This year’s survey of integrators, distributors, and end users comes at a critical point when companies across the world return to business as usual after two years of hiatus. The pandemic has had a profound impact on the industry and consumers, opening up new perspectives toward technologies and solutions. Most significantly, businesses have realized the importance of remote operations and AI-based analytics that would increase convenience and security.

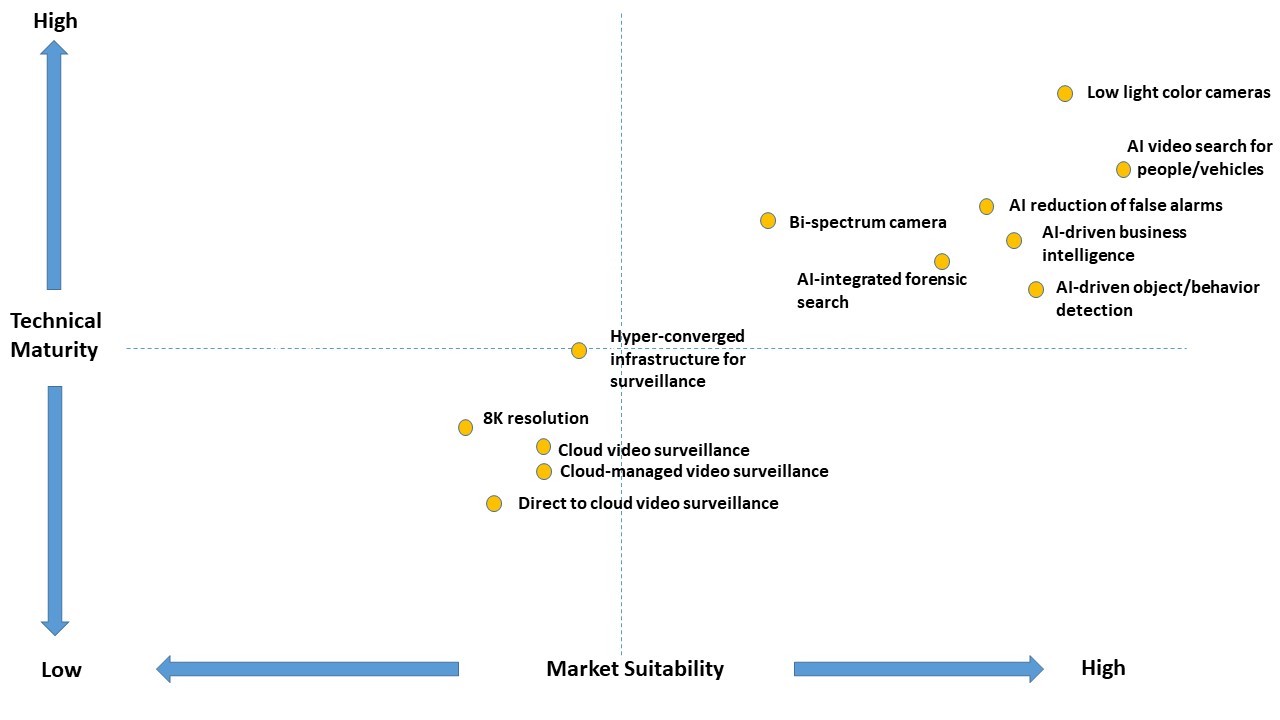

Low-light cameras, AI-based search for people/vehicles, AI-based false-alarm reduction, and AI-driven business intelligence are the four major trending features in video surveillance, according to this year’s respondents. Among these, most respondents chose low-light cameras as the most mature solution and AI-based search for people/vehicles as the most sustainable.

The rise of AI

That three of the top four trends are related to AI shows the importance of this technology in video surveillance. Algorithms have improved dramatically over the last few years, providing unprecedented value to customers in the form of real-time alerts, business intelligence, easy video management, and better accuracy.

According to Adam Ring, Sr. Manager, Tech Services and Sales Engineering at i-PRO Americas, AI-based technology represents a technological evolution that is driving multiple innovations. For video surveillance, AI-driven object detection enables AI-integrated forensic searches of people and vehicles along with a wealth of business intelligence data.

“i-PRO cameras can reliably detect objects and capture around 60 unique attributes associated with those objects,” Ring said. “This enables operators to perform a very fast and efficient forensic search as well as real-time event notification while minimizing false alarms. Our Active Guard software presents AI metadata in an easy-to-use interface for the world’s most popular VMS software like Genetec and Milestone.”

Security and operations teams are now able to change their posture from “reactive” to “proactive” when it comes to incidents and events with a goal of preventing events from occurring in the first place. AI-based cameras can also provide valuable business intelligence insights for both marketing and operations teams with analytics that measure peak occupancy, dwell times, queue lengths, and more. The technology is proven, mature and is fundamentally changing the value proposition for surveillance systems.

“We expect to continue to see more and more technology like artificial intelligence (AI) and machine learning (ML) gain in popularity,” explained Vijay Dhamija, Global Video Engineering Leader at Honeywell Building Technologies. “A big focus is developing more mature AI models that have advanced people-detection logic, an especially vital tool as more of our public spaces return to their pre-pandemic capacity.”

2022 Video Surveillance Technology Trends in Physical Security: Maturity and Suitablity

2022 Video Surveillance Technology Trends in Physical Security: Maturity and Suitablity

Edge adds more value to analytics

Analytics alone is making a lot of difference to customers. But the added impact of edge-based solutions is providing even more value. As edge devices become increasingly more powerful, processing information at the edge is a trend that is evident across all technology fields.

“The cost reductions compared to deploying servers for the same tasks are significant,” Ring said. “Edge analytics, and particularly those assisted by AI-based machine learning, are changing the game for security professionals enabling them to do more with less. With so many cameras to monitor, security operators can rely on analytics to notify them about events that need attention versus trying to do everything manually.”

“For the physical security industry, we believe open architecture is very popular because the future needs to be built on platforms that interoperate seamlessly with multiple technology stacks,” Ring continued. “Since no single company can provide the best solutions for every scenario and need, it’s important that customers be able to choose “best of breed” tools that match their unique requirements and be able to integrate them seamlessly.”

Companies that don’t offer open systems are sometimes regarded as “hostage as a service” platforms since they force users to use cameras, tools, and infrastructure that they may represent a compromise to what is available in the market. SIs who can offer customized solutions that precisely fit an end-user’s needs stand the best chance of winning a bid.

More to the cloud

Parallel to the interest in edge is an increased migration to cloud-based solutions. Perhaps what’s interesting is how businesses try to balance the use of cloud as well as edge-based solutions in the future.

Dhamija explained that they continue to see Cloud VSaaS and direct-to-cloud video surveillance gain in popularity as more and more customers become comfortable with the idea of the cloud and realize its benefits. There is so much data today and so many compliance requirements to keep in mind, it’s becoming increasingly more difficult and expensive to keep this data on-prem.

“With a cloud-based program, it’s easier to set up and maintain, more cost-effective, and more efficient with reporting and compliance,” Dhamija said. “Plus, users can access cloud-based systems from anywhere at any time.”

Certain hardware trends making a difference

Although software hogs the limelight in terms of advancements, we also see specific trends in the use of hardware. Dhamija pointed out that post-pandemic, we see the trend of utilizing technologies in multiple ways. For example, bi-spectrum cameras, including thermal and visible light, are becoming more common. Previously, this may have been two separate cameras. Now, however, the same camera can do two different jobs.

The use of more niche solutions like Radar and LiDAR is also gaining momentum in mainstream security applications. LiDAR sensors can be deployed in security contexts for a wide range of applications and use cases, including outdoor/indoor surveillance and public safety, border control, intruder detection, access control, and perimeter defense.

“For Honeywell, critical infrastructure represents the largest security market for LiDAR with data centers, energy generation and distribution, water and utilities, nuclear facilities, and oil and gas as the main segments,” Dhamija said. “Other security categories include commercial buildings, warehouses, and border control. In many environments, LiDAR will coexist with biometrics sensors to offer a full range of security features stretching from early, long-range detection to facial recognition. Cameras are starting to incorporate LiDAR, so adding another level of security, with more accurate scans, increased depth perception, and more.”

Conclusion

The arrival of AI has clearly revolutionized the video surveillance industry, dramatically increasing the features and benefits. The latest survey underscores this and provides an indication of the future of video surveillance, which would see a more substantial influence on software.

On the hardware side, we are sure to see more solutions on edge as companies try to take maximum advantage of the technology. A combination of edge, cloud, and AI is the current direction for the video surveillance industry.