Smart buildings are an excellent application for the Internet of Things (IoT), as utilizing the IoT allows for a more connected and efficient building, and by combining the strengths of Johnson Controls in building automation with the security applications of Tyco International, a fuller, more complete solution can be provided by the single entity.

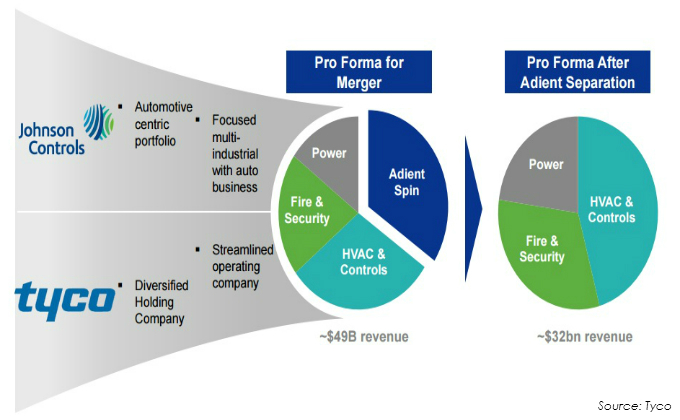

On January 25 Johnson Controls (JCI) announced it had entered into a definitive merger agreement with Tyco International. The US-based Johnson Controls and Ireland-based Tyco International will combine under Tyco International and be renamed Johnson Controls, subject to regulatory approvals and approval by both companies' shareholders. The transaction is expected to be completed by the end of the fiscal year 2016.

There has been a lot of focus on the deal as a tax inversion deal; however, a lot is at stake for both companies, and the merger will create a leader in building technologies and even possibly the Internet of Things (IoT).

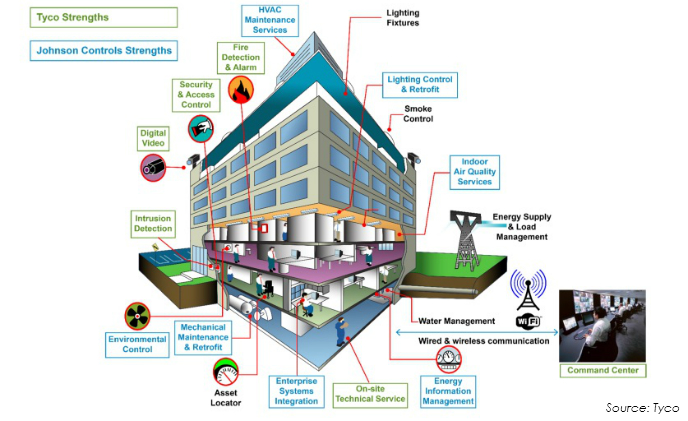

Many have pointed out that the growing interest in the IoT makes the merger a strong move by both companies to not only capitalize on this trend, but emerge as a leader in it. With building management and building automation becoming increasingly important, any and all things related to making a building more efficient has gained popularity. In fact, the smart building market is expected to grow from $7.3 billion in 2015 to $36.4 billion by 2020, at a CAGR of 38% from 2015 to 2020, according to a 2015 report by MarketsandMarkets. Smart buildings are an excellent application for the IoT, as using the IoT allows for a more connected and efficient building, and by combining the strengths of JCI in building automation with the security applications of Tyco, a fuller, more complete solution can be provided by the single entity.

The image below highlights the strengths of both JCI and Tyco in the building automation industry, showing what the new Johnson Controls will be able to offer to the smart buildings markets and the IoT.

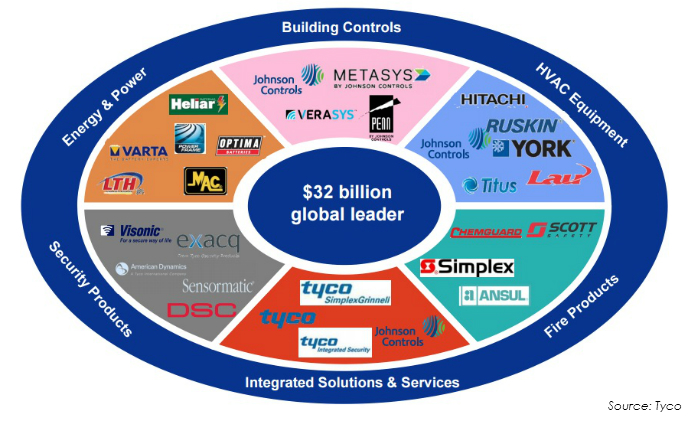

In terms of the security industry, what this means is the merger of two large brand portfolios. The strength of JCI's existing building technologies portfolio will now be further strengthened with the addition of Tyco's security and integrated solutions and services brands.

Furthermore, JCI announced in July of last year plans to divest its its Automotive Electronics and Interiors and Global Workplace Solutions businesses. The new company, Adient, is expected to be spun off at the beginning of the 2017 fiscal year, according to a press release. The new company will see JCI shareholders and Tyco shareholders with a 56% and 44% stake in the company, respectively--the same as their stakes in the new Johnson Controls. What this means for Tyco is that they have a new interest in the automotive field.

The Tyco name has been a giant in the security industry for decades, so a security industry without the Tyco name will be new. Tax disputes aside, major mergers and acquisitions such as this will help shape the security industry to come and are only expected to continue. Will the new Johnson Controls be everything people think it will? We'll find out.