Security in 2010 saw a rebound in M&A activity. Allan McHale, Director of Memoori,

delves into key trends and considers what they portend for 2011.

Security in 2010 saw a rebound in M&A activity. Allan McHale, Director of Memoori, delves into key trends and considers what they portend for 2011.

This is Part 1 of a two-part synopsis of Memoori's study “Survey of the Security Business 2010,” an annual review about the world's business for physical security equipment. Its objective is to bring together valuable statistics about the business size, shape and structure across three main segments: Access control, video surveillance and intruder alarms. The review will analyze business opportunities that have taken place in mergers and acquisitions, alliances and investment across the world in 2010. It also reviews technological and commercial trends shaping the future and impact on where investment is most likely to be targeted in 2011 and beyond.

We estimate that the world market for electronic physical security equipment in 2010 was US$18.67 billion, growing 4 to 5 percent on 2009 but still marginally below its peak in 2008. Of this, video surveillance took the largest share at 47.5 percent increasing its share by 4.5 percent, at the expense of intruder alarms at 29.5 percent; with access control at 23 percent.

So despite overall growth, intruder alarms sales have declined and access control has lifted marginally, while video surveillance has performed well despite poor economic trading conditions that have prevailed over the last three years. This is a robust market which has outperformed many of the electronic equipment businesses supplying the industrial and commercial markets. For this reason, acquisition and investment has surged ahead in 2010 and is forecast to continue for the next two years.

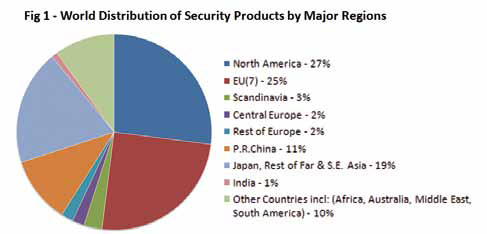

Figure 1 shows the geographic distribution of sales 2010 and has changed significantly in the last three years. China has doubled its market share in the last five years to 11 percent, while other emerging markets in Asia, Central and Eastern Europe and South America have similarly increased their share of the market. This trend will continue with China probably becoming the biggest single market by the end of this decade.

Figure 1 shows the geographic distribution of sales 2010 and has changed significantly in the last three years. China has doubled its market share in the last five years to 11 percent, while other emerging markets in Asia, Central and Eastern Europe and South America have similarly increased their share of the market. This trend will continue with China probably becoming the biggest single market by the end of this decade.