2013 was a year full of uncertainty and modest growth; nevertheless, European countries have finally started to get back on their feet from the economic slump, right on the eve of 2014. Despite current economic circumstances not being favorable adventurous investments, some companies have found ways to survive these difficulties.

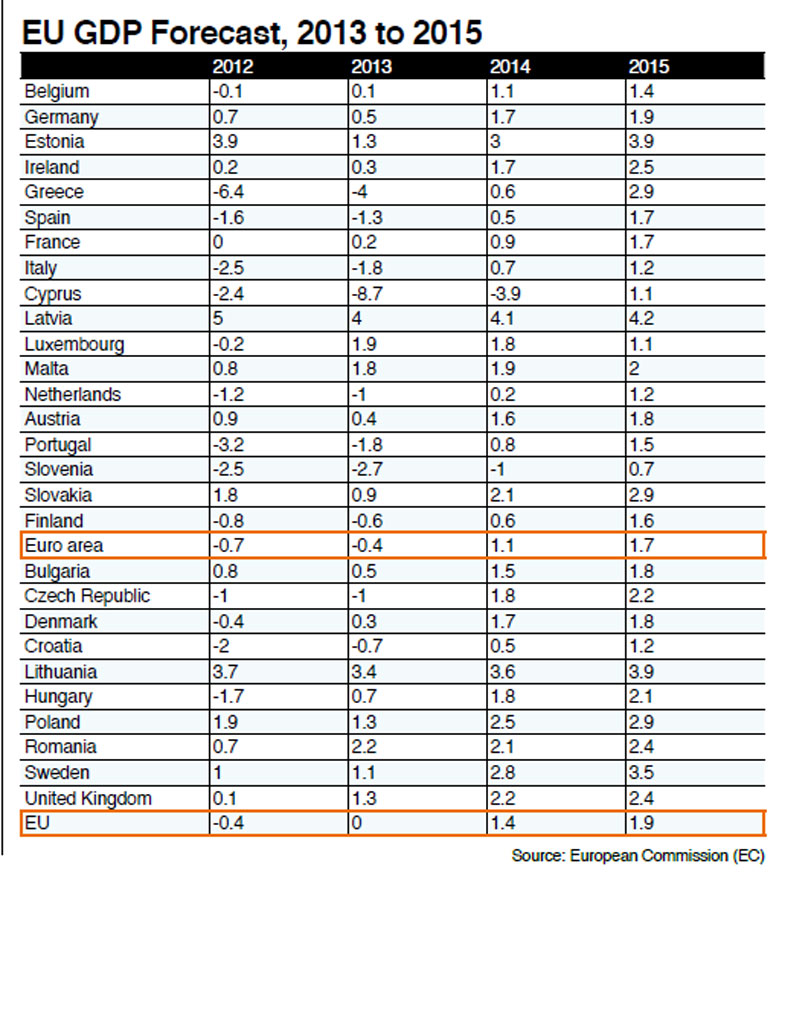

According to a report released by the European Commission (EC) in November 2013, the European economy saw growth in Q2 2013, with GDP foreseen to continue growing through the end of the year; however, the euro area is expected to contract by 0.5%. Economic activity in 2014 is looking forward to 1.5% and 1-% growth in the EU and euro area, respectively.

It seems as though Europe has finally pulled itself out of their recession slump, at least for the time being. Some remain skeptical due to the unacceptably high unemployment rate. According to the report by the EC, Germany has managed to maintain growth in private consumption and construction activities. France has witnessed modest growth and resilient private consumption, mainly credited to the comparatively lower inflation rate than other countries. On the other hand, Italy has taken a more gradual pace for domestic-demand recovery. Outside the euro area, the U.K. has had all around positive growth, which is expected to carry over into next year.

Despite slow economic recovery, the security market is seeing some growth in certain European countries. The German security market has performed quite well, while most of other European countries are still being affected by the economic downturn. However, increased privacy laws have somewhat tempered the surveillance market in Germany.

The UK network surveillance market saw a moderate but steady uptake in 2013. In the years to come, there is high potential to upgrade and refurbish roughly 4.3 million surveillance cameras around the country. Even though there is a significant trend of upgrading analog cameras with IP-based or HD-SDI solutions, the vulnerable economy and recession have caused many projects to be delayed or cancelled.

In the next 5 years, impressive growth in video surveillance devices can be expected in Eastern Europe and Russia, with the market forecasted to reach US$1.3 billion in 2017, up from $581.4 million in 2012, according to reports by IMS, an IHS company. Preparing for the upcoming 2014 Sochi Winter Olympics and 2018 FIFA World Russia is replacing old surveillance systems with new high-end video surveillance. Another major driver for surveillance device upgrades and replacement in Russia and Eastern Europe is the threat of terrorism. Due to these issues, IP-based cameras in these areas are forecasted to account for more than 80 % of security camera revenue in 2017.

Italy

The tough economic climate in 2012 dragged down the Italian economy, along with the economies of Portugal, Greece, and Spain. Putting these economies at the edge of collapse, continuous economic uncertainty has made making a comeback even more challenging. The sector that has been experiencing the most backlash from the economic doubt has been the government.

Daniela D'Amico, Marketing and Export Manager at Marss believes that the residential sector will remain the main driver for the security industry in the coming year since it is a common need for the public to want to protect their belongings. This focus may lead to a merging with smart devices for remote operations.

Video Surveillance

With an estimated 40% growth in the small to mid-size enterprises segment, D'Amico is convinced that IP-based video has penetrated this section of the market. The integration of video and access control will definitely be a main driver for network surveillance in the years to come. Hosted service solutions have also seen increased uptake in the residential and small business sectors; however, lack of sufficient knowledge on the installers' part will be the biggest challenge.

Intelligent video will continue to gain ground, with public transport, railways, and healthcare as the main verticals, which will also provide vital support to improve a company's efficiency. As the number of manufacturers offering HD-over-coax solutions continues to grow, D'Amico is confident that the retrofit market will be the main customers for HD-SDI. She further suggests that the HD-SDI manufacturers should work on more standardization and also reduce the cost of storage to win higher adoption in the market.

Alarm

Being reinvigorated by home automation devices is a possible direction of development for the intruder alarm market. D'Amico believes that the convergence of these two devices is ideal since these solutions are both supported by the same technology.

Slovenia

Slovenia had their economy slapped down during the European economic crisis. Due to these harsh circumstances, the Slovenian government had to withdraw investments for budget cuts in order to survive. The focus in 2014 will mainly be on the retail and residential sectors. The rising crime rate caused by the harsh economic climate has made the need for video surveillance and outdoor protection products stronger. “Alarm and video is getting quite popular – increasing crime is the best marketing to convince people to invest into protection,” Bajec said.

Video Surveillance

While megapixel and IP-based solutions have become hot topics recently, these solutions are still far from reliable in Slovenia, according to the company's observation. Meanwhile, a bunch of manufacturers are currently busy with making network cameras and software solutions with NVRs, “but the ONVIF still does not work as well as they expect,” Bajec said, “the compatibility between different producers is still questionable.” As a result, even though network surveillance is penetrating the Slovenian market, as long as the functions are not well supported, and interoperability remains unstable, there will not be a high demand for IP-based system integration in Slovenia.

In general, the demand for access control in Slovenia has held on to growth. Although the economic situation is not helping the market, it is not affecting the main industrial trend of integration of access control with time attendance in this region. There are numerous local producers aggressively trying to apply this integrated system for salary calculation, in response to the growing need from enterprises.

Alarm

The intruder alarm market is not likely to be reinvigorated by the home automation market, since integration with alarm control panel manufacturers was never fully supported. Furthermore, most of the manufacturers in Slovenia are much more interested in hardware solutions in this market.

Future Perspective

In this IP-lead market, products are getting more and more complicated as new functions and niche technologies are being added. Facing fierce competition on the channel side, distributors and installers must provide either better products or better services in order to survive. Bajec believes that their solutions-oriented products and insistence on technology will continue to set them apart from their competitors.