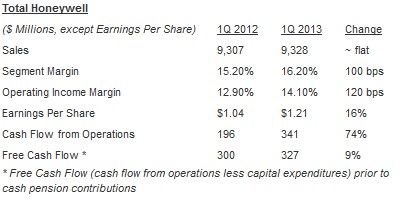

* Strong Productivity Driving EPS Growth of 16%, Up 12% Using Expected Full-Year Tax Rate

* Segment Margin Increase of 100 Bps to 16.2%, Operating Margin Up 120 Bps

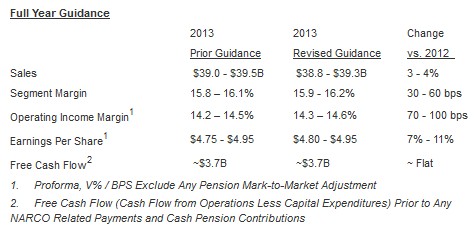

* Increasing Low-End 2013 Proforma EPS Guidance to $4.80 - $4.95, From $4.75 - $4.95

* Strong Productivity Driving EPS Growth of 16%, Up 12% Using Expected Full-Year Tax Rate

* Segment Margin Increase of 100 Bps to 16.2%, Operating Margin Up 120 Bps

* Increasing Low-End 2013 Proforma EPS Guidance to $4.80 - $4.95, From $4.75 - $4.95

Honeywell announced its results for the first quarter of 2013:

"Honeywell delivered better than expected quarterly earnings and margins even in a continued slow global growth environment," said Honeywell Chairman and CEO Dave Cote. "We had strong productivity in the quarter, and our balanced portfolio of both short- and long-cycle businesses continues to drive our outperformance. As a result of our strong start to 2013, we're raising the low-end of our full-year earnings guidance by five cents. We're achieving these results in a slow growth environment while also maintaining our seed planting for the future by investing in new products and technologies, geographic expansion, and driving our key process initiatives. And, it will continue. It's what will help Honeywell deliver top-tier earnings performance this year and over the long-term."

First quarter 2013 earnings per share (EPS) reflects a 23.1% effective tax rate compared to 26.5% last year. Using the expected full-year tax rate of 26.5%, EPS growth would have been 12%.

The company is updating its full-year 2013 sales and EPS guidance and now expects:

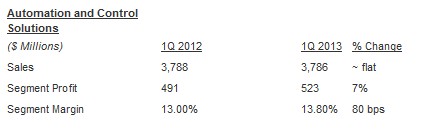

- Sales were approximately flat on both a reported and organic basis compared with the first quarter of 2012. Energy, Safety, and Security sales were up primarily due to growth in ECC and Security products, partially offset by lower sales in Process Solutions and Building Solutions and Distribution.

- Segment profit was up 7% and segment margins were up 80 bps to 13.8% driven by commercial excellence and productivity net of inflation.