. Sister publication a&s Türkiye talks to local players about what's ahead in product trends, markets and challenges.

The outlook for Turkish security is bright, after A&S Türkiye interviewed dozens of companies over three months and checked import statements.

While the market is large, it is difficult to document officially, as products are imported with no record or registered under different tariff numbers. However, estimates from different companies are relatively similar, registering the end of the economic downturn and heralding a more prosperous future.

2010 was considered to be the turning point of the financial crisis, as security professionals observed a noticeable uptick in construction activity, said Okay Nasir, GM of Kont, a distributor for Samsung Techwin in Turkey. Economic indicators were positive, resulting in real estate growth that had a positive effect on security.

New construction boomed, including hospitals, banks, residential housing and shopping centers, said Murat Terzioglu, Business Unit Manager of Koyuncu Secura. The building boom was beneficial to security.

Projects took off in 2010, with integration becoming a priority and bringing demand for integrated solutions, said Egemen Kilic, Business Development Manager of InfoMET. Tarkan Tuncel, GM of Kekova Security Systems — a system integrator who has worked with brands such as Anixter, Shrack, Seconet and Samsung — said 2010 was the best year in his company's 10-year history.

UTC Fire & Security was among the companies that had a successful year in 2010. EMEA became the eighth biggest market for the company, said Ozan Demirel, Regional Manager for Turkey, Israel and the Commonwealth of Independent States. Turkey alone grew 55 percent, making it the highest-growth country.

In Turkish security, service or technical support is now more important than sales, said Ekrem Ozkara, Chairman of the Board, Okisan. The company focused on training personnel and vendors, which it plans to continue in 2011. Bosch Security Systems is another company that had a successful year. Hakan Ozyigit, Sales Manager for Turkey, said its Turkish business grew 45 percent in 2010. This represents the highest growth among other Bosch offices in EMEA.

However, not everyone felt the market had turned the corner. The worldwide recession still had an effect on the private market, resulting in largely government tenders, said Yahyahan Uslubas, Sales and Marketing Manager of Ekin Technology. The company is the Turkish distributor for Sanyo and has undertaken many domestic projects, particularly in city surveillance.

Tuncer Oral, GM of Bilgi Electronics, felt the security market shrunk. However, favorable developments include government IP purchases for video surveillance projects. Other notable projects included business centers and shopping centers breaking ground.

GROWING MARKET

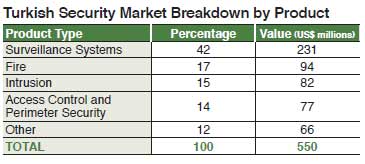

The general consensus estimated the Turkish security market to be worth US$550 to 600 million, with doubledigit growth predicted. Bülent Cobanoglu, GM of Senkron Security, pegged the market share for video surveillance to be about 40 percent, while intrusion made up 20 percent, then fire and access control were each at 10 percent. The company is a solution partner of Honeywell Integrated Security and Honeywell Life Safety.

Other estimates are more modest. Erdal Goksen, Chairman of the Board for Biges, felt the market to be worth $500 to $550 million, with a margin of error of 10 percent.

The security market grew 20 percent in 2010, said Hasim Yalcin, Chairman of the Board, Bilmak, the Turkish distributor of Korean brands Hyundai and Yakotech. Ozyigit said security grew about 15 to 16 percent, in concert with the 16 percent growth of the construction sector.

Other experts felt security grew 10 to 15 percent. Mehmet Kahramanoglu, Chairman of the Board for Videofon, said the market increased $60 million to reach $550 million. lsmail Uzelli, Chairman of the Board for Sensormatic Security Services (a Tyco International company), said the security market was about $520 million. Video surveillance represented 50 percent of product market share, while fire was 15 percent and 6 percent was access control.

Anixter in Turkey deals primarily with video surveillance, which was estimated to be worth $150 million, said Bülent Tekkaya, Business Development Manager. Of that total, about $50 million came from branded products. The security market grew 30 percent in 2010 in terms of products, but 10 percent for sales. “There are two reasons for that: The first one is that technology has gotten cheaper, and the second is that the market in Turkey is now on the verge of exceeding a certain capacity,” Nasir said.