As recovery looms on the horizon, the forecasts for physical and electronic security are still hazy. A&S talks to vendors, integrators and distributors to hear what they had to say about the past year.

As recovery looms on the horizon, the forecasts for physical and electronic security are still hazy. A&S talks to vendors, integrators and distributors to hear what they had to say about the past year.

Innovation seemed stagnant in 2010, as truly brand new products were scarce, while sales of existing products slowed. Budget freezes or cuts hampered technology development, with most product launches emphasizing entry-level features. However, a number of disruptive technologies cropped up, holding tantalizing promise.

A flurry of vendor partnerships signaled greater interoperability. Former competitors chose to bury the hatchet and pool their R&D resources instead, seen in DVTel's cooperation with Nice Systems and Software House. This boosted DVTel's VMS offering, fast-tracking its development with Nice's PSIM and Software House's know-how. Similar partnerships included Milestone Systems adding BriefCam's video synopsis solution into its VMS, making it easier to do advanced searches and sparing operators from switching between interfaces.

Other partnerships crossed product segments. Gallagher Security Management Systems integrated its access control software (ACS) with Pelco's NVRs, enabling ACS alerts to activate the NVR to review related footage. The NVR can also send alerts to the ACS, increasing the value of both systems.

Some partnerships boosted a company's weak area. Bosch Security Systems selected Legic Identsystems, incorporating its solutions for all of Bosch's access control, time and attendance and biometric applications. This move greatly expanded the range of Bosch's capabilities, while keeping costs to a minimum.

Product Trends

The cloud concept for electronic and physical security emerged this year in more commercial offerings. “We are seeing more and more Web-based, scalable solutions in video surveillance and access control, as in software or security as a service (SaaS),” said Paul Everett, Research Director of Access Control and Fire and Security, IMS Research. “In access control, we are also seeing more vertical-specific solutions, especially in education and health care.”

While cloud computing and SaaS are in their early stages, it is being picked up in North America. “The one major product development I've seen over the last 12 months is cloud technology,” said Peter Brissette, owner of www.cctv-security-camera-systems.com. “That is where network cameras can connect to networks and then all the magic happens inside the cloud, which means the data is accessed and stored through virtual servers.”

While cloud computing and SaaS are in their early stages, it is being picked up in North America. “The one major product development I've seen over the last 12 months is cloud technology,” said Peter Brissette, owner of www.cctv-security-camera-systems.com. “That is where network cameras can connect to networks and then all the magic happens inside the cloud, which means the data is accessed and stored through virtual servers.”

Convergence came to the fore, with more solutions delivering situational awareness. “PSIM is emerging as a strong technology in the high end of the market,” said Matia Grossi, Research Manager for Physical Security EMEA, Frost & Sullivan. “The maturity of the technology and increasing user acceptance position it as a key technology for the future.”

Software

Software is the heart and soul of integration. “We decided 1.5 years ago to be an IT player in the security market,” said Frank Pedersen, CEO of Security Solutions, Siemens Switzerland. “This is where the future is.”

Management software was a staple in 2010. Milestone Systems created waves in August, releasing a free eightchannel version of its VMS. IMS Research issued a press release just to discuss how Milestone's freeware could open up the low-end market. While Asian manufacturers have long bundled software with DVRs or NVRs, Milestone's free release is a first among pure software providers. This reflects the present times, as large installations are scarce. Vendors are keen on penetrating smaller projects, such as SMBs or homes.

Management software was a staple in 2010. Milestone Systems created waves in August, releasing a free eightchannel version of its VMS. IMS Research issued a press release just to discuss how Milestone's freeware could open up the low-end market. While Asian manufacturers have long bundled software with DVRs or NVRs, Milestone's free release is a first among pure software providers. This reflects the present times, as large installations are scarce. Vendors are keen on penetrating smaller projects, such as SMBs or homes.

Other software providers are now rolling out hardware, such as Genetec's NVR embedded with its VMS. “This initiative will considerably reduce setup time for our system integrators and will allow us to better serve locations with less than 16 cameras,” said Alain C?té, Executive VP of Genetec.

Scalability was an emphasis for management software. “We will be seeing larger scalable systems utilizing analytics for automated alerts and adjustments,” said Eric Fullerton, Chief Sales and Marketing Officer, Milestone Systems.

New imaging techniques enhance the user experience. “Like HDTV and 3-D in the consumer space, security is starting to see more of these technologies,” said Kim Robbins, Director of Marketing Communications for DVTel. “In a busy scene, 3-D representation actually helps identify objects and people better, as they are no longer just on a single, flat plane. 3-D also helps with analytics, especially in outdoor perimeter installations.”

Video

Video

“I would say integrated platforms, HD and video analytics are key trends for security development,” said Sean Wong, Business Director for Security Systems in Asia, Anixter.

Video content analysis is an imperfect tool, but is improving reliability. “Video analysis is the best partner for operators to help them to identify alarms,” Wong said.

The migration to IP depends on what users want. “For us, analog product development and sales are still going strong,” said Jake Kim, MD of Europe, Samsung Techwin. “However, IP networking is naturally the biggest area of growth and opportunity for us as the adoption rate continues to pick up pace.”

Megapixel counts are increasing, with more 2- and 5-megapixel cameras. “However, the lens technology still needs to catch up,” said Vincent Chen, Assistant VP of Product Marketing at GeoVision. “Mobile and remote surveillance will be the next killer applications.”

Megapixel counts are increasing, with more 2- and 5-megapixel cameras. “However, the lens technology still needs to catch up,” said Vincent Chen, Assistant VP of Product Marketing at GeoVision. “Mobile and remote surveillance will be the next killer applications.”

Several network video providers like Arecont Vision managed to flourish. It doubled its sales team in 2009, seeing good results this year. “We led the H.264 charge and drove the change in mindset for megapixel cameras,” said Raúl Caldéron, VP of Marketing for Arecont Vision.

“The biggest lesson is never reduce R&D spending and remain aggressive.”

Hybrid solutions offer a midway point between analog and IP. Users can maximize their existing investments, while adding network solutions in phases. “There will always be room for coexistence between analog and IP, as processing, bandwidth and storage constraints will always be there,” said Mark Wilson, VP of Marketing at Infinova.

Reliability is essential, as downtime does not serve customer needs. “What's more expensive — a good product working reliably without any failure, or a product that has a lower price but has problems?” said Georg Martin, Marketing Director for Dallmeier electronic. “A casino can't afford to have a system that doesn't work properly.”

Customizable solutions offer added flexibility. “We are quite open and we support practically any compression format or hardware,” said Katharina Geutebruck, MD of Geutebruck. “We offer whatever the customer needs.”

Customizable solutions offer added flexibility. “We are quite open and we support practically any compression format or hardware,” said Katharina Geutebruck, MD of Geutebruck. “We offer whatever the customer needs.”

However, some integrators cautioned against an over reliance on video. “Due to the explosive growth of video surveillance, some less-informed end users may perceive it as the ‘magic bullet' to all their security challenges,” said Patrick Lim, Director of Sales and Marketing, Ademco Far East. “We are seeing some users spending 70 to 80 percent of their budget on video alone and neglecting the other basics of security.”

One example was a large transportation user, who asked Ademco to increase video coverage by 300 percent. Lim instead recommended a good fence intrusion detection system and increasing surveillance by 100 percent. This offered better protection, as well as being more cost-effective.

Standards

Interoperability made strides this year, with increased membership in vendor alliances such as ONVIF and PSIA. “It's creating conditions to have open platforms in which applications and software can be developed by virtually anybody,” Grossi said. “This can only benefit end users and, therefore, the market as a whole.”

Standards make good business sense. “Open standards deliver better security and ROI, because users have the flexibility to upgrade on their own terms at lower prices,” said Rajesh Venkat, VP of Marketing for Ingersoll Rand Security Technologies.

ONVIF's founding members — Axis Communications, Bosch Security Systems and Sony Corporation — continue to roll out compliant products. “All of our network cameras are ONVIF-conformant, ensuring compatibility with other ONVIF surveillance products, regardless of the manufacturer,” said Daniel Gundlach, VP of Marketing for the Americas, Bosch Security Systems. “This helps end users save on future upgrade or migration costs and provides seamless integration for installers.”

An increasing number of plug fests attest to the boom in standardized solutions. “Samsung is a full member of the ONVIF, and many of our new networking products are fully compatible with the standard,” Kim said. “Aside from this, we continue to bolster compatibility with thirdparty independent software vendors to ensure that our network products are compatible with the vast majority of systems that are being installed today.”

At least 300 cameras on the market are ONVIF-compliant, compared to 100 in 2009. “There are many other business sectors where standardization created opportunities,” said Jonas Andersson, Director of Business Development and Global Sales, Axis Communications. “The interface just changed the market. It's providing the entry level for confidence in equipment.”

At least 300 cameras on the market are ONVIF-compliant, compared to 100 in 2009. “There are many other business sectors where standardization created opportunities,” said Jonas Andersson, Director of Business Development and Global Sales, Axis Communications. “The interface just changed the market. It's providing the entry level for confidence in equipment.”

As technology changes, standards are works in progress. “In standardization, we are a leading participant for the PSIA initiative in video surveillance and storage,” said Clifford Cox, PM of Digital Video Systems, Global Security Products, UTC Fire & Security.

The HDcctv standard is seeing increased uptake, extending the lifespan of analog products. “2010 saw a tremendous amount of development in HDcctv products,” said Robert Beachler, VP of Marketing, Operations, System Design for Stretch. “Stretch announced its first production HDcctv in 2009, and during 2010 we saw more than 50 different customers begin development of their HDcctv end products.”

Not everyone believes in HDcctv, as some vendors are convinced IP is the wave of the future. “HDcctv is a good try, but we will not go that way,” Martin said. “Sony, Axis and Dallmeier are working together in a work group for ONVIF.”

Access

Access

New construction remained sluggish in 2010, pushing access control makers into the logical realm. “The ecosystem that we have fostered is not just about opening doors any more, but also trusted identity and credential management,” said Denis Hébert, President and CEO of HID Global (an Assa Abloy company). “The acquisition of ActivIdentity will widen the scope of HID's expertise with incremental and complementary capabilities focused on the convergence of physical and logical access control.”

Scalability and adaptability are essential in new solutions. “Different layers and levels of security should be provided to customers in flexible modules and applications, such as multitech, multimodal readers,” Venkat said. “We are also seeing more access integration with building technologies.”

Scalability and adaptability are essential in new solutions. “Different layers and levels of security should be provided to customers in flexible modules and applications, such as multitech, multimodal readers,” Venkat said. “We are also seeing more access integration with building technologies.”

Nedap integrates access control with other security systems at the controller, simplifying the user's network architecture. “We handle the storage, network camera, IR detector, intercom and card reader directly from our controls,” said Hans Schipper, GM of Nedap Security Management. “Then you have one solution and a single server. When we talk to customers, we talk about TCO, not initial investment.”

Nedap integrates access control with other security systems at the controller, simplifying the user's network architecture. “We handle the storage, network camera, IR detector, intercom and card reader directly from our controls,” said Hans Schipper, GM of Nedap Security Management. “Then you have one solution and a single server. When we talk to customers, we talk about TCO, not initial investment.”

A deeper integration benefits users with many doors. “We see better integrated public address/ intercom products in the market and wireless access control systems that can be used by enterprises, offices, residential homes and hotels,” Lim said.

Several companies strengthened their portfolio through partnerships. “We feel our biggest successes have been some innovative enhancements in widening compatibility, a robust product deployment, and significant successes in our OEM or partnered solutions,” said Timo Jauhianen, VP of Sales and Marketing, Idesco. “In particular, partnered solutions have proven to be a dynamic area for us because, in addition to enabling leaps in product innovation, they often serve as resources for other projects as well.”

Biometrics

Biometrics was hampered by the construction slowdown, as well as uncertainty limiting uptake. “Probably the most frustrating challenge is one of legislation,” said Tomaz Bergant, CEO of TAB Systems. “Some countries have adopted restrictions on the use of biometrics for access control or time and attendance. We have some ways to overcome this, but clearly this is not an ideal situation for us.”

Users are unfamiliar with biometric readers, requiring constant education. “Until they have experienced using facial recognition, customers can start out skeptical,” Bergant said.

Establishing Channel

Manufacturers had trouble expanding their channels, as the recession affected end users across the spectrum. “Project funding remains an issue,” said Phil Scarfo, Senior VP of Sales and Marketing, Lumidigm. “Confusion in health care programs has caused some delays and has slowed growth in this key vertical.”

However, start-ups fared better. “Regarding channel development, we actually increased our channel by adding a distributor in Korea and establishing a sales office in Shanghai, China,” Beachler said.

However, start-ups fared better. “Regarding channel development, we actually increased our channel by adding a distributor in Korea and establishing a sales office in Shanghai, China,” Beachler said.

Education

End users are more aware of security, but face a dizzying amount of choices. This requires ongoing outreach from installers and vendors. “The trend is more the identification of the right products to use for the right applications,” Brissette said. “There are so many new products and changes. Users must decide between network cameras and analog cameras, as well as how to store video and how to view it.”

Some vendors have increased education for professional users, with more online resources. “The type of training needed now is different; it used to be about explaining why IP, but now it's all about what choices are available in IP and what you need to look out for,” said Fredrik Nilsson, GM for North America, Axis Communications.

Production Costs

Production Costs

Production was an issue this year, with increased logistics costs, but did not affect some makers. “We have an advantage over competitors as we manufacture the bulk of our components on-site,” said Peter Francis, Regional Manager for Asia, Gallagher Security Management Systems. “We also work with a lean manufacturing philosophy — production on demand.”

Other makers managed to reach their growth targets. “We were truly fortunate in the recession, because it actually gave us an opportunity to ‘retool' some of our processes and make rapid progress innovating exciting new products,” Jauhianen said. “We had a projected goal of 25-percent growth from the previous year, and we achieved that. The recession did impact our component forecasting, but even that has proved a boon because it compelled us to emplace and synthesize processes that will enable our future growth.”

Component supplier Stretch witnessed significant component and raw-material shortages firsthand, beginning in 2009 and continuing to 2010. “However, once we adjusted to the increased lead times, we were able to shield our customers from that issue,” Beachler said. “Because some of our customers were cutting their engineering staff, we saw a marked increase in our board-level business, rather than customers designing their own boards.”

The component shortage had little effect on Genetec, apart from slowing its access control projects. “We were affected by currency fluctuations this year, making it more challenging to maintain pricing across regions and preserve profitability,” C?té said. “We also experienced more creditrelated losses than ever before in our history.”

The component shortages made pipeline planning more difficult for Lumidigm, Scarfo said.

However, some vendors were unaffected by a limited supply chain. “Being one of the major camera modules and image sensor manufacturer, Sony uses its own camera modules for the security cameras it produces,” said Yoshikazu Hirano, GM of Security Solutions, Business and Professional Products Asia Pacific, Sony Electronics. “Therefore, we did not experience any component shortage or supply issues.”

However, some vendors were unaffected by a limited supply chain. “Being one of the major camera modules and image sensor manufacturer, Sony uses its own camera modules for the security cameras it produces,” said Yoshikazu Hirano, GM of Security Solutions, Business and Professional Products Asia Pacific, Sony Electronics. “Therefore, we did not experience any component shortage or supply issues.”

Transmission solutions are essential, beating market expectations. “Weak consumer confidence and frozen budgets continue to linger in the markets that were most affected by the 2008 financial market crisis,” said John Crockett, CEO of KBC Networks. “However, many organizations view KBC's products as way to reduce existing costs, so we are seeing a strong demand from companies that need to lower expenditures.”

Industry experts felt the recession sorted the wheat from the chaff. “Less established companies tend to forget that they cannot service their customers long-term if they cut corners to lower prices and are not profitable,” Lim said. “It is a vicious circle, and the downturn exposed many of these weaker companies.”

R&D

Product development remains a crucial differentiator. “While we understand other companies are cutting back on R&D, Samsung continues to invest more than ever in improving and expanding product ranges based on feedback from our customers,” Kim said. Samsung makes its own DSP chipsets, with a new manufacturing facility to bring solutions to market faster and take advantage of the latest technology.

A long-term road map keeps companies on track. “One of the key lessons is don't change your strategies based on good or bad times — otherwise, you lose your focus,” Nilsson said. “Despite the slower growth last year, we still increased our investment in marketing, R&D and sales, and grew our application development partners to more than 800.”

Growing Pains

A rare group of vendors actually had too much business during the downturn. An increased number of threats boosted sales for some.

“Delta Scientific's greatest challenge was keeping up with our orders, a wonderful challenge to have,” said David Dickinson, Senior VP of Delta Scientific. “We have hired additional people and added extra manufacturing shifts to do so.”

Asia was a goldmine, as demand remains strong. “Sony's security solutions business in Asia has rebounded particularly well, with double-digit growth in the first half of the year,” Hirano said. “In fact, the business has enjoyed a steady growth in the last three years.”

Asia was a goldmine, as demand remains strong. “Sony's security solutions business in Asia has rebounded particularly well, with double-digit growth in the first half of the year,” Hirano said. “In fact, the business has enjoyed a steady growth in the last three years.”

Smaller companies were able to increase their footprint. “Recessions are actually a great time to be a start-up because we are not as affected by the global economic environment,” Beachler said. “Because we are growing market share rather than already having a large market share, we did not see a downturn in business. Quite the contrary, Stretch has had an unbroken string of five consecutive record sales quarters.”

Marketing

Online media were an affordable option for companies on a budget. “As the industry moves toward IP, a lot more training will be required, and webinars are a great but cost-effective way to deliver the right message,” Robbins said.

New media had more direct benefits and cut down unnecessary costs. “We pursued a strategy of using interactive marketing to create awareness through social media, industry influencers and also relying on a lean, dedicated sales force,” said Stephen Whitten, founder and CTO of FutureSentry. “By foregoing the extraordinary expense of traditional advertising, direct mail and public relations to build our sales pipeline, we preserved capital and maintained our financial independence.”

Consolidation

Consolidation

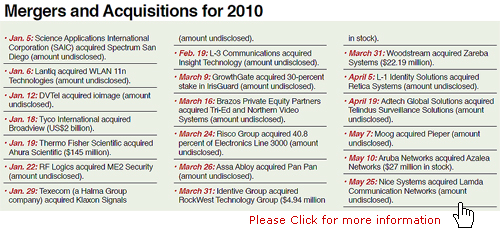

Consolidation saw marked improvement in 2010. “Memoori predicts the spend on merger and acquisition activity in 2010 will more than double the 2009 figure and will exceed the previous high of 2007,” said Allan McHale, Director of Memoori. “The recent flurry of activity in September slated buys worth $3.5 billion. The vast majority was spent on US companies in biometrics, defense and enterprise security linked to PSIM.”

Mergers or corporate restructuring yields improved efficiency. Samsung Electronics transferred its security division to Samsung Techwin at the beginning of the year, swelling its product development team. “As a result, this year alone we are on track to bring out more than 170 new products — not only across our video surveillance and IP networking portfolios, but also our new access control, video door entry and intrusion detection portfolios,” Kim said. “Under a single Samsung, we have been able to accelerate our plans for growth and have quickly evolved into a provider of fully integrated security solutions.”

In a fragmented industry, mergers and acquisitions are a welcome sign. “At the moment, there's a lot of competition, but that's a good thing because it means there's a lot of potential,” Nilsson said. “Size does make a difference in this business, so we are expecting more consolidation — perhaps from more than 300 players to less than 50 over the next few years.”

In a fragmented industry, mergers and acquisitions are a welcome sign. “At the moment, there's a lot of competition, but that's a good thing because it means there's a lot of potential,” Nilsson said. “Size does make a difference in this business, so we are expecting more consolidation — perhaps from more than 300 players to less than 50 over the next few years.”

The global credit crisis took everyone by surprise, crippling many industries. While security was no exception, the industry took market conditions in stride and adapted technology accordingly.

Developments in HD, smarter management software and remote monitoring deliver real value, which is in demand for all seasons. Newcomers are giving established brands a run for their money, offering quality alternatives at lower prices.

“Competition is getting tougher, and one needs to have a unique solution and great partners to grow business,” Wong said.

Find more information about 2010 Market Review:

●2010 Market Review: Market Dynamics Pick Up the Pace